OMERS Gains a Solid 4.2% in 2022

The chief executive officer of the Ontario Municipal Employees Retirement System sees opportunities for pension fund managers in a difficult environment marked by higher interest rates after returns from private assets helped keep the plan’s returns buoyant at 4.2 per cent in 2022.

OMERS reported $4.9-billion in investment gains last year and boosted its assets in spite of losses on public-market investments. After a volatile year for economies and markets that the pension fund’s leaders described as “exceptionally challenging,” CEO Blake Hutcheson said in an interview Monday that 2023 is likely to remain “a complicated time.”

But he said that a period of high employment and elevated interest rates also offers some possible upside for pension funds that can invest in securities such as bonds or in private credit at higher returns than have been available for many years. And with billions of dollars of investable capital on hand, Mr. Hutcheson said OMERS is poised to “take advantage of dislocations” as competitors that have lost access to cheap sources of capital become forced sellers of assets.

“Over the course of the year, we think that there will be some terrific buying opportunities with less competition because of our strength of our balance sheet,” Mr. Hutcheson said. “Historically, we’ve been competing against a lot of players whose cost of funds is almost nothing. That’s over.”

The return OMERS reported for 2022 fell short of an internal benchmark of 7.2 per cent that was set at the end of 2021, when market conditions looked rosier. But it compares favourably with widespread investment losses across the sector after stock and bond prices plunged in the first half of last year.

Last week, Quebec-based pension giant Caisse de dépôt et placement du Québec reported a 5.6-per-cent loss in 2022. On average, Canadian defined pension plans performed much worse, with an average annual loss of 10.3 per cent, as measured by a typical mix of publicly held stocks and bonds tracked by Royal Bank of Canada’s RBC I&TS All Plan Universe.

The varying returns of pension funds are hard to compare directly as they are driven by differences in their portfolios and the makeup of their membership and liabilities.

Over 10 years, OMERS has averaged returns of 7.5 per cent, after expenses, which beat its multiyear benchmark of 7.4 per cent. The fund had assets of $124.2-billion as of Dec. 31, up from $119.5-billion at the end of June.

High inflation, rapidly rising interest rates, and the continuing fallout from the war in Ukraine as well as the COVID-19 pandemic combined to drive sharp declines in global stock and bond markets last year. Though OMERS suffered losses in its equity and bond portfolios, which fell 5.4 per cent for the year, they were offset by returns from its investments in private assets, which include infrastructure, real estate and private equity.

Private equity investments returned 13.7 per cent, ahead of an internal benchmark of 11.2 per cent, and the companies OMERS invests in through the portfolio broadly held their valuations during the year. Infrastructure investments gained 12.5 per cent, beating a 7.7-per-cent benchmark. And real estate investments gained 13.6 per cent, topping a 7.1-per-cent benchmark.

Mr. Hutcheson said that dynamic could reverse in the coming year: Capital markets and equities in particular “could surprise on the upside,” he said, while “certain valuations on the privates could surprise on the downside.”

In that context, OMERS has been shifting billions of dollars more of its investments into fixed-income and credits, and is evaluating how much more money to pour into those assets.

“You can get equity-like yields without taking equity risks,” Mr. Hutcheson said. “And I haven’t seen that literally in 30 years.”

Christine Dobby of The Toronto Star also reports Ontario pension plan OMERS posts annual gain as real estate and other assets offset falling stocks and bonds:

One of Ontario’s largest pension fund managers said its investments in private assets, real estate and infrastructure helped save it from a wipeout last year as public stocks and bonds took big hits amid turbulent markets.

Ontario Municipal Employees Retirement System (OMERS) said Monday that it generated an investment return of 4.2 per cent in 2022, adding $4.9 billion in investment income to the plan, which had $124 billion in assets by the end of the year.

That still fell short of an internal benchmark targeting a gain of 7.2 per cent for the year, but it comes after other large pension managers, including the Caisse de dépôt et placement du Québec, reported losses in recent weeks.

“It’s an extraordinarily difficult year for any investor … So, on balance, we are pleased with the outcome,” OMERS CEO Blake Hutcheson told the Star.

“I don’t want to be cocky or overstate it. It’s only one data point, it’s only one year and we’re looking down the road. But I am proud of our team and I am confident (in) our strategy.”

The pension fund (which has 559,000 active and retired members, including union and non-union workers at municipalities, school boards, transit systems, electrical systems and other employers) said its investments in bonds fell by 3.8 per cent last year and its public equity assets lost 11.9 per cent.

