Ontario Teachers’ Returns 1.9% in 2023

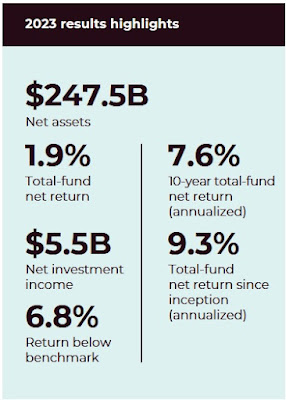

The Ontario Teachers’ Pension Plan announced it returned 1.9% in 2023, significantly underperforming its benchmark of 8.7%. The fund saw its assets grow to C $247.5 billion ($183.41 billion) in 2023, with the fund setting a goal of reaching C$300 billion in assets by 2030.

Poor returns were attributed to losses from real estate and infrastructure investments offsetting strong performance in equities and credit.

“The benchmark underperformance was driven by several factors, including a relative underexposure in listed equities, which performed strongly through the year, as well as valuation adjustments in the infrastructure and real estate portfolios due to higher interest rates and asset-specific events that negatively impacted select investments,” fund officials wrote in a release.

Ontario Teachers’, formed in 1990, has posted annualized one, five and 10-year returns of 1.9%, 7.2% and 7.6%, respectively.

Public equity, private equity and venture growth returned 20%, 3.6% and negative 0.7% in 2023, compared with benchmarks of 20.3%, 16.3% and 12.8%, respectively. These asset classes represent 10%, 34% and 3% of the portfolio.

Credit, 16% of the portfolio, returned 9.1%, slightly less than the fund’s 9.6% benchmark.

Bonds and real-rate products returned 0.6% and 7.3%, respectively, with these fixed-income assets meeting their benchmarks. These two assets comprised 35% and 4% of the fund’s portfolio.

Inflation-sensitive assets like commodities and inflation hedge assets returned negative 0.5% and negative 3%, matching their benchmarks, with natural resources returning 0.2%, less than their 3.3% benchmark. These assets made up 9%, 5% and 5% of the portfolio, respectively.

Finally, real assets like real estate and infrastructure returned negative 5.9% and negative 2.8%, well off of the benchmarks of 2% and 7.6%, respectively. These two assets comprise 12% and 16% of the portfolio.

These returns are not what was expected, Jo Taylor, Ontario Teachers’ president and CEO, noted in the release: “While we advanced key strategic areas of focus in 2023, we did not generate investment results to desired levels. This was largely due to positioning the portfolio for a more challenging economic environment than ultimately transpired, our relatively lower exposure to public equities, and valuation adjustments in certain real estate and infrastructure assets.”

The pension fund, like many other Canadian funds, has a surplus in funding. Ontario Teachers’ reported a funding surplus of C$19.1 billion by the end of 2023. The fund also reported investment income of C$5.5 billion, contributions of C$3.3 billion, C$7.6 billion in benefits paid and administrative expenses of C$0.9 billion.

“We remain fully funded and delivered a positive return, which are both important financial metrics for our members,” Taylor said in the statement. “As a pension plan with multi-generational liabilities, our investment strategy is intentionally designed for stable long-term returns.”

Barbara Shecter of the National Post also reports that Ontario Teachers' returns disappoint as markets soar and interest rates hit real estate:

The Ontario Teachers’ Pension Plan ended 2023 with disappointing results after allocating assets based on expectations of a recession, but chief executive Jo Taylor said he’s not planning a major shift into equities given that markets still look overheated.

Underexposure to listed equities plus valuation adjustments in Teachers’ infrastructure and real estate portfolios stemming from higher interest rates led to a net return of 1.9 per cent to end the year with $247.5 billion in assets.

“We only have about 10 per cent of our portfolio invested in listed equities,” Taylor said in an interview, adding that what the pension did hold performed well as markets soared at the end of last year. “But you look at valuations as we go into 2024 — they look as challenging if not more challenging than they were when we entered 2023, and that’s going to be an interesting debate for us in terms of, if we want to blend the risk up a little bit, how we do that?” he said.

Real estate

About 28 per cent of the fund is invested in global real estate and infrastructure, both of which took valuation hits in the higher interest rate environment. Taylor said some retail space in downtowns was affected by continuing struggles in the aftermath of the COVID-19 pandemic, while an infrastructure project in Europe was subject to a regulatory change that affected projections.

Adjustments were made to real estate capitalization rates — an indicator of the rate of return expected from an investment based on operating income and costs — in both 2022 and 2023, Taylor said. Now, the pension fund is in a holding pattern to see whether interest rates come down, he said.

