HOOPP Gains 9.4% in 2023

Freschia Gonzales of Wealth Professional reports HOOPP achieves 9.38% return in 2023:

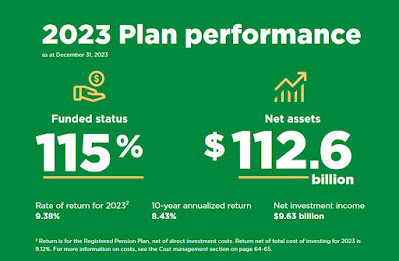

The Healthcare of Ontario Pension Plan (HOOPP) announced a return of 9.38 percent for the year 2023, increasing its net assets to $112.6bn from $103.7bn at the end of 2022.

This performance secures the Plan's funded status at 115 percent, demonstrating its robust financial health by having $1.15 in assets for every dollar owed in pensions.

Despite the slight slowdown from 2022's growth, HOOPP achieved strong returns across multiple asset classes including fixed income, public equities, private equity, and private credit.

The investment team strategically increased exposure to bonds following a rise in yields during the summer and fall, contributing significantly to the Plan's performance as the bond and stock markets rallied towards the end of the year.

“In 2023, there was considerable economic uncertainty resulting from several factors, including increased geopolitical tension, persistent inflationary pressures, and unsteady global growth,” said Jeff Wendling, president, and CEO of HOOPP. “Amidst this volatility, HOOPP delivered strong returns in support of our pension promise to the healthcare workers of Ontario.”

The Plan capitalized on market volatility by enhancing its investment in real return bonds at attractive valuations, which protected the Fund against inflation and generated value for the Plan.

By the end of the year, inflation-indexed bonds constituted roughly half of HOOPP’s targeted portfolio allocation to bonds, facilitating the provision of a cost-of-living adjustment to retired members in 2024.

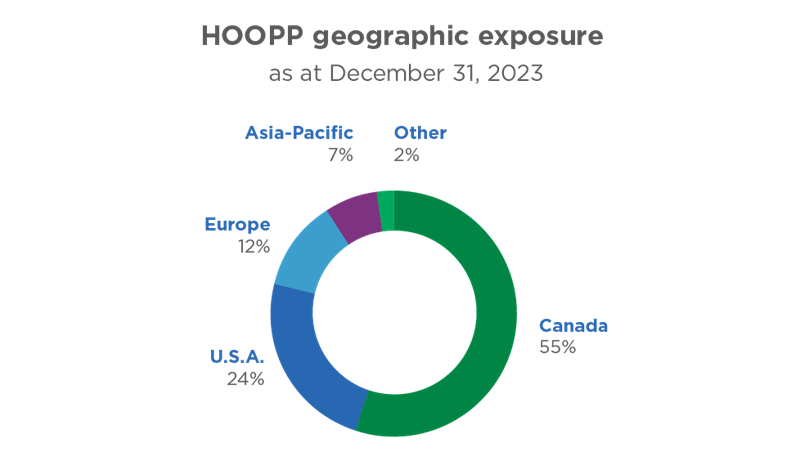

A significant contributor to the strong 2023 return was HOOPP's substantial investment in Canada, with over $60bn of its assets within the country. This investment spans real estate, including major industrial and logistics parks, office towers, and housing, as well as supporting Canadian innovation and entrepreneurship.

Additionally, HOOPP stands as one of the largest investors in Canadian bonds, which make up about half of the Canadian portfolio. The proceeds from government bond sales contribute to public services and infrastructure essential to Canadians, such as hospitals, public transportation, and schools.

“Our commitment to investing in Canada is strong. Canada is not only our home but also a safe and stable country that offers attractive investment opportunities,” stated Michael Wissell, Chief Investment Officer at HOOPP.

He further explained that the bond portfolio is central to HOOPP’s Liability Driven Investing (LDI) strategy, mitigating the Plan's liability sensitivity to interest rate and inflation changes, providing government-guaranteed returns, supporting other investment activities, and diversifying the Fund's assets.

HOOPP also highlighted its initiatives in 2023, including reinforcing its commitment to sustainable investing with the launch of a climate change strategy aimed at achieving net-zero portfolio emissions by 2050.