But OMERS’ private equity holdings increased by 13.7 per cent, its infrastructure investments gained 12.5 per cent and its real estate assets were up by 13.6 per cent.

War in Ukraine, runaway inflation

At the halfway point of 2022, OMERS actually posted a loss of $500 million amidst a rout of financial markets following the start of the war in Ukraine and central banks beginning to tackle runaway inflation with a string of interest-rate hikes.

By the end of the year, however, its real estate, infrastructure and private equity investments boosted the fund to a net gain.

Diversifying away from stocks and bonds and investing significant capital in alternative assets has become a hallmark of Canada’s big pension funds (though some critics say such assets can be more difficult to value and valuations are not conducted as often as investments that trade on public markets).

Hutcheson said the fund’s real estate assets (which generate a stream of rental income and tend to steadily increase in value) are also a good hedge against inflation.

Inflation itself has been a mixed blessing for OMERS. On the one hand, its funded ratio has decreased to 95 per cent, down from 97 per cent a year earlier, after it increased pension payments of its retired members by six per cent to reflect the higher cost of living.

But as central banks have raised interest rates, that’s made it easier for the fund to save money, said OMERS chief financial officer Jonathan Simmons.

And Hutcheson said the higher cost to borrow money also gives OMERS an edge when it comes to competition to purchase new private assets. Where other international investors may face capital constraints, the fund has a healthy balance sheet with about $8 billion ready to invest, he said.

The fund didn’t invest in cryptocurrency, which has been a headache for other Canadian pension funds (Ontario Teachers’ Pension Plan incurred a significant writeoff after the meltdown of crypto exchange FTX).

And while OMERS missed out on a boom in tech stocks in 2020 (contributing to a $3 billion loss that year), Hutcheson said Monday, “We try not to get distracted by short-term fads or shiny objects.”

Benefits Canada also reports OMERS returns 4.2% for 2022, led by alternative investments:

The Ontario Municipal Employees’ Retirement System’s assets grew by 4.2 per cent to $124.2 billion in 2022, according to its annual results.

“Our significant allocations to private investments and focus on short-term credit over long-term bonds protected OMERS from the worst period of market losses incurred by investors since the 2008 global financial crisis,” said Jonathan Simmons, chief financial and strategy officer, in a press release.

The defined benefit pension plan’s returns were led by its allocations to alternative asset classes. Its private equity portfolio generated the strongest returns, rising 13.7 per cent, while its real estate allocations were a close second, at 13.6 per cent. Its infrastructure allocations grew by 12.5 per cent and investments in credit rose 3.5 per cent.

The value of the OMERS’ public markets assets depreciated during the year. Public equity investments declined 11.9 per cent while its bond holdings fell 3.8 per cent.

“As we look to 2023 and beyond, we will continue to actively create value across the portfolio, selling assets as the right opportunities arise and making new investments that are built for the future,” said Blake Hutcheson, president and chief executive officer of the OMERS, in the release. “We have ample liquidity and are well-positioned globally to pursue emerging investment opportunities that are aligned with our long-term strategy.”

On Monday, OMERS put out a press release stating its investments appreciated in the worst financial since the 2008 financial crisis:

OMERS, the defined benefit pension plan for municipal sector employees in the province of Ontario, generated a 2022 investment return of 4.2%, net of expenses, adding $4.9 billion of investment income to the Plan. Net assets as at December 31, 2022 were $124.2 billion.

2022 was an exceptionally challenging year for investors globally. Central banks raised interest rates to combat the soaring inflation that resulted from the impact of war and the lingering effects of the COVID-19 pandemic. As a result of these and other factors, global stock and bond markets suffered sharp declines.

“Our investment strategy that emphasizes high-quality assets, diversification, active management, and a disciplined, long-term perspective, served the Plan and our members well in 2022, producing positive returns in a year where broad market indices and the vast majority of investors experienced losses,” said Blake Hutcheson, OMERS President and Chief Executive Officer. “In a difficult environment, our portfolio and the team behind it have performed very well. We are pleased with this outcome and remain focused on the long term. Over 10 years, OMERS has earned an average net return of 7.5%, exceeding our benchmark, and adding $64.4 billion to the Plan.”