Teachers’ real estate portfolio generated a negative return of 5.9 per cent against a positive benchmark of two per cent in 2023. For infrastructure, the 2023 return was negative 2.8 per cent against a benchmark positive return of 7.6 per cent.

“The overall prognosis for real estate, I would say, in 2024 and possibly 2025 is still pretty tough,” Taylor said, through he added that Teachers’ Canadian real estate portfolio is fairly concentrated in major cities, including Toronto and Vancouver, that are doing relatively well.

“We’ve got good occupancy within our office portfolio and pretty good occupancy levels in our retail portfolio as well, so operationally they’re doing fine. It’s just really, who would want to buy at what prices in terms of transaction values.”

Taylor said Teachers’ is not looking to be a seller at the moment.

“We like the assets we have, but I think if you did want to sell anything, people would be looking for a bargain at the moment.”

Investing in Canada

Taylor said his response to the growing debate about whether Canadian pensions should invest more in their home market is to continue on the path Teachers’ has followed since it was set up in its current form as an active investor in 1990.

“We are investing in Canada. We have $20 billion in (real estate unit) Cadillac Fairview in Canada. We have about $100 billion in total in Canada, it’s about 35 per cent of our portfolio,” he said, adding that the run rate for private equity investing in Canada is around 15 to 20 per cent. “So what are we not doing? We’re probably not investing a lot in Canadian listed equities. But, you know, I think we invest enough in other areas to compensate for that.”

When it comes to Canadian infrastructure, “slower uptake … isn’t necessarily our issue,” Taylor said. “It’s what’s made available to us.”

He said he will look at any projects brought forward by the newly created Ontario Infrastructure Bank, adding that pensions are most interested in operating assets rather than those under development that will take years to start throwing cash.

“We’ve run airports, we’ve run lotteries, we’ve run a few things of that type. I think we could show we’ve been a good custodian of important, sometimes politically sensitive assets,” he said. “So I think we’re well placed to be eligible to be considered to either co-own or operate those assets independently.”

Teachers’ posted a ten-year annualized total-fund net return of 7.6 per cent in 2023 and a 9.3 per cent return since inception. The pension retained a $19.1 billion preliminary funding surplus and is fully funded for the eleventh year in a row.

Paula Sambo of Bloomberg also reports real estate, infrastructure losses sap Ontario Teachers' returns:

Ontario Teachers’ Pension Plan gained 1.9 per cent last year, underperforming its benchmark by a wide margin, as strong results in credit and stocks were overshadowed by losses in hard assets.

The fund lowered its valuation on some infrastructure and property holdings due to higher interest rates and “asset-specific events that negatively impacted select investments,” which it didn’t specify in a statement Tuesday.

Ontario Teachers’ underexposure to stocks also weighed on its returns. That part of the portfolio rose 20 per cent, but the fund has just 10 per cent of its assets in public equities on a gross basis.

“While we advanced key strategic areas of focus in 2023, we did not generate investment results to desired levels,” chief executive Jo Taylor said in the statement, adding that the fund had prepared for “a more challenging economic environment than ultimately transpired.”

The real estate portfolio declined 5.9 per cent, compared with a two per cent gain for its benchmark. Infrastructure assets lost 2.8 per cent.

Overall, Ontario Teachers’ return trailed its benchmark by nearly seven percentage points.

Earlier today, Ontario Teachers' Pension Plan issued a press release announcing their 2023 results:

- Achieved a one-year total-fund net return of 1.9%.

- Underperformed benchmark return of 8.7% resulting in negative value add of $15.8 billion.

- Delivered a ten-year annualized total-fund net return of 7.6% and return since inception of 9.3%.

- Retained a $19.1 billion preliminary funding surplus and is fully funded for the 11th straight year.

- Reduced portfolio carbon emissions intensity by 39% compared to 2019 baseline and 10% relative to 2022.

- Announced the establishment of an in-house real estate asset class group.

TORONTO (March 12, 2024) -- Ontario Teachers’ Pension Plan Board (Ontario Teachers’) today announced a one-year total-fund net return of 1.9% for the year ended December 31, 2023.1 The net-return for 2023 was driven primarily by strong returns from public equities and credit, offset by losses in infrastructure and real estate. Net assets grew to $247.5 billion, reflecting incremental progress toward a strategic goal to reach $300 billion in net assets by 2030. Investment income of $5.5 billion and contributions of $3.3 billion for the year were largely offset by benefits paid of $7.6 billion and administrative expenses of $0.9 billion.