Additionally, the Plan continued its research to improve retirement security outcomes for Canadians and expanded its contribution to Ontario's healthcare sector by increasing its employer and member base.

Reflecting on the year's achievements, Wendling expressed pride in the team's accomplishments and reiterated the Plan's dedication to fulfilling its pension promise to Ontario's healthcare workers, emphasizing the Plan's continued strong funded status to ensure pension security.

The 2023 performance by asset class revealed diverse returns, with public equities and private equity showing significant gains, while real estate recorded a decline.

Palash Gosh of Pensions & Investments also reports Healthcare of Ontario Pension Plan notches net 9.38% return in 2023:

Paula Sambo of Bloomberg also reports real-return bonds reap gains for HOOPP:

Canadian inflation-protected securities known as real-return bonds are reaping gains for one of the country’s largest pension funds during a turbulent period for fixed-income markets.

Healthcare of Ontario Pension Plan became an “aggressive” buyer of the inflation-linked bonds when interest rates started climbing in 2022, chief investment officer Michael Wissell said in an interview. By December, the notes represented roughly half of the fund’s target portfolio allocation to bonds, he said.

“Right now, one of the most compelling things is real-return bonds,” Wissell said. “This is the ‘Get Out of Jail Free Card’ here. These notes, which were for years at minus 100 basis points — even more negative in some jurisdictions — are now offering a real rate of return.”

Canada stopped issuing the bonds in 2022, making them harder to buy in larger quantities.

HOOPP said Wednesday that it posted an 9.4 per cent return last year, booking gains in fixed income, stocks, private equity and private credit. The Toronto-based pension fund — which serves about 460,000 active, deferred and retired health-care workers in Canada’s most populous province — increased exposure to bonds after yields rose in the summer and into the fall, helping net assets grow to $112.6 billion.

“We used the volatility in the fixed-income market, which, by all accounts, was pretty substantial, to continue to add real-return bonds, which are more difficult to accumulate,” Wissell said. “It is very unlikely that you will see us selling them anytime soon.”

The returns for HOOPP’s asset categories are as follows:

- Fund’s fixed-income portfolio advanced 4.3 per cent

- Public equities jumped 15.7 per cent

- Credit grew 4.6 per cent

- Private equity climbed 15.9 per cent

- Private credit gained 9.3 per cent

- Infrastructure advanced 8.2 per cent

- Real estate investments lost 6.5 per cent

“The dispersion that exists within real estate assets is hard to understand,” Wissell said.

“We’re diversified across segments, and I’m not sure that I’m smart enough to know which of those segments are going to be the winners going forward because we’re seeing big price adjustments across these different sectors.”

And James Bradshaw of the Globe and Mail reports health care pension plan earns 9.38 per cent in 2023 but missed internal benchmark due to real estate losses:

Healthcare of Ontario Pension Plan recorded a 9.38-per-cent return on investments in 2023 as stocks soared but missed its internal benchmark by about one percentage point as real estate assets struggled.

In a year when high interest rates and persistent inflation created volatility in markets, HOOPP’s returns were bolstered by strong performance from public stocks and private equity investments, which respectively gained 15.71 per cent and 15.9 per cent.

Real estate had a tough year that resulted in a 6.5-per-cent loss, which was similar to other large pension plans that have reported annual results.

HOOPP’s real estate holdings are most heavily tilted toward industrial and logistics properties, which have benefitted from a shift toward e-commerce, with lesser exposure to hard-hit office and residential assets. But the values of properties the fund manager owns outside Canada – which make up about half of its real estate portfolio – were marked down more rapidly than the buildings it owns in Canada.

The weakness in real estate last year “was pretty broad-based,” president and chief executive officer Jeff Wendling said in an interview.

“We think the worst of real estate is behind us but it could be another sort of flat-ish year this year,” he said.

HOOPP invests on behalf of about 460,000 employees at 677 employers in Ontario’s health care sector, including nurses and medical technicians.

The pension fund manager’s total assets increased to $112.6-billion, from $103.7-billion in 2022. And its funded status ended the year at 115 per cent, which means the plan has $1.15 for each dollar it owes to members. “And that’s our key metric that we focus on,” Mr. Wendling said.

“I feel really good about the year.”

Over 10 years, HOOPP has earned an average annual return of 8.43 per cent.