“Our significant allocations to private investments and focus on short-term credit over long-term bonds protected OMERS from the worst period of market losses incurred by investors since the 2008 global financial crisis,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “At the same time, investing sustainably continues to be a priority and we have successfully lowered the carbon intensity of our portfolio by 32% since 2019, exceeding our 2025 carbon reduction target.”

“As we look to 2023 and beyond, we will continue to actively create value across the portfolio, selling assets as the right opportunities arise and making new investments that are built for the future,” said Mr. Hutcheson. “We have ample liquidity and are well-positioned globally to pursue emerging investment opportunities that are aligned with our long-term strategy.”

OMERS remains highly rated by four credit rating agencies, including two ‘AAA’ ratings.

Driven and connected by our purpose of delivering on our pension promise to our members, 2022 was a year where we came back together in-person in our global offices to further our work to ensure the Plan remains sustainable, affordable, and meaningful. “We serve the people who keep Ontario’s communities thriving. With a focus that is firmly on the future, we are proud to build tomorrow for our members and their families, and for the generations of members to come,” Mr. Hutcheson concluded.

Further details on OMERS 2022 return can be found in our latest Annual Report, released today.About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over half a million active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in public markets, private equity, infrastructure and real estate.Net Investment Returns for the years ended December 31, 2022

2022

2021

Public Investments

Bonds

-3.8%

1.3%

Credit

3.4%

5.8%

Public Equity

-11.9%

20.7%

Private Investments

Private Equity

13.7%

25.8%

Infrastructure

12.5%

10.7%

Real Estate

13.6%

15.9%

Total Net Return

4.2%

15.7%

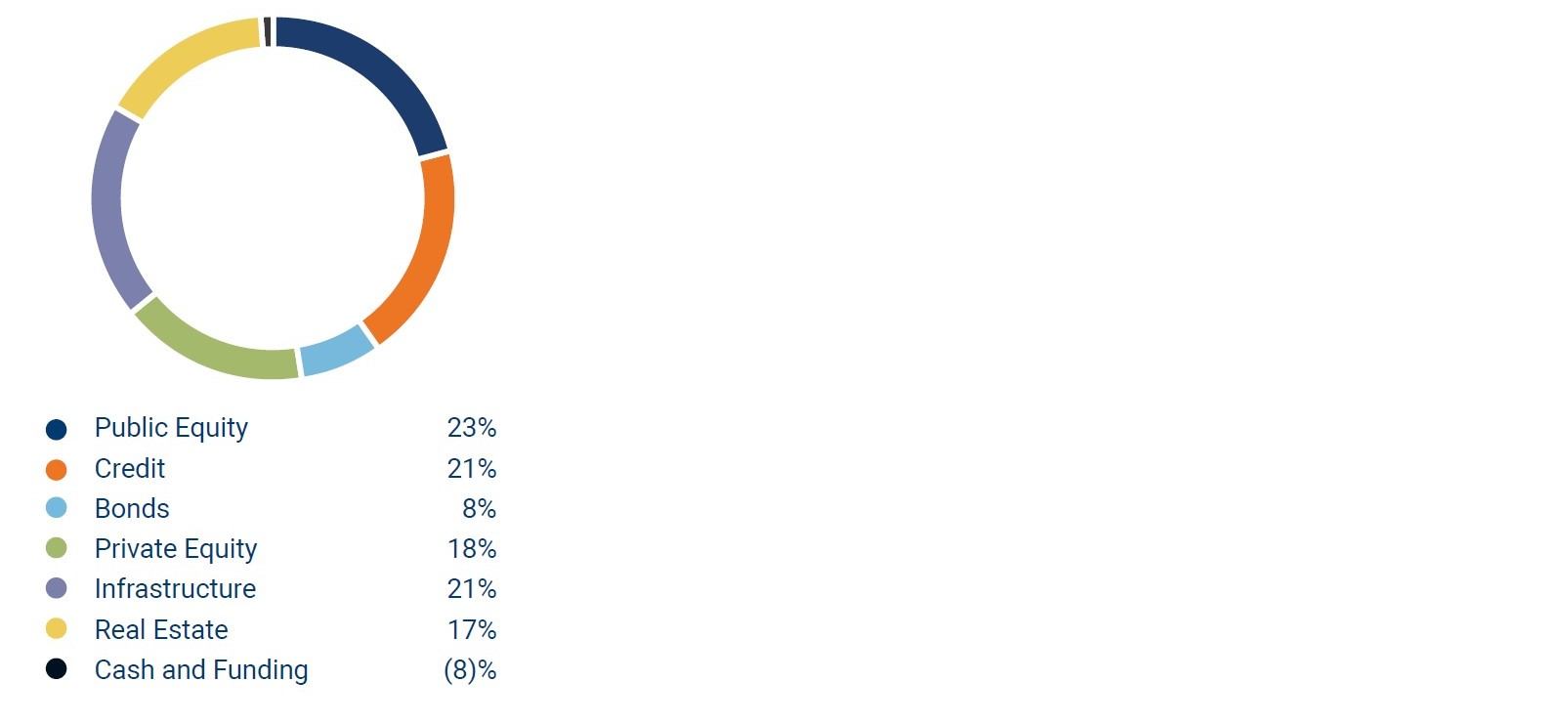

2022 Asset Mix

Transaction Update & Funded Status Update

Investing for Tomorrow

To create value for our members over the long term, OMERS remains focused on strengthening our portfolio and deploying capital towards our target asset mix. We are disciplined as we invest in diverse, high-quality assets that meet the Plan’s risk and return requirements. Please find below highlights of investments made in 2022.

Healthcare and Life Sciences

We believe that investments centred around life sciences and health care make a meaningful difference today, as they support and advance innovative solutions for tomorrow’s medical needs. Over the course of 2022, we:

- Formed a partnership with Novaxia to invest in and develop life sciences properties in France and completed the first acquisition under this partnership, acquiring a life sciences campus (Biocitech) in Paris, France, with lab, office and specialist storage.

- Established a strategic partnership for the Navy Yard in Philadelphia (US) which will, over time, own and develop up to 3 million square feet of life science properties; and completed the acquisition of a nine-asset, 13-building life sciences portfolio in San Diego’s Sorrento Mesa and Sorrento Valley

