This Week in Pensions & Investments: 20-10-2023

1) Canada will do all it can to prevent the oil-producing province of Alberta from leaving the Canada Pension Plan (CPP), a move that would cause "undeniable" harm, Prime Minister Justin Trudeau said on Wednesday.

In a letter to Alberta premier Danielle Smith, Trudeau said a withdrawal would weaken the pensions of millions of people across Canada.

In his first public comments on Alberta’s proposal to withdraw from the

Canada Pension Plan, Conservative Leader Pierre Poilievre says that

Albertans are seeking to “get some of their money back,” and says “I

encourage Albertans to stay in the CPP.”

The statement, sent exclusively to the National Post, marks the first time Poilievre has explicitly addressed the issue of Alberta’s proposal to withdraw from the Canada Pension Plan (CPP) and set up its own pension fund.

Meanwhile, Barbara Shecter of the National Post reports CPP Investments is taking issue with a process assessing whether Alberta should break away from the national pension scheme:

In an Oct. 17 letter to Jim Dinning, a former provincial treasurer who has been chosen to lead the Alberta Pension Plan Engagement Panel, the Canada Pension Plan Investment Board says advertising and a survey to solicit the views of Albertans are “unbalanced and incomplete” and thus favour the notion the western province should go it alone with its retirement plan.

“We respectfully want to flag to you as head of the panel some troubling elements that in our view undermine the transparency, fairness and integrity of the consultation process that has been put forward to the public so far,” Michel Leduc, CPPIB’s senior managing director and global head of public affairs, said in the letter that was also provided to some media outlets.

CPPIB hired its own third-party market research firm to analyze the survey, and says the resulting report by Innovative Research Group concluded the survey “failed to meet its objectives of effective public consultation.” Among other shortcomings, the report found the survey asked respondents to provide feedback on idealized positive outcomes of a theoretical provincial pension plan without providing any contextual information about how difficult such outcomes might be and the corresponding risks and drawbacks.

“Most concerning is the starting point of assuming that every individual who responds to the survey wants to leave the CPP and start an APP,” Leduc wrote. “The survey is unfortunately formulated to direct opinions rather than seek them.”

As I stated publicly, Alberta's insane report has more holes in it than Swiss cheese.

However, in private and public consultations with Senator Clement Gignac this week, I agree with him, it's not the job of CPP Investments to publicly attack this report.

I would much prefer to see the Chief Actuary of Canada provide a comprehensive, unbiased report on what an Alberta Pension Plan would mean for Canadians and Alberta.

2) CPP Investments released its 2023 Report on Sustainable Investing.

You can download the report here and the 2023 Policy on Sustainable Investing here.

Chief Sustainability Officer (CSO) Richard Manley said this: "At CPP Investments, we believe the value of companies integrating sustainability effectively into their strategy, operations and financial disclosures is increasing. So is our ambition to integrate sustainability into the life cycle of our investment process to drive value creation."

3) Benefits Canada reports that BCI is acquiring U.S.-based fiber communications solutions provider Consolidated Communications Holdings Inc. in a joint transaction with private investment firm Searchlight Capital Partners.

The acquisition will be worth about US$3.1 billion. The purchase agreement price suggested a 70 per cent premium to Consolidated Communications’ public share price at April 12, 2023.

Searchlight already owns 34 per cent of Consolidated Communications’ outstanding shares of common stock. The BCI and Searchlight will acquire the remaining consolidated common stock not already owned by the private investment firm.

Read more here and see BCI's press release here.

My take: This is a great deal for BCI and Searchlight, a private equity firm BCI seeded. Consolidated Communications is a leading fiber-first provider and it will grow nicely as a private company with BCI/ Searchlight as its partners.

4) Cadillac Fairview (CF) is pleased to announce the company's 2023 results within the Global Real Estate Sustainability Benchmark (GRESB) Survey. For the fourth time, and third consecutive year, CF ranked first in its peer group (Northern America | Diversified - Office/Retail | Non-listed). CF was also named a Regional Sector Leader (Americas Diversified Office/ Retail), which recognizes the industry's champions, leading the charge towards a net-zero future and propelling the sector forward. In addition, CF achieved 'Green Star' ranking for an eighth time. These impressive results demonstrate consistent industry leading performance and commitments at both the corporate and property levels.

GRESB is a mission-driven and industry-led organization that is internationally-recognized as an ESG (Environmental, Social, Governance) benchmark for assessing ESG risks and opportunities. CF's rankings demonstrate strong results in achieving superior building performance, and best practices for ESG management, such as policy, risk management, stakeholder engagement, implementation and measurement. GRESB assesses and benchmarks the ESG performance of assets worldwide, providing clarity and insights to financial markets on complex sustainability topics. The 2023 benchmark covered 2,084 real estate entities, 687 infrastructure assets and 172 infrastructure funds.

