OMERS Posts 4.6% Return in 2023

Ontario Municipal Employees Retirement System, Toronto, returned a net 4.6% in 2023, an annualized 8% for the three-year period and an annualized 7.3% for the 10-year period.

The pension fund did not provide benchmark returns.In 2022, OMERS returned a net 4.2%.

Net assets totaled C$128.6 billion ($97 billion) as of Dec. 31, up from $124.2 billion at the end of 2022, said a Feb. 23 news release.

By asset class, the top performers were public equities, which returned a net 10.4%; credit, 8.3%; bonds, 5.8%; infrastructure, 5.5%; and private equity, 3.9%.

Real estate, which returned a net -7.2%, ranked as the worst-performing asset class.

"Returns in 2023 reflected a major divergence between the performance of public and private assets," said Jonathan Simmons, OMERS' chief financial and strategy officer, in the news release.

"Public equities and fixed income had a strong year, and fixed income assets benefited from higher interest rates. Returns from private asset strategies were held back by the increased cost of debt, increased operating costs, and anticipated slower economic growth, all of which are affecting private market investors worldwide," Simmons added.

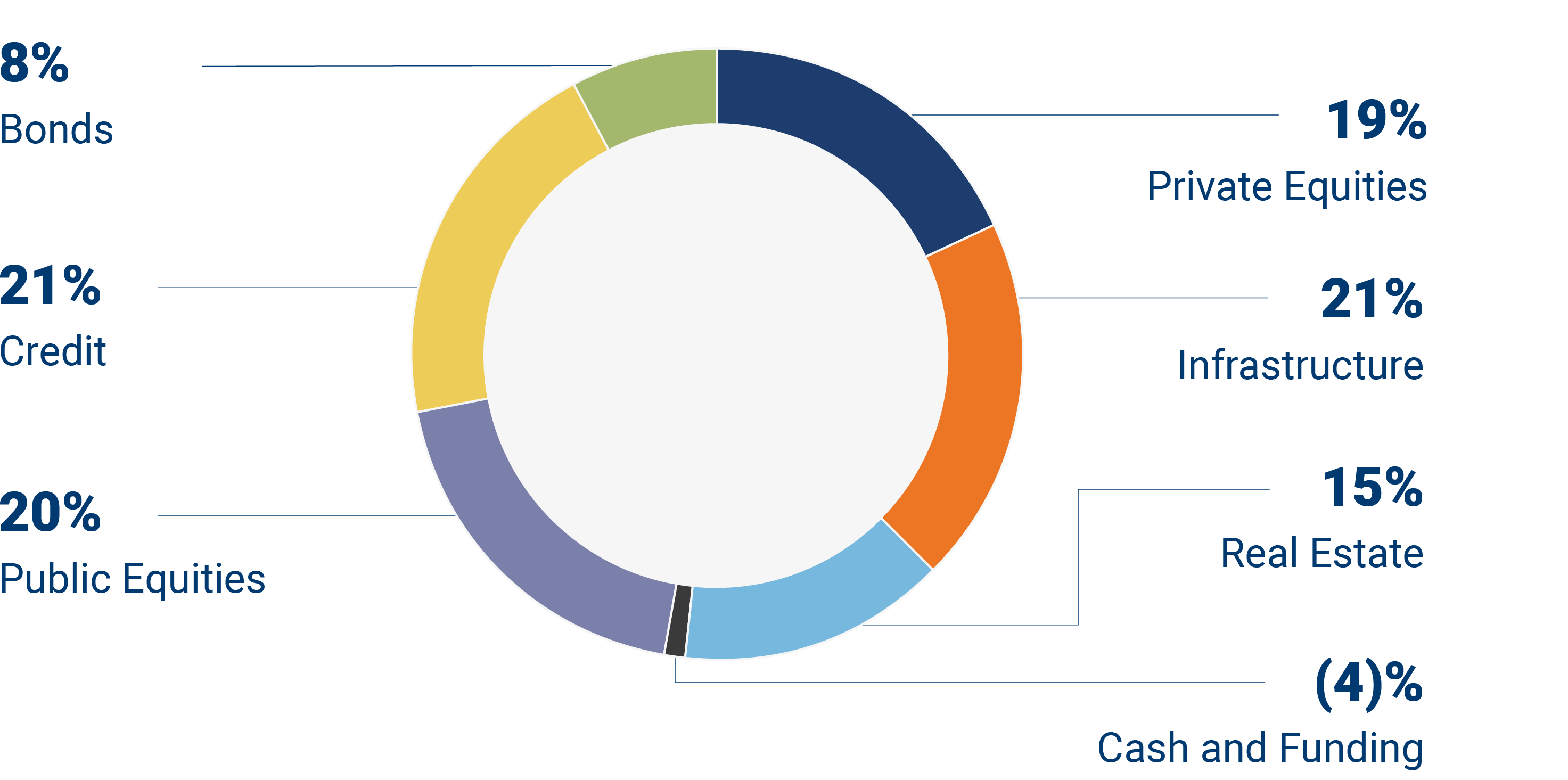

As of Dec. 31, OMERS actual asset allocation was 21% each credit and infrastructure, 20% public equities, 19% private equity, 15% real estate, 8% bonds, and -4% cash and funding.

Looking ahead to 2024, Blake Hutcheson, OMERS president and CEO, said in the release: "Higher interest rates are creating opportunities for us to deploy capital into fixed income to improve future returns, consistent with our new, more diversified strategic asset mix."

James Bradshaw of the Globe and Mail also reports that OMERS chief executive sees better days ahead for real estate portfolio:

Falling property values across the commercial real estate sector put a dent in the Ontario Municipal Employees Retirement System’s investment returns last year, but chief executive officer Blake Hutcheson predicts that “the worst is behind us.”

OMERS investments gained 4.6 per cent in 2023, or $5.6-billion after expenses. The pension fund manager’s results were buoyed by strong gains from stocks and bonds, but its real estate portfolio lost 7.2 per cent as higher borrowing costs and operating expenses drove down commercial property values.