Results reflect underperformance relative to the benchmark return of 8.7% by 6.8%, or $15.8 billion in negative value add2. This compares to a total-fund net return of 4.0% in 2022, which beat the benchmark by 1.8% or $4.4 billion in value add.

The benchmark underperformance was driven by several factors, including a relative underexposure in listed equities which performed strongly through the year as well as valuation adjustments in the infrastructure and real estate portfolios due to higher interest rates and asset-specific events that negatively impacted select investments.

The plan is fully funded as at January 1, 2024, with a $19.1 billion preliminary funding surplus. This marks the plan’s 11th consecutive year being fully funded (meaning plan assets exceed future pension liabilities), underscoring the plan’s long-term financial health and stability.

“While we advanced key strategic areas of focus in 2023, we did not generate investment results to desired levels. This was largely due to positioning the portfolio for a more challenging economic environment than ultimately transpired, our relatively lower exposure to public equities, and valuation adjustments in certain real estate and infrastructure assets,” said Jo Taylor, President & Chief Executive Officer. “With that said, we remain fully funded and delivered a positive return, which are both important financial metrics for our members. As a pension plan with multi-generational liabilities, our investment strategy is intentionally designed for stable long-term returns.”

1 All figures are as at December 31, 2023, and denominated in Canadian dollars unless noted.

2 Value-add is the amount of return in excess of (below) benchmarks after deducting management fees, transaction costs and administrative costs allocated to the Active programs (includes annual incentives but does not include long-term incentives).

Investment performance

Given the plan’s liabilities stretch decades into the future, results over longer periods is particularly important. Ontario Teachers’ has delivered an annualized total-fund net return of 9.3% since inception in 1990, and five- and 10-year annualized total-fund net returns of 7.2% and 7.6%, respectively.

The table below summarizes Ontario Teachers’ investment returns and related benchmark returns by investment asset class for the current and previous year.

The table below summarizes Ontario Teachers' portfolio mix by asset class for the current and previous year.3 The total-fund net return is calculated after deducting transaction costs, management fees and investment administrative costs. Asset-class returns are calculated before deducting investment administrative costs.

4 Effective January 1, 2023, the Innovation asset class is included in Equity - Venture growth and is benchmarked to an active benchmark. Previously, Venture growth was benchmarked to its actual return during an initial incubation period. Prior period returns for Equity and Credit have not been restated.

5 Effective January 1, 2023, investments of $7,438 million formerly included in the Innovation asset class are now included in Equity - Venture growth ($7,331 million) and Credit ($107 million) asset classes.

6 Includes funding for investments (term debt, bond repurchase agreements, implied funding from derivatives, unsecured funding, and liquidity reserves) and overlay strategies that manage the foreign exchange risk for the total fund.

7 Comprises investments less investment-related liabilities. Total net assets of $247.5 billion at December 31, 2023 (2022 – $247.2 billion) include net investments and other net assets and liabilities of $3.6 billion (2022 – $3.1 billion).

Impact of currency on returns

In 2023, the fund experienced a foreign currency loss of $2.2 billion as assets denominated in foreign currencies depreciated in value when converted back into Canadian dollars. This corresponds with a negative impact from currency on our total-fund net return of 0.8%. This loss was primarily driven by the depreciation of the US dollar compared to the Canadian dollar. The fund’s net exposure to the US dollar is significantly larger than any other foreign currency.

Volatility management

Considerable attention is paid to managing volatility of returns alongside other growth metrics. Volatility is a common way of measuring risk or uncertainty. CEM Benchmarking, a market leader in analyzing performance and cost data, measures risk-adjusted returns of 289 pension plans from all over the world. CEM assesses Ontario Teachers’ to be a top performer when it comes to risk-adjusted returns over a 10-year period ending December 31, 20228, placing us in the 100th percentile compared to a peer group of 18 Canadian and global plans suggested by CEM as similar to Ontario Teachers’ in size.9

Ontario Teachers’ has a Sharpe ratio of 2.01 over the past 10 years versus our peer group median of 0.80. A higher Sharpe ratio signifies higher returns with lower volatility when comparing portfolios.

8 CEM Benchmarking study is dated December 31, 2022. This is necessary to include comparable data for all funds from 2022, the most recent year where all return data is available given funds report with different year-end dates.

9 CEM Benchmarking utilizes the Sharpe ratio to assess risk-adjusted return, which is calculated using the 10-year net return, less the 10-year risk-free rate, divided by the standard deviation of excess return. The Sharpe ratio is a commonly used method of comparing the return of an investment with its risk.