"As the owner and operator of some of Canada's largest office complexes and shopping centres, we are dedicated to mitigating our impact on climate change and enabling a sustainable future," said John Sullivan, President and CEO of Cadillac Fairview. "Our continued top ranking celebrates the leadership, commitment and drive of our entire team who strive to integrate ESG principles into all aspects of our company culture."

5) University Pension Plan (“UPP”) has committed €150 million to Copenhagen Infrastructure Partners’ (“CIP”) latest flagship strategy, Copenhagen Infrastructure V (the “Fund”), as part of the Fund’s first close.

The commitment is one of several new investments by UPP in infrastructure and real estate as part of its active strategy to further diversify its portfolio with inflation-protected assets and help build sustainable value for Plan members.

The Fund – which is dedicated exclusively to greenfield renewable energy infrastructure investments – is on track to achieve its target size of €12 billion, which will make it one of the largest of its kind globally. Building upon the legacy of its predecessor flagship funds, it aims to invest across a range of technologies, including offshore wind, energy storage, and onshore wind and solar projects, in countries spanning North America, Western Europe, and the Asia Pacific.

“We are delighted to partner with CIP, a global leader in development and construction of renewable energy projects. CIP has a very robust risk focus and strong value creation track record, and we expect the Fund to generate positive value and great long-term investments, that will support our ability to meet the needs of our members,” said Peter Martin Larsen, Senior Managing Director, Head of Private Markets Investments at UPP.

The Fund is classified as an Article 9 fund under the European Union’s Sustainable Finance Disclosure Regulation as having an objective of sustainable investment or a reduction in carbon emissions, ensuring alignment with UPP’s Climate Action Plan, which sets a path to net-zero portfolio emissions by 2040 or sooner, with an emphasis on decarbonizing the real economy.

“Establishing mutually beneficial partnerships with market-leading, like-minded investors like CIP is a cornerstone of our investment strategy,” added Larsen. “Energy transition infrastructure provides an opportunity to capture attractive and stable long-term returns for our members while also promoting a sustainable future beyond our own portfolio.”

Read full press release here.

6) James Bradshaw of the Globe and Mail reports OMERS striked partnership with Goldman Sachs to invest in Asian private debt:

Ontario Municipal Employees Retirement System has formed a partnership with the asset management arm of Goldman Sachs Group to invest in private loans in Asian and Pacific markets, as investors race to grab a share of the burgeoning global market for private debt that has grown more lucrative with rising interest rates.

Under the partnership, Goldman Sachs Asset Management will run a separately managed account where it will invest with OMERS, mostly offering senior direct loans to highly rated companies and sponsors, but with an option to invest in other strategies such as mezzanine debt. Neither the size of the fund nor OMERS’s contribution were disclosed.

Institutional investors see private debt as an area of huge opportunity in the coming years. Most private loans are floating rate, meaning the returns rise in step with interest rates. And demand for the loans has exploded as some banks, particularly in the United States, have tempered their appetite for lending to mid-market companies, constrained by tougher market conditions and onerous regulatory capital requirements.

Investors with money to deploy in private credit are also increasingly partnering with banks, which have broad relationships and distribution networks, to roll out private credit funds.

Brookfield Asset Management Ltd. partnered with French bank Société Générale S.A. to launch a new €10-billion ($14.3-billion) private debt fund earlier this month. And New York-based alternative investment manager Centerbridge Partners said Tuesday it is joining with California-based bank Wells Fargo & Co. on a new direct-lending strategy, with British Columbia Investment Management Corp. and subsidiaries of the Abu Dhabi Investment Authority as anchor investors.

Major Canadian pension plans and asset managers are building up their private credit businesses, and OMERS’s partnership with Goldman Sachs allows it to tap the bank’s Asian private credit team, which is a subset of a broader direct lending team that manages more than US$100-billion. Its investments focus on India, China, Korea, Japan and parts of Southeast Asia, as well as Australia and New Zealand.

Asia is a region where OMERS plans to expand its presence, Kal Patel, OMERS’s head of global credit, said in a statement. “Private credit remains an attractive area within the credit space globally, and the expansion of our existing relationship with Goldman Sachs into Asia will position us well to further unlock these opportunities.”

Earlier this week, Goldman Sachs announced it has appointed Stephane Amara as the new head of its Canadian institutional client business. Mr. Amara will be based in Montreal, and most recently led institutional sales for MFS Investment Management.

My take: No doubt about it, private debt is where everyone is focusing their attention. But there are concerns. Moody's recently warned about systemic risks in private equity and private credit. OMERS takes measured risks in this area, stringently underwriting its loans. In Asia, it will partner with GSAM to explore this growing market. There is intense competition in the region with Hillhouse recently pitching its billion dollar private debt fund in Asia.