OMERS missed its internal target to earn 7 per cent for the year. But its longer-term returns have cleared that mark, with the fund averaging an 8-per-cent annual gain over the past three years, after expenses, and 7.3 per cent over 10 years.

It has been a harrowing year for commercial real estate investors, and OMERS’s business in the sector “got hit hard,” Mr. Hutcheson said. High interest rates drove up borrowing costs, inflation increased operating costs and vacancy rates climbed higher. That has forced investors to sharply mark down property values after many had stubbornly stuck by higher valuations even as central banks ratcheted up interest rates.

Much of the angst has focused on office buildings and retail outlets such as shopping malls, as hybrid working arrangements took hold and consumer purchases tilted more toward e-commerce after the COVID-19 pandemic.

But Mr. Hutcheson said OMERS felt the impact on property values across its real estate portfolio in 2023, including for industrial properties that have generally been more resilient. That was in spite of a 9-per-cent increase in income from properties owned by its real estate subsidiary, Oxford Properties.

“This year it was pretty universal,” Mr. Hutcheson said.

With interest rates likely at their peak, however, he predicted that capitalization rates – the ratio that measures the annual yield from an investment property, and gives an indication of how risky it is – have hit a high, meaning that property values could soon start to stabilize, easing the risks to investors.

“As the cost of money comes down, by definition appraisers bring cap rates down,” Mr. Hutcheson said. “We think, on a go-forward basis, real estate as an asset class will start to pick up. … The worst is behind us from a valuation perspective.”

That doesn’t mean the pain is over for real estate, as some property owners will struggle to refinance expensive debt and to off-load lower-quality buildings, except at bargain prices.

That could create buying opportunities, not only in real estate but other sectors as well, and OMERS has stockpiled capital to take advantage as assets come up for sale at attractive prices.

“We didn’t see any of it in 2023, of note,” Mr. Hutcheson said. “We do expect more of that in the next year and two years.”