Investment highlights

Ontario Teachers’ manages approximately 80% of its assets internally, with a focus on deploying capital into active strategies around the world. Investment highlights in 2023 include:

Equities

- Acquired a majority stake in Sevana Bioenergy LLC and made a capital commitment to develop renewable natural gas projects across North America.

- Invested in 7IM, a leading UK wealth manager that excels in technology-driven wealth and investment solutions.

- Supported BroadStreet Partners Inc. in their acquisition of Westland Insurance, one of the largest independent insurance brokers in Canada.

- Entered an agreement to sell an equity stake in SeaCube Container Leasing Ltd., one of the world's largest operating lessors of intermodal containers.

- Entered a definitive agreement to sell Shearer’s Foods, a leading contract manufacturer and private label supplier serving the snack industry in North America.

Infrastructure & Natural Resources

- Acquired a significant equity ownership position in Diamond Communications, one of the largest privately held U.S. wireless communications infrastructure platforms.

- Acquired a 25% equity stake in Sweetwater Royalties, a base metals, industrial minerals and renewable energy royalty company.

- Acquired a significant majority stake in GreenCollar, a leading Australian environmental markets platform.

Real Estate

- Acquired a co-control position in Compass Datacenters, a company that designs and constructs data centres for some of the world’s largest hyperscalers and cloud providers.

- Acquired a significant majority stake in Lincoln Property Company’s Residential Division to support and grow multifamily property across the United States. The company was subsequently rebranded as Willow Bridge Property Company.

- Through our real estate joint venture with Boreal IM, acquired logistics assets in France, Spain, Italy, and Germany.

Teachers’ Venture Growth

- Invested in Xpressbees, one of India’s market-leading and fastest-growing third-party end-to-end logistics platforms.

- Participated in the latest funding round for Databricks, the world’s leading lakehouse platform on the cloud that unifies data, analytics, and artificial intelligence.

Corporate news

- After year-end, announced the appointment of Stephen McLennan and Gillian Brown, two longstanding Ontario Teachers’ leaders, as Chief Investment Officers focused on portfolio construction and alpha generation, respectively. Gillian Brown was appointed Chief Investment Officer, Public & Private Investments and Stephen McLennan was appointed Chief Investment Officer, Asset Allocation.

- Also following year-end, announced the appointment of Jonathan Hausman as Chief Strategy Officer, a newly established, cross-enterprise strategy role. Jonathan joined Ontario Teachers’ in 2004 and has led Global Investment Strategy (GIS) since 2017.

- Appointed Pierre Cherki as Executive Managing Director, Real Estate, a new investment leadership position that oversees the newly established in-house real estate team.

- Alongside Cadillac Fairview (CF), announced an evolution to our real estate operating model that will see the establishment of an in-house real estate asset class group at Ontario Teachers’. This aligns the real estate investment approach to that of other asset groups, where investment capabilities are embedded within Ontario Teachers’ to enable information sharing, co-sourcing, and best practices across geographies. Moving forward Ontario Teachers’ will focus on global real estate investing and portfolio management, while CF will focus on growth, diversification, and densification of its real estate portfolio in Canada.

- Appointed Bruce Crane as Executive Managing Director, Asia-Pacific. Bruce joined Ontario Teachers’ in 2020 and most recently led the Infrastructure & Natural Resources team in Asia-Pacific.

Climate ambition

As part of its journey to achieve net zero on its investment activities by 2050, Ontario Teachers’ has established industry-leading interim targets to reduce portfolio carbon emissions intensity10 by 45% by 2025 and 67% by 2030, compared to its 2019 baseline. At the end of 2023, Ontario Teachers’ has reduced portfolio carbon emissions intensity by 39% compared to our 2019 baseline and 10% relative to 2022. This reduction is primarily driven by an increase in market value of assets and a decrease in absolute emissions of our portfolio carbon footprint.

In 2023, Ontario Teachers’ wholly owned subsidiary, Ontario Teachers’ Finance Trust (OTFT), issued its fourth green bond with the $1 billion in proceeds being invested in companies or assets that enable the net-zero transition, reduce emissions, and build a sustainable economy. Net proceeds from OTFT’s green bond issuances are fully allocated to eligible green assets in our portfolio.