- a minority stake in US-based Medical Knowledge Group, a leading commercialization services platform serving pharmaceutical and biotechnology companies.

- Completed a funding round to help Aledade continue scaling its practice management solutions, serving more than 11,000 physicians in 37 US states and the District of Columbia.

- Invested in Birdie, a UK-based home healthcare technology company that aims to reinvent care at home and radically improve the lives of millions of older adults.

- Made an investment in Ultragenyx Pharmaceutical Inc., which will earn royalties from the future sales of Crysvita®, a drug that is improving the lives of pediatric and adult patients with two rare diseases.

- Completed the conversion of the Boren Labs office building to a fully dedicated life sciences facility in downtown Seattle, Washington (US) with tremendous early leasing success.

- Led a funding round in Caraway, a hybrid 24-hour healthcare platform focused on women’s health.

Logistics and Transportation

We expect the global growth of e-commerce and demand for expedited supply chains to result in strong long-term demand for logistics and transportation assets. In 2022, we:

- Invested in Direct ChassisLink Inc., one of the largest chassis lessors in the US, with over 151,000 marine and 100,000 domestic chassis in its fleet.

- Increased our stake in VTG, Europe’s largest freight railcar lessor.

- Announced that existing portfolio investment IndInfravit, which owns a series of toll highways in India, would add additional roads across four states in the country.

- Grew our investment in global logistics, including the purchase of a portfolio of seven high quality UK logistics assets

- Announced a first real estate investment in Spain with the acquisition of seven urban logistics assets in prime logistics hubs within the key cities of Barcelona, Bilbao and Tarragona.

Sustainable Investing and Renewables

We have made several investments in assets that address key sustainability issues, and which reflect the growing investor confidence in renewables, while supporting our commitment to achieve our goal of net-zero greenhouse gas emissions by 2050. Other initiatives focused on the social dynamic of sustainability. In 2022, we:

- Invested in Groendus, a Dutch energy transition firm active in rooftop solar, metering and energy services.

- Joined other institutional investors in funding Group14 Technologies, an innovative electric battery materials manufacturer.

- Led a funding round for 99 Counties, a US-based platform that supports regenerative farming that brings sustainable products to market and offers healthy, nutrient-dense foods to consumers.

- Increased our support for NovaSource Power Services, the world’s largest independent solar operations and maintenance provider for utility-scale, commercial, industrial, and residential solar assets.

- Established a partnership to explore North American investments that address sustainability in sectors including food, water, energy, transport, and waste.