Last year, OMERS had a wide divergence in performance between publicly traded stocks and bonds and privately held investments. Stocks gained 10.4 per cent and bonds were up 5.8 per cent. By contrast, OMERS had gains of 5.5 per cent from infrastructure and 3.9 per cent from private equity, which are lower-than-normal returns that compounded its real estate losses.

That was a reversal from 2022, when gains from private investments boomed and public equities and bonds lost money, adding up to an overall return of 4.2 per cent.

OMERS also shifted about $4-billion into bonds and private credit last year, seeking to take advantage of stronger returns from fixed income while rates are at their highest level in two decades. Most of that sum was moved out of investments in equities.

“When the markets soften, we think our focus on credits and privates will outperform, and that’s what we’ve experienced over the past three years,” Mr. Hutcheson said.

OMERS invests on behalf of approximately 600,000 Ontario public-service workers, including nurses, firefighters and police officers. It now manages $128.6-billion of assets, up from $124.2-billion a year earlier.

The plan is 97-per-cent funded and inching closer to being fully funded, up from 95 per cent at the end of 2022.

“All things considered, we’re feeling good about the way we’re positioned,” Mr. Hutcheson said.

On February 23, the day of my spinal fusion surgery, OMERS issued a press release stating it generated $5.6 billion in investment income in 2023:

OMERS, the defined benefit pension plan for broader municipal sector employees in the province of Ontario, generated a 2023 investment return of 4.6%, or $5.6 billion, net of expenses. Over the past 10 years, OMERS has averaged an annual investment return of 7.3%, net of expenses, adding $66.4 billion to the Plan. Net assets at December 31, 2023, were $128.6 billion, up from $124.2 billion in 2022, and the Plan reported a smoothed funded status of 97%, up from 95% last year.

“We are investors for the long term for the benefit of our members and their families. Our focus at OMERS remains on our ability to see through economic cycles. I am extremely pleased that in the past three years, coming out of the pandemic, our extraordinary global team has earned an average annual net return of 8.0%, a track record that stands up by any objective measure. Our 10-year result speaks to our ability to invest through turbulent times while continuing to deliver for our members,” said Blake Hutcheson, OMERS President and Chief Executive Officer. "These returns enable us to keep the pension promise, paying pensions on time and as planned, as we have done consistently since our creation as a Plan in 1962.”

“As we look ahead to 2024, higher interest rates are creating opportunities for us to deploy capital into fixed income to improve future returns, consistent with our new, more diversified strategic asset mix. We are confident in our ability to generate long-term returns that will build up the Plan’s assets given the high quality of our investment portfolio and the strategies that underpin it. I am very pleased with the way we are positioned for the future.”

“Returns in 2023 reflected a major divergence between the performance of public and private assets,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “Public equities and fixed income had a strong year and fixed income assets benefitted from higher interest rates. Returns from private asset strategies were held back by the increased cost of debt, increased operating costs, and anticipated slower economic growth, all of which are affecting private market investors worldwide.”

“Through a combination of pension payments, investment activities and our operations, OMERS impacts more than 1 in every 11 Ontario households,” said Mr. Hutcheson. “Our plan is contributing $13.7 billion annually to Ontario’s GDP and supporting more than 143,000 jobs provincewide. We have significant investments in Ontario with assets that include Bruce Power and Yorkdale Shopping Centre. We are proud to make a meaningful contribution to the economic and social strength of this great province.”

“With a promise to deliver for our members over the long term, our global teams are relentlessly focused on building a sustainable, affordable and meaningful plan that will continue to provide security in retirement for generations of members to come.”

OMERS remains highly rated by four credit rating agencies, including two ‘AAA’ ratings.