HOOPP also ended the year with 55 per cent of its assets invested in Canada, which is the largest proportion among any of the eight largest pension funds in the country.

“We’re happy to always look at Canada, and we do,” Mr. Wendling said.

A debate has flared up after a group of prominent CEOs suggested Canadian pension plans underinvest in Canada, and that governments should take steps to encourage them to invest more domestically.

A number of senior pension fund executives, both current and former, have pushed back, arguing that anything that detracts from a clear mandate to seek the best returns possible, relative to the risks involved, could be harmful to pension funds.

Asked about potential new measures that could complicate a pension fund’s mandate, Mr. Wendling said, “for sure, I have a concern about that. There are very strong arguments to not doing that. So I’m hopeful those arguments will prevail.”

He said HOOPP’s mantra is to deliver on its promise to pensioners, and that the strictly independent governance that most Canadian pension funds maintain has been key to their relative success.

“I’d be careful if the borders get muddied with other objectives,” he said.

A large part of HOOPP’s Canadian exposure is to bonds and fixed-income instruments, including real return bonds that are tied to inflation. HOOPP boosted its exposure to fixed income as yields spiked. And it is building up its infrastructure portfolio, which includes investments in assets that typically have stable cash flows and sometimes also protection against inflation, which would help reduce HOOPP’s reliance on bonds.

Investments that have performed well through a period of high inflation have been key to HOOPP’s results as investors grapple with the fallout from a period of high interest rates.

“There is a risk that maybe [inflation] remains sticky here,” Mr. Wendling said. “And we have to be prepared for that.”

Today, HOOPP released its 2023 results stating its success was bolstered by strong Canadian portfolio:

The Healthcare of Ontario Pension Plan (HOOPP) announced today that it delivered a 9.38% return in 2023, bringing its net assets to $112.6 billion, up from $103.7 billion at the end of 2022. The Plan’s funded status remains very strong at 115%, meaning that for every dollar owed in pensions, it has $1.15 in assets (all numbers in this release as at Dec. 31, 2023).

HOOPP delivered strong returns across many asset classes, including fixed income, public equities, private equity and private credit. The investment team increased exposure to bonds after yields rose in the summer and into the fall, contributing significantly to strong performance when bond and stock markets rallied late in the year.

“In 2023, there was considerable economic uncertainty resulting from several factors, including increased geopolitical tension, persistent inflationary pressures, and unsteady global growth,” said Jeff Wendling, President & CEO, HOOPP. “Amidst this volatility, HOOPP delivered strong returns in support of our pension promise to the healthcare workers of Ontario.”

He added: “As a pension delivery organization, we are focused on building a portfolio to best deliver on the pension promise. Last year, the market volatility provided an opportunity to increase our exposure to real return bonds at attractive valuations, protecting the Fund against inflation and generating value for the Plan.”

By year-end, inflation-indexed bonds comprised roughly half of HOOPP’s target portfolio allocation to bonds, which continues to align investment assets with the Plan liabilities and supported HOOPP’s ability to grant a cost-of-living adjustment to retired members in 2024.

The strong 2023 return was bolstered by our strong Canadian portfolio. Over $60 billion of HOOPP’s assets are invested in Canada. This includes real estate, such as major industrial and logistics parks, office towers and housing. It also includes supporting Canadian innovation and entrepreneurship by investing in home-grown companies. HOOPP is also one of the biggest investors in Canadian bonds, which comprise about half the Canadian portfolio. Money raised through government bond sales helps pay for the public services and infrastructure Canadians rely on – including hospitals, public transportation and schools.

“Our commitment to investing in Canada is strong. Canada is not only our home, but also a safe and stable country that offers attractive investment opportunities,” said Michael Wissell, Chief Investment Officer, HOOPP.

He added: “The bond portfolio is the backbone of HOOPP’s LDI (Liability Driven Investing) strategy and helps offset the sensitivity of the Plan’s liabilities to changes in interest rates and inflation. Bonds provide government-guaranteed rates of return, serve as high-quality liquid collateral to support other investment activity, and are a diversifying asset for the Fund.”