And here are the top stories on investments:

1) US stocks ended Friday's trading session in the red, as the benchmark 10-year Treasury yield hovered just below 5% in the wake of comments by Federal Reserve Chair Jerome Powell.

The Dow Jones Industrial Average (^DJI) fell 0.9% or 270 points, while the S&P 500 (^GSPC) shed 1.3%. The tech-heavy Nasdaq Composite (^IXIC) dropped about 1.5%. All three major indexes posted weekly losses.

Stocks lost ground after Powell signaled the Fed is committed to its "higher for longer" rates stance, which spurred gains in Treasury yields. The benchmark 10-year yield (^TNX) rose briefly to 5% late on Thursday, a closely watched level not seen since July 2007.

“The underlying message is 'don’t be looking for a bailout from the Fed anytime soon,'” Greg Whiteley, a portfolio manager at DoubleLine, told Reuters. "That gives people the go-ahead to take rates above 5%.”

On Friday afternoon, the yield on the 10-year retreated from that key level, dropping to around 4.91%, as part of a broader recovery in fixed-income assets. But the "pain trade" in bonds could have further to run, even after weeks of putting pressure on stocks.

My take: It's been all about long bond yields this week but the next two weeks will be telling:

30-Year Treasury Yield surges to 5.11%, the highest level in more than 16 years pic.twitter.com/KPV64nTJEj

— Barchart (@Barchart) October 20, 2023

Fed Chair Jay Powell on why longer-term yields are moving higher: “It’s not apparently about expectations of higher inflation. And it’s also not mainly about shorter term policy moves.” To his point, real yields are surging toward 2.5%, the highest since 2008. pic.twitter.com/IyaTOOCXqA

— Lisa Abramowicz (@lisaabramowicz1) October 20, 2023

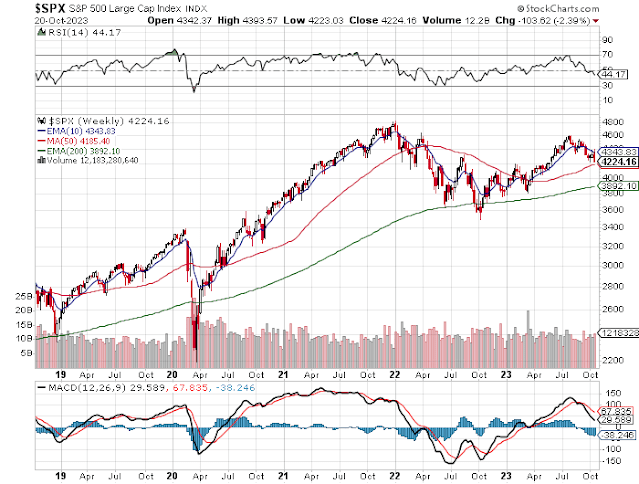

$SPX closed below its 200 MA.

— Sven Henrich (@NorthmanTrader) October 20, 2023

The next 2 weeks will likely decide the rest of the year.

Have a good weekend everyone. https://t.co/Chjeup5StY

These are the charts to watch over the next couple of weeks:

Alright, that's a wrap for me, back to feeding and changing the baby and sterilizing bottles.

I should write a blog comment about that one day to help parents with newborns but one thing I can tell you is set a schedule early, stick to it, feed your baby well (formula at night, breast milk in morning) and always burp and swaddle them well or else they won't sleep for three hours (sometimes they make weird noises in first two weeks when they sleep, like grunting, just elevate their head a bit in the bassinet but it's all normal).

We still haven't figured out how to make him sleep five consecutive hours at night but that's wishful thinking for now until he starts feeding at least 4 ounces and more.

Below, CNBC's Steve Liesman reports on the latest All-America Economic Survey, which shows that Americans' confidence in the stock market is dropping as the economic outlook becomes more uncertain.

Next, former Treasury Secretary Lawrence Summers says the Federal Reserve may need to get involved in fiscal policy and weigh in on the US government's $33.5 debt mountain because of its implications for interest rates. Summers, a Harvard University professor and paid contributor to Bloomberg TV, speaks on "Wall Street Week" with David Westin.

Third, Mohamed El-Erian, a Bloomberg Opinion columnist, says the Federal Reserve needs to pivot from excessive data dependence to data dependence with a greater forward-looking component. He speaks with Jonathan Ferro on "Bloomberg The Open." El-Erian's opinions are his own.

Lastly, Prime Minister Trudeau sends an open letter to Alberta Premier Danielle Smith warning of the consequences of pulling out of the Canada Pension Plan. The NDP drops a pharmacare ultimatum on the Liberals. Plus, Quebec’s plan to hike tuition fees for out-of-province students.

At Issue is Canada's most-watched political panel, hosted by CBC Chief Political Correspondent Rosemary Barton and featuring leading political journalists Chantal Hebert, Andrew Coyne and Althia Raj.

Comments

Post a Comment