About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over 600,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in bonds, public and private credit, public and private equity, infrastructure and real estate.2023 Asset Mix

2023 Highlights

By the numbers

2023 investment return of 4.6%, or $5.6 billion, net of expenses

$128.6 billion in net assets

A 3-year net return of 8.0%, and a 10-year net return of 7.3%

612,533 OMERS members including 44,462 new non-full-time employees

97% smoothed funded ratio – up from 95% in 2022

3.75% real discount rate

$34 billion invested in Canadian assets

$13.7 billion contributed by OMERS to Ontario’s GDP

143,200 jobs supported by OMERS in Ontario

96% all-time-high OMERS member service satisfaction

94% of employees are proud to work for OMERS and Oxford (+6 points above best-in-class)

Transactions in 2023

In 2023, OMERS deployed $11.5 billion in capital, making investments that will contribute to our long-term ability to pay pensions for our members.

In addition to the transactions we reported in August with our 2023 Mid-year Update, we made the following announcements in the latter part of the year.

Maple Leaf Sports & Entertainment

OMERS invested US$400 million for an indirect stake in MLSE. MLSE is the parent company of sports teams including the National Hockey League’s Toronto Maple Leafs, the National Basketball Association’s Toronto Raptors, Major League Soccer’s Toronto FC, and the Canadian Football League’s Toronto Argonauts.

Redwood Materials

OMERS participated in Redwood Materials' over US$1 billion investment round. This funding will help build Redwood’s capacity, expanding the domestic battery supply chain and allowing customers to purchase battery materials made in the US for the first time

Alright, I'm back from the hospital, recuperating at home and have to get to work to catch up on items.

First order of business is to cover OMERS' results properly.

Nothing surprised me, the results are in line with what we saw at CDPQ which posted a 7.2% return in 2023.

Why did OMERS post a 4.6% return last year and CDPQ a 7.2% return?

OMERS is a pension plan which manages assets and liabilities, like OTPP, and it has more exposure to private markets which didn't fare well last year.

It also has a different approach to privates than CDPQ, doing more direct investing in private equity.

Moreover, in public equities, OMERS takes more of a value investing approach and has less tech exposure than CDPQ there, and that too impacted returns last year.

As Jonathan Simmons, OMERS Chief

Financial and Strategy Officer said in the press release:

“Returns in 2023 reflected a major divergence between the performance of public and private assets. Public equities and fixed income had a strong year and fixed income assets benefitted from higher interest rates. Returns from private asset strategies were held back by the increased cost of debt, increased operating costs, and anticipated slower economic growth, all of which are affecting private market investors worldwide.”

When I spoke to Jonathan in August, covering OMERS' mid-year results, he shared some insights with me:

Moving on to Private Equity, I told him people I'm speaking with tell me profits remain strong, the US consumer remains resilient but there's a slowdown as financing costs rise and there may be a valuation reset there.Jonathan replied:EBITDA growth is slow right now. I would say top line is very healthy but costs are up, specifically in the US. Many of our private equity investments are in US markets and there is certainly wage growth going on there. Cost pressures are keeping EBITDA growth flat.As it relates to multiples, hard to say, the market is very slow right now, there's not a lot of trades going on right now. I think we are still going to have to wait and see as to whether the reset happens and how significant it is. But it's not quite crystalizing yet.In Real Estate, I told him I just spoke to the Caisse and they told me cap rates are rising hitting their valuations there, and I also noted Daniel (Dan) Fournier just took over the helm at Oxford and sometimes new leaders want to take writedowns on assets they don't like.Jonathan corrected me immediately:Valuation is the CFO's responsibility. Valuations sit in my shop, not in the asset classes. And Daniel is great, we are so pleased to have him in our team.I think cap rates is where it's at in that sector. Cap rates are changing. Underlying performance of operations is actually quite healthy but interest costs are up and cap rates are up and that's really what is holding back the performance in that segment of our business.

What I found interesting is what OMERS CEO Blake Hutcheson told the Globe and Mail, namely, all real estate sectors got hit last year, including Industrials, as cap rates climbed with interest rates and the economy slowed.

Blake thinks better days lie ahead for real estate as rates peak and he should know, he used to be head of Oxford Properties.