Other highlights from the year included:

- Climate Plan: Reinforced our long-standing commitment to sustainable investing with the launch of our climate change strategy in March, outlining our approach for achieving net-zero portfolio emissions by 2050. Progress updates can be found in the Annual Report and on hoopp.com.

- Retirement security research: Continued our research around improving retirement security outcomes for all Canadians, including commissioning a discussion paper by Former Bank of Canada Governor Stephen Poloz, which suggested Canada may be heading for a renaissance of defined benefit pension plans.

- Supporting healthcare through growth: Continued to expand our value to Ontario’s healthcare sector by growing the number of HOOPP employers from 646 to 677, and the number of members from 439,630 to 460,381.

“HOOPP had a successful year on many fronts and I’m proud of all that the team accomplished,” Wendling said. “At the core of all we do is our commitment to our pension promise to the healthcare workers of Ontario, so we are pleased to have delivered significant value to our members this past year, maintaining our strong funded status so pensions remain secure.”

About the Healthcare of Ontario Pension Plan

HOOPP serves Ontario’s hospital and community-based healthcare sector, with more than 670 participating employers. Its membership includes nurses, medical technicians, food services staff, housekeeping staff, and many others who provide valued healthcare services. In total, HOOPP has more than 460,000 active, deferred and retired members.

HOOPP is fully funded and manages a highly diversified portfolio of more than $112 billion in assets that span multiple geographies and asset classes. Over $60 billion of HOOPP’s assets are invested in Canada and HOOPP is one of the biggest investors in Canadian bonds, with over $40 billion in total government bond holdings. HOOPP is also a major contributor to the Canadian economy, paying more than $3 billion in pension benefits to Ontario healthcare workers annually.

HOOPP operates as a private independent trust, and is governed by a Board of Trustees with a sole fiduciary duty to deliver the pension promise. The Board is jointly governed by the Ontario Hospital Association (OHA) and four unions: the Ontario Nurses’ Association (ONA), the Canadian Union of Public Employees (CUPE), the Ontario Public Service Employees' Union (OPSEU), and the Service Employees International Union (SEIU). This governance model provides representation from both management and workers in support of the long-term interests of the Plan.

Earlier today, I had a nice chat with Michael Wissell, CIO of HOOPP, going over their 2023 results.

I want to thank Michael for taking some time to talk to me this morning. I also want to thank James Geuzebroek and Jackie Emick for setting up the call and sending me material to review on an embargoed basis.

Before I get to my discussion with Michael, please take the time to read highlights here and the annual report here.

Let me go over some important items here.

First, take the time to read Chair Gerry Rocchi and Vice-Chair Dan Anderson's message:

I note the following:

We are also pleased that the Plan’s funded status remains strong at 115%. This is the one of the best indicators of the overall health of the Plan and its ability to pay pensions over the long run. The strength of the Plan helped us make several decisions that benefit our members.

For example, the Board provided cost-of-living adjustments (COLA) to help pensions keep up with rising prices. Retired and deferred members will receive an increase of 3.40%, starting April 1, 2024, in addition to the 6.32% increase received in 2023. We know how important this is for retired members, particularly in the current environment. HOOPP has a strong history of providing COLA at 100% of the rate of increase in the Consumer Price Index.

When you're in a position of strength, you can deliver on your pension promise and also offer full indexation when the cost of living soars.

This is why HOOPP's retired and deferred members will receive an increase of 3.40%, starting April 1, 2024, in addition to the 6.32% increase received in 2023.

Next, take the time to read CEO Jeff Wendling's message:

I note the following:

Strengthening our investment activities

To complement our significant investment holdings in Canada, we are strengthening our ability to add to our global investment exposure. To this end, we were busy in 2023 preparing for the opening of our London,England office in the first half of 2024. This physical presence in the U.K. will enhance our access to high-quality investment opportunities in Europe, particularly in private markets, as we deepen existing relationships and develop new ones in the international investment community.

Strengthening our risk management activities

We also continued to strengthen and build out our risk management and compliance frameworks, capabilities and policies, including new analytical tools and methodologies for managing investment risks, enhanced tools for analyzing and reporting on operational risk, and further developments in comprehensive risk reporting. Robust policies, effective governance, and a strong risk aware culture help increase the organization’s resilience.