- Broke ground on one of North America’s largest housing co-operative renewal projects, a multifamily development in South Vancouver that will help address the local housing choice and supply crisis by adding a significant source of purpose-built rental supply into the community, more than doubling the existing number of housing co-operative units on site.

- Received approval on a new mixed-use commercial building in Boston that, among its benefits, will increase access to affordable housing and improve community connections.

Tech-Forward Innovation

We are investing in businesses doing interesting work to innovate, harnessing the power of technology to do so. During 2022, we:

- Partnered to provide a term loan to AGP, a highly specialized glass manufacturer with advanced technology for autonomous vehicles and producer of specialty automotive glazing components, to support its global expansion plans.

- Led the funding rounds in exciting businesses including Moves, an all-in-one banking app for gig workers, and Altana, a startup using AI to sift through data points across the supply chain to spot anomalies and identify potential risks.

Communications and Business Services

We invest in companies that provide important tools for individuals, communities and organizations. These range from utilities and infrastructure that provide vital connections to services that support efficient business operations. In 2002, we:

- Purchased TPG Telecom's mobile towers and rooftop portfolio, located across Australia; and Stilmark, an independent developer, owner and operator of Australian mobile tower assets. These acquisitions were subsequently combined to operate as a single business under a new brand, Waveconn.

- Invested in Network Plus, a leading utility and infrastructure repair and maintenance service provider in the UK, that maintains and delivers essential services – including water, electricity, gas and telecoms – to homes, businesses, and industry.

- Acquired Pueblo Mechanical & Controls, a leading mechanical services company providing HVAC and plumbing installation, retrofit and repair services to commercial clients, based in Arizona (US).

- Led funding for Fairmarkit, an AI-enabled procurement platform built to efficiently source lower-dollar, non-strategic purchases; Joyn Insurance who are using technology to provide coverage for small to mid-sized businesses; and Falkon AI, a data-insights company providing reporting, analysis and automated recommendations to businesses clients.

Deploying into Private Credit

For a number of years, we have been steadily building out our private credit investing expertise, platform and relationships. In 2022, we took advantage of the rising interest rate environment to strategically deploy capital into high-quality short-term credit, pleased that the risk-adjusted returns continue to present a compelling opportunity.

Realizations

We rotate capital out of assets with the same level of discipline with which we invest. This activity generates capital, which we deploy into future investment opportunities that align to our strategy. In 2022, we completed the following realizations:

- Straight Crossing Development Inc., which operates the Confederation Bridge, a Canadian landmark connecting the provinces of New Brunswick and Prince Edward Island.

- GNL Quintero S.A., a liquid natural gas terminal in Chile.

- Forefront Dermatology, a consolidated dermatology clinic business. As part of the transaction, we reinvested with a minority stake.

- A 50% interest in the Sony Centre, an office-led mixed-use landmark property in Berlin.

- Royal Bank Plaza in Toronto’s financial district and St. John’s Terminal in Manhattan; each representing one of the largest office transactions of the year in their respective markets.

- The Plan’s interest in the holding company that controls the Michigan-based Midland Cogeneration Venture (MCV), a gas-fired cogeneration facility.

- The sale of our investment in Skyway Concession Company LLC, which manages, operates and maintains the Chicago Skyway toll road.

- In addition to the above completed transactions, we announced the sale of a majority stake in Trescal, the global leader in calibration services. We have announced a reinvestment as part of the transaction, retaining a minority stake.

Funded Status Update

- After almost a decade of reporting a progressively stronger funded position (from 86% in 2012 to 97% in 2021) – measured with an increasingly lower real discount rate – our funded ratio dipped to 95% at December 31, 2022, as measured on a “smoothed” basis, averaging our investment returns over five years. The funded ratio is a measure of OMERS assets to OMERS pension liabilities.

- The largest reason for this decline was the impact of Canada’s historically high rate of price inflation. For payments made in 2023, OMERS retirees received a 6% increase to their annual pension payments due to inflation indexation. This rate is well above our 2% long-term assumption for inflation, which is the target rate for the Bank of Canada.

Indeed, the cost-of-living adjustment last year dinged a lot of defined-benefit plans with guaranteed indexation (more like conditional inflation protection because if funded status gets really bad, OMERS can now remove guaranteed indexation).

Alright, time to cover OMERS' 2022 results.

I'm on record stating OMERS and OTPP will likely have the best results for 2022 among the Maple 8 (HOOPP will also likely have excellent results).