I'm not sure how much central banks will lower rates this year but rest assured, it will be a lot less than markets anticipate unless a crisis unfolds.

Real estate remains an asset class in transition, some segments will continue to struggle, others will chug along fine. You need to remain well diversified across economies and sectors.

OMERS Infrastructure posted a decent return of 5.5% last year.

Michael Hill, the new head of Infrastructure, has been busy revamping that team over there and despite the significant writedown of Thames Water, they were still able to generate a 5.5% gain last year.

That too speaks to the diversification on that portfolio and how resilient it remains in challenging markets.

In Infrastructure specifically, I note this in the 2023 annual report:

Infrastructure assets generated a net return of 5.5%, compared to our 2023 benchmark of 7.7% (2022 –

net return of 12.5%). This equates to net investment income of $1.5 billion in 2023 (2022 – $2.9 billion) and an operating cash yield of 3.5% in 2023, compared to 3.1% in 2022. Currency effects decreased the 2023 return by 0.4%.Our returns were supported by steady income generation and valuation gains from operational performance across several assets, particularly in the energy and utilities sector, which benefitted from inflationary tailwinds and recent regulatory outcomes. Overall performance was adversely impacted by unrealized losses from operational underperformance in a few specific assets in the energy and utilities and transportation sectors.

In Private Equity, I note this:

Private equity assets generated a net return of 3.9% in 2023, compared to our 2023 absolute return benchmark of 9.6% (2022 – net return of 13.7%). This equates to net investment income of $0.9 billion in2023 (2022 – net investment income of $2.6 billion). Currency effects decreased the 2023 return by 1.6%.

Our private equity returns were driven by organic EBITDA growth and accretive M&A activities across our portfolio companies, particularly in our business services, healthcare and industrial verticals. However, EBITDA growth across the portfolio was weaker than plan given the challenging macro environment impacting top-line growth and operating margins. Valuations for high-quality and recession-resilient assets we own generally remained stable throughout the year – though the valuations of our software and technology assets, which primarily reside in our ventures and growth equity strategies and comprise less than 2.3% of OMERS assets, were negatively impacted by operational underperformance in some assets and lower valuation multiples.

Lastly, in Real Estate, I note this:

Real estate assets generated a net loss of 7.2%, compared to our 2023 benchmark of 6.3% (2022 – net

return of 13.6%). This equates to net investment loss of $1.5 billion in 2023 (2022 – net investment income of $2.6 billion). Currency effects decreased the 2023return by 0.6%.Our performance in 2023 was impacted by valuation declines as higher long-term borrowing costs increased discount rates and terminal capitalization rates across all sectors. In particular, the office sector, which represents 21% of Oxford’s real estate portfolio, came under the most strain. Despite low vacancy rates in Oxford’s office portfolio, negative market sentiment from investors towards the asset class resulted in lower valuations. While pricing declines were also experienced in other real estate asset classes, these were partially offset by valuation increases from favourable leasing mainly in our industrial and retail sectors. Oxford’s stable income from property operations continues to outperform budget.

And in the spirit of transparency, the summary compensation table covering senior officers at OMERS (except the heads of subsidiaries who also get paid very well):

Keep in mind what ultimately counts is the funded status which crept up to 97% last year and long-term returns which are stable, that's where the focus should be:

Also worth mentioning that OMERS is a bit of a different beast because it manages third party monies, so they do things differently there than other large Canadian pension funds but still maintain the focus on funding and diversification.

Finally, it's worth reading my recent comment on how OMERS contributes far more than $13.7 billion to Ontario's GDP.

I know a lot of people are off this week in Quebec, last week in Ontario, and I know I have some catching up to do but bear with me as I'm still recuperating at home from back surgery (going well).

Below, the Ontario Business Lifetime Achievement Award is given to a leader who demonstrates outstanding leadership throughout their career and has made a significant and positive impact on the province and beyond.

This year’s award recipient is Blake Hutcheson, President and CEO of OMERS. Take the time to watch the interview below and learn more about Huntville's man.

Comments

Post a Comment