There's more but clearly HOOPP is looking to expand its international presence to seize opportunities in private markets and needs to open an office in London to start developing and nurturing the right relationships there.

I also want to congratulate Jeff for marking his 25th anniversary at HOOPP.

Jeff succeeded Jim Keohane and has done a great job steering this big pension plan in the right direction, focusing on implementing HOOPP's LDI 2.0 and continuing the great work on advocacy Jim and other predecessors had done as well.

My only criticism of HOOPP, and I stated this earlier to Michael, James and Jackie, is I need to see a lot more transparency on investment activities, compensation and other areas.

In fact, I want to have more interviews with Michael Wissell, Jeff Wendling, Lori Hall-Kimm, Eric Plesman, Jacky Lee, Stephen Smith and other senior investment professionals at HOOPP to drill down and see exactly what they are doing.

I know, "HOOPP is in the pension delivery business" and it's a private trust so it doesn't really need to answer to me or anyone else, but it manages C$112.6 billion in net assets and it's high time it revamps its communications strategy and be more out there and be a lot more transparent (all of Canada's Maple Eight should follow CPP Investments' lead in terms of transparency and even try to do better).

Keep in mind, HOOPP is a private trust but it manages the pension assets of Ontario's healthcare workers which are public sector workers.

That is my only bone to pick with this outstanding organization, STOP FLYING UNDER THE RADAR, I know it's easier to do so but time to rethink this strategy and come out more than once a year when you release results.

Alright, now that I threw that out there, let me also cover some other tidbits.

The table below shows HOOPP's short-term and long-term performance relative to its benchmark:

As shown above, the Plan underperformed its benchmark by 98 basis in 2023, owing to weakness in real estate where there was widespread weakness according to Jeff Wendling:

What else? The first article above notes that HOOPP doesn't provide asset allocation data which is true, you need to deduct it on your own but you can read HOOPP's statement of investment policies to see what their long-term asset mix and target allocations for each asset class are:

Again, it would be a good idea just to include a table breaking down asset allocation in detail and explain the asset mix in detail because it's critically important to understand.

Lastly, I bring to your attention this chart which shows total benefits have exceeded total contributions since 2018:

outcome as a pension plan naturally matures and does not indicate that HOOPP is unable to pay

its promised benefits."

Also keep in mind that HOOPP is still relatively young compared to OTPP and OMERS and is still growing its members (younger demographics).

Discussion with CIO Michael Wissell

Alright, enough with the preliminaries, let's get to my discussion with Michael Wissell.

Michael is a really nice guy, super smart, very experienced, worked many years at OTPP before joining HOOPP and he really knows his stuff.

We started off by discussing my spinal fusion surgery and how those ten days in the hospital opened my eyes once again to how nurses, doctors, personal assistants (orderlies), cleaning crews, technicians, you name it, are all incredibly dedicated employees working long, grueling hours.

Importantly, unless you see it with your own eyes, you will never understand how demanding these jobs are and as Michael correctly pointed out, apart from nurses which make decent wages, the rest make modest incomes and are relying on a modest pension of roughly $30,000 a year to get by during retirement.

For the most part, the public is totally clueless about what nurses and personal assistants are actually doing at hospitals, let me assure you it's not glamorous work but it's necessary work which serves a social purpose and it takes very patient and dedicated staff to do this job over many years.

Also keep in mind, as Canada's population ages, patients are older and require a lot more care, especially if they are suffering from dementia.

I also saw this dedication when my baby boy was born one month prematurely in late September and his mother and I had to take shifts going to the Neonatology Intensive Care Unit (NICU) for ten stressful days. The nurses and staff there were incredible individuals doing very important work, taking care of precious newborns.

All this to say, HOOPP is taking care of the pensions of very important people working at Ontario's healthcare sector and that isn't lost on Michael Wissell and other employees there (they also take part in their pension plan and thus have skin in the pension outcomes).

Michael agreed with me, that healthcare workers are kind, patient, compassionate and most of them don't get paid a lot for the work they do (similar to teachers), adding this:

"We are not in the money management business, we are in the pension delivery business, we take very seriously the opportunity to help healthcare workers focus on the job at hand, and not worry about their retirement."

He reiterated: "These are humble workers making a modest living and getting a modest pension, and it's part of our ethos here to focus on the sustainability of their pension so they don't have to worry about it."