How did I know this? Because it's my job to cover these pensions extremely well and I covered OMERS' and OTPP's mid-year results here and here.

Generally speaking, when it's a tough time in public markets, pension plans like OTPP, OMERS and HOOPP that manage both assets and liabilities fare better than the large pension funds like CPP Investments, CDPQ, PSP Investments, AIMCo and BCI because pension plans manage risks a lot tighter.

In the case of OTPP and OMERS, they also have more than 50% of their assets in private markets -- Real Estate, Infrastructure and Private Equity -- and this too helped insulate them in a year like 2022 when both stocks and bonds got hit hard.

Again, according to the latest survey from RBC Investor & Treasury Services (I&TS), Canadian defined benefit (DB) pension plans posted hard-hitting losses in 2022 despite a positive final quarter, losing 10.3% in 2022.

So if OMERS and OTPP post positive returns (HOOPP remains to be seen) when most DB plans in Canada were down 10.3%, it's because of their higher allocation to privates and better strategy, internalizing a lot of the asset management across public and private markets.

In OMERS case, I was also impressed with their Public Markets. Bonds were only down 3.8% in 2022 when most Canadian pensions had their largest annual fixed income decline in more than 30 years, losing 16.8% over the 12-month period, compared to the -11.7% return for the FTSE Canada Bond Index.

In Public Equities, their focus on value over growth also came in handy as they were down 11.9% in line with most Canadian DB pensions which were down 11.3% in foreign equities (ahead of the MSCI World Index, which returned -12.2%) and domestic equities which were down 3.6% in the All Plan Universe (versus -5.8% for the TSX Composite Index), attributable to a large exposure to commodity stocks.

OMERS' great performance last year can be summed up here from Jonathan Simmons, OMERS Chief Financial and Strategy Officer:

“Our significant allocations to private investments and focus on short-term credit over long-term bonds protected OMERS from the worst period of market losses incurred by investors since the 2008 global financial crisis,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “At the same time, investing sustainably continues to be a priority and we have successfully lowered the carbon intensity of our portfolio by 32% since 2019, exceeding our 2025 carbon reduction target.”

Now, on Monday, I got a chance to speak to Jonathan and Blake Hutcheson, OMERS CEO, and I want to thank them for taking 30 minutes to talk to me to go over results (also want to thank their communications people which are always top-notch professionals and a real pleasure to deal with).

I'm going to spare you the play by play of our conversation and repeating a lot of stuff which was said in the media.

You are all reading Pension Pulse for one reason, you want me to get to the bottom of things and cover results properly which is exactly what I'm going to do in this case:

- Blake told me when you look at the high inflation, central bank tightening, public equities and bond indexes in negative territory, they were pleased with their results. But he made a point to state one good year doesn't matter because they need to focus on the long-term. "Over 10 years, we are above our index and over two years because I happen to be in leadership, and our 2-year is close to 10% and that indicates were are fairing well during this turbulent time." He added: "We are doing well, I'm proud of our people and like our strategy but we are not naive, you've got to keep up with reality and always think long-term. Our philosophy is to look at best track record historically where you can look at earnings history and less prone to new shining object and things of that nature. That's what it's all about, being best owners, having the best partners and conservative financing, over time that is the right strategy and we are trying to do that in all of our books" (taking a small swipe there at OTPP and CDPQ for investing in FTX and Celsius but others like CPP Investments, BCI, PSP, HOOPP, AIMCo also didn't invest in this crypto space and thank God they didn't!).

- I interjected and told Blake: "Alright, I'm going to be brutally honest with all you CEOs, next two years, buckle up, the party is over! It is going to hurt public and private markets, guaranteed." I told him that there is always a lag between public and privates, REITs got killed last year and so did public equities, so it's only a matter of time before valuations fall in private markets. I told him when CPP Investments' CEO John Graham was in Montreal last June, we talked about the next global recession and he agreed with me the next one is going to be "deep and prolonged" making it a lot more difficult for asset owners and forcing senior employees to coach the younger ones who haven't really experienced a deep and prolonged recession. Blake, ever the level headed optimist, responded:"So we went through 1929, I'm older than you (not by much) I remember Black Monday (so do I, was in high school), I remember the dot.com blowup (boy do I remember it well), lived through the financial crisis, raised about $3 billion during that 2007-08 period to buy assets on the cheap and we've been through a difficult Covid period this time, so turbulence is part of our lives, the good thing about getting older is I've seen these cycles before, you have to figure out ways to walk between the rail rocks and you have to make sure you have enough diversification that if something goes wrong, you can still profit, so I share some of your concern but I actually know our businesses intimately and so does Jonathan,and I think we will find ways to impress. For example, the credit space is a massive opportunity. Without getting into details, we can lend money in significant tranches of $500 million at 10%+ yields in assets we understand and are very comfortable with the risks. I haven't seen suck opportunities since 1992. We can pay pensions by deploying significant capital in the private credit space without taking equity risk. The marked to market can affect valuations but we will get paid over the term of loans."

- Again, I interjected telling Blake and Jonathan the private credit space makes me very nervous because I recently wrote a detailed comment on how private debt is likely to be the next subprime credit crisis. I told him a lot of banks are originating it and are now stuck with billions of unitranche loans packed with second lien (junior) debt and a lot of the Johnny come lately private debt funds are a disaster waiting to happen when the next global recession/ depression hits us. I asked Jonathan what percentage of total assets does private credit constitute and how much of those loans are junior debt? Jonathan responded: "Our overall allocation to credit is 21%, I don't have at tip of my fingers how much is private but Ann (DeRabbie) will get that to you (Ann told me it’s 11.6%) but what I can tell you is we are not invested in junior debt in private credit, it doesn't meet our risk appetite. We do lending in real estate and it might happen there but frankly we are so far up the capital stack, that's very remote. In the same way, our private lending to businesses is in those with high quality earnings and decent moats around their businesses. Our teams are very careful not to get seduced by "shiny new objects". We are very disciplined and we underwrite al our private loans. Blake also added: "We are not deploying capital in funds doing junior debt lending, we underwrite our loans, we understand the businesses we invest in and default rates are very low. We are trying to get great risk-adjusted yields of 10% over ten years. Most portfolios out there don't have a Bruce Power providing 31% of the power to Ontario. Now, some of businesses can get hit hard from a recession but we are pruning them back over the last 2-3 years. In real estate, we will get hit by cap rate rises, we did raise a billion dollars, some markets will be better than others, some sectors will fare better than others and our development assets are great. We have liquidity to take advantage of dislocations as they arise"

- I told Blake that i recently covered how Dan Fournier is going to be heading up Oxford Properties and how Ralph Berg will be the next CIO on April 1st.I told him too many people are nervous about Dan Fournier but he's impressed with the talent there and wants to enable them. Blake said: "I've known Dan for many years, he's a very thoughtful leader and manager, we have an amazing team underneath him, and the combination of his experience and knowledge and that team is formidable. I have trust in both of them."

- I asked Blake and Jonathan if it's fair to say OMERS had many sales (realizations) of assets last year that contributed to the overall great performance and Blake responded: "It is fair to say but we also have great assets with stable valuations, had some favorable mark to market on some debt, changed our hedging program (forgot to ask about F/X gains and losses), but with respect to privates, we spent decades buying great businesses (privates are now at 56% of OMERS total assets after last year).

- Lastly, I asked Jonathan about benchmarks and why they don't publish benchmarks every year in their press release to show how much value add they added. Jonathan said it's all there in the annual report but what's important is we are an absolute return investor because of our construct, our ten-year performance is above our benchmark. On funded status, Blake noted that they keep reducing their discount rate and still maintained a 95% funded status on a smoothed basis.

I have an issue with absolute return benchmarks in private assets, it might incentivize managers to take dumb risks when markets aren't doing well. This is a long discussion on benchmarks I have to post in a separate post, looking at all of Canada's Maple 8, 9 , 10, 11...

Alright, let me wrap it up with executive compensation:

As you can see, Blake made a little over $5 million last year but he and his team delivered solid gains. In 2020, when they got hit, their compensation got hit.

I would suggest you take the time to read a detailed compensation discussion starting on page 124 of the Annual Report. Make sure you read the entire annual report here.

Compensation and benchmarks go hand in hand and this year, I will start the Pension Pulse 2023 Compensation Report and ask all of the Maple 8 (including HOOPP) to give me more details on compensation and benchmarks as well as how well the CEOs of the subsidiaries get paid (they too get millions).

Below, I covered how OMERS aims to triple its assets in Asia in eight years and went over this great panel discussion featuring Blake Hutcheson and Jim Pittman, Head of PE at BCI. Phenomenal, take the time to watch it all, it was the best panel discussion of 2022!

Comments

Post a Comment