We then got into it and Michael gave me an overview of results:

We returned 9.38% last year. All the asset classes did well with the exception of real estate which is adjusting to the higher cost of capital. As you know, our real estate portfolio is incredibly diversified relative to some others out there. We have a decent allocation to multifamily and logistics properties ( a little more than 50% combined). Offices are manageable for us because it isn't a big weight and we have premium assets like the two big towers we own on York street and we will continue to do very well.

It's true our aggregate returns for real estate was down for the year but I think we've taken the bulk of the losses we will see there and I think diversification inside our portfolio will continue to pay dividends as we go forward.

We then moved on to discuss fixed income where HOOPP is very active. I noted that last year was a very volatile year in terms of long bond yields and if we didn't have that end-of-year rally in bonds, a lot of investors would have lost money, including Teachers'.

Michael replied:

It's interesting, you're right, in the near term that volatility is a challenge but in the medium and long term that volatility creates that opportunity to create lasting value.

I'll give you two examples. We run a liability-driven investments portfolio to defuse our liabilities, we are in the pension delivery business, not the money management business, but that doesn't mean we are not dynamic in terms of managing our fixed income portfolio. And given that range of volatility, there are opportunities to reduce your holdings, there are opportunities to increase your holdings, all within one year because of that magnitude of volatility.

At the same time, and this was really key for us, we are planning and hoping to pay COLA-adjusted pensions for our members and that means when we get the opportunity to pick up in large amounts real return bonds, we grab that opportunity. Don't forget, we had negative real rate bond yields here for a long time and the backup in yields in 2022 and 2023 gave pension plans an opportunity to buy and accumulate real return bonds with yields above 2% and 2.5%. Those are really constructive long-term investments for the health of a plan.

So the volatility in nominal yields in 2023 was challenging in the near term but it was an enabler at the same time. allowing us to better position ourselves going forward.

I noted that Canada foolishly stopped issuing real return bonds but he told me there are some still around and they trade TIPS (Treasury Inflation Protected Securities) and the volatility last year enhanced liquidity in this market, allowing them to accumulate RRBs.

He added: "We have a significant allocation to real return bonds in our fixed income portfolio which we think in a deep far left tail situation will serve us well. Real rates can go up but they can only go up by so much"

That's smart risk management.

I asked Michael if they feel inflation stickiness will persist and he replied:

It's difficult to know how inflation will unfold over the next several years and so like anything that's unknowable, we diversify. If a recession is all I had to worry about, I can just go nominals. But if I need to also worry about inflation stickiness and a reemergence of inflation, those real return bonds will do better in that environment.

So we take a very diversified approach to our portfolio because as you mentioned, these are volatile times and our crystal ball is only so clear.

We shifted our discussion to private equity where I noted they performed very well, better than their larger peers which are seeing lower returns as the cost of financing and higher labor costs have hit margins, and I asked him if that's because HOOPP has a mid-market focus.

Michael replied:

We had some interesting product wins (HOOPP exited a long-held investment in Alberta-based Champion Petfoods, best known for their ACANA and ORIJEN brands, after the company agreed to be acquired by a global US-based consumer goods company). We are more mid-market and we are more about value creation than financial engineering.

We were not involved previously in venture. We are using this market to establish our venture platform. So we don't have any legacy venture assets that did very poorly last year. And our sector allocation worked out well as we were in the right ones and not in ones with material headwinds (he didn't provide details on that and none were made available in annual report either).

So mid-market, lack of venture although we are using this market to get into it, sector selection and idiosyncratic wins all contributed to private equity's performance last year.

All true but if I were to drill down and do a performance audit, I'd say the sale of Alberta-based Champion Petfoods to a global US-based consumer goods company contributed significantly to PE returns last year.

What about infrastructure? Here is what Michael noted:

As you know, we are in a very different space in infrastructure because we are just rolling out our portfolio. We have a 5% policy weight in our portfolio. First of all, the team has done a great job. Secondly, you have a bit of a J-curve effect where it takes a while before you really start to see investment decisions really come to the forefront.

We had a surprisingly strong year in infrastructure last year but I would suggest that's still a relatively low rate and all the investments have been made in the last five years. Our comparatively stronger returns have been made over the last five years and we've been very fortunate to make good investments over those last five years.

I noted that right now HOOPP is using external partners to co-invest in infrastructure but as Jo Taylor told me yesterday, the pricing isn't there yet so to really scale meaningfully into that asset class isn't easy until we see serious dislocations.

So for HOOPP to go from 5% to 15% in infrastructure, it will take several more years.

Michael replied:

Here's the good news, we are not in the capital deployment business, we are in the pension delivery business which means we can be incredibly patient. One of the great advantages of working at a pension plan as opposed to some other entity is we can be incredibly patient. It's what we don't do some years that really pay dividends.

So our teams across all of the private markets have been quite patient in picking our spots and watching the higher cost of capital working its way through the marketplace.

And that higher cost of capital is working its way through the marketplace in very uneven ways. Some sectors are seeing that happen sooner, some to your point because of the sheer quantum of dollars being put to work not adjusting in the way they should. But over the course of time, you're going to get those risk-reward relationships come in line with the higher cost of capital, and while you're waiting for that to happen, you just have to be patient.

On Credit and specifically private debt, here's what Michael notes:

We put private credit in our policy portfolio in 2023. We've invested in private credit for many years but more from a value-added perspective. It's a 5% weight in the policy portfolio, we had very strong returns last year, the team did a great job.

Our approach to private credit is perhaps a bit different because it's a collaborative approach. It's the one area where our capital markets team has a sleeve in it, our real estate teams has a sleeve in it and or private equity team has a sleeve in it and they collectively populate that 5%. And that collaborative approach really paid dividends in 2023 because you're constantly cross-referencing risk-reward opportunities across sectors, across silos in the private as well as pubic markets in terms of what's available.

We are relatively constructive on private credit, acknowledging that the asset class has done well and there might be some mean reversion but the underpinnings remain healthy. I'm not sure the regional banks any time soon are going to be the force they were in he years gone by and that's going to create opportunities in the mid-market private investments and we remain relatively constructive.

I tend to agree except big banks are getting into the space in a big way and that can ruin it for everyone.

HOOPP is also working with external partners to fund opportunities in the space and they also find internal opportunities.

HOOPP also scaled up its investments in external hedge funds to complement their internal absolute return strategies, going external when they cannot replicate alpha internally.

He told me absolute return strategies had a good year after a few great years but didn't provide me with details on how much they are allocating there saying it's not public information (make it public!).

It's funny, I used to allocate to the best hedge funds all over the world, still track them very closely, makes me chuckle when Canada's Maple Eight are all secretive about hedge funds (no big secret).

Lastly, I asked Michael where he sees the biggest risks going forward:

We use a factor based approach to understand our risks and our risks are inflation, growth and real rates. We are 26% in public equities,, we are comfortable with that, we think equities are fairly priced. We are 12% in private equity, it continues doing well and has done well over time. We are really proud of the returns in that portfolio, Lori-Hall Kimm is doing a phenomenal job managing that team and working with some really expert investors.

And by bringing that bond portfolio in to better balance between reals and nominals, we think we can mitigate any growth shocks that might come down the pipe.

Quite frankly, I think this is going to be a decent year, still relatively constructive going forward.

I told him I remain bearish but Q1 was exceptional as herding in Nividia and a few other Mag 7 continued and I remain focused on trading my biotech stocks as they swing like crazy.

He told me to remain diversified and they have a relatively small allocation to emerging markets.

I reiterated my plea to see more transparency at HOOPP and ramp up their communications strategy but Teams froze and I'm not sure if that was done purposely (lol, it wasn't, they probably think I'm a pain in their pension ass but I'm saying this to all of Canada's Maple Eight for their own good as I know what is going on in the background at governments).

Alright, let me once again thank Michael Wissell for another great discussion, he's a really nice guy and sharp as hell, I'd recommend working at HOOPP just to gain exposure to him, Lori, Eric and others.

Below, Jeff Wendling, president and CEO of HOOPP, appeared on BNN Bloomberg earlier to discuss their investments in Canada and why they're now expanding abroad.

Listen carefully to Jeff's comments, I think he nailed it and answered tough questions very clearly. He also discusses markets and where they see opportunities.

Comments

Post a Comment