10 For further information on our methodologies, please see page 151 of our Annual Report.

Investment costs

Ontario Teachers’ is committed to cost-effectiveness and links costs to the investment value creation process. Total investment costs, including administrative expenses, transaction costs, and external management fees, totaled $1,855 million (75 cents per $100 of average net assets) in 2023, compared to $1,886 million (78 cents per $100 of average net assets) in 2022. The decrease in investment costs compared to the previous year is largely due to lower transactions driven by a decrease in mergers and acquisitions activity during the year, partially offset by a small increase in administrative expenses.

Note to Editors: To read our annual report, please click here.

About Ontario Teachers’

Ontario Teachers' Pension Plan Board (Ontario Teachers') is a global investor with net assets of $247.5 billion as at December 31, 2023. We invest in more than 50 countries in a broad array of assets including public and private equities, fixed income, credit, commodities, natural resources, infrastructure, real estate and venture growth to deliver retirement income for 340,000 working members and pensioners.

Our more than 450 investment professionals operate in key financial centres around the world and bring deep expertise in a broad range of sectors and industries. We are a fully funded defined benefit pension plan and have earned an annual total-fund net return of 9.3% since the plan's founding in 1990. At Ontario Teachers', we don't just invest to make a return, we invest to shape a better future for the teachers we serve, the businesses we back, and the world we live in. For more information, visit otpp.com and follow us on LinkedIn.

Please take the time to download and read OTPP's 2023 annual report here.

Earlier today, I had a conversation with CEO Jo Taylor and want to thank him for taking the time to talk to me as it was a fruitful discussion.

I also want to thank Dan Madge for reaching out to set up the call and for sending me material beforehand on an embargoed basis, helped me better prepare.

Now, before I get to my discussion with Jo, a few more items.

First, take the time to read Chair Steve McGirr's message:

Second, take the the time to read CEO Jo Taylor's message:

I note the following on appointments:

Since last year’s annual report, there have been a number of changes to our senior team. Our Chief Investment Officer, Ziad Hindo, left the organization after more than 20 years. We thank Ziad for his many contributions.

I took time to reflect on the CIO role, given its demands and complexity. Earlier this year, I announced a change in our leadership model in Investments, appointing Gillian Brown and Stephen McLennan as our new CIOs. This approach will share responsibility between two accomplished and long-serving investors and enable us to sharpen our capital allocation focus moving forward.

We established a Chief Strategy Officer role and appointed Jonathan Hausman, with a mandate to lead an enterprise-wide approach to advance our strategic objectives. Nick Jansa, who leads investment activities in Europe, Middle East and Africa, has joined our Executive Team on a permanent basis to ensure that international perspectives are formally embedded in all our discussions at the most senior level.

We elevated Bruce Crane to head our activities in Asia-Pacific, taking over from Ben Chan who had served the region admirably for five years. Asia-Pacific is an important investment area for the fund, and Bruce will look to optimize our returns from our teams in Singapore, Hong Kong and Mumbai. These internal appointments show the strength that we have at Ontario Teachers’ in our senior team and reinforce a strong commitment to developing our people.

We also announced a revised approach for real estate investing (see page 77) and appointed Pierre Cherki to head up our new in-house real estate team. Our returns in real estate have not been good enough in recent years. We believe taking a more active role in our investment activities there, as we do in other asset groups, will allow us to strengthen and diversify this portfolio.

That brings me to the Q&A with CIOs Gillian Brown and Stephen McLennan:

Both Gillian and Stephen are very experienced and very competent, it was actually a smart move to split the CIO job in two to focus on asset allocation (Stephen's role) and strategies/ manager selection across public and private markets (Gillian's role).

These are NOT easy jobs, far from it, and both are critically important. Most of returns come from asset allocation but if you don't pick right strategies and managers and add value, you're not going far.

And as Jo told me earlier today, Teacher's is a mature pension plan, there is little room for big errors as they cannot afford big downside risks.

You might have noticed the press release discussed their risk-adjusted returns over the long run:

Clearly Teachers' is very risk conscious, it needs to be given the demographics of its plan are older, it needs to manage liquidity risk and other risks tightly.

I do not read too much into risk-adjusted returns, however, because every pension plan/ fund is different and some can and should take more risks.

And as Jo told me earlier, even Teachers' might need to modify its risk-taking going forward.

Alright, let me jump into my discussion with Jo Taylor.

Discussion with OTPP CEO Jo Taylor

I always enjoy talking to Jo, he's very nice, bright and straightforward, doesn't shy away from answering tough questions.

I began by noting that looking at the asset mix, bonds, real estate and infrastructure make up 63% of total assets:

I also noted the weakness in real estate didn't surprise me as challenges in that asset class are widespread but what did surprise me somewhat was the underperformance of infrastructure, contributing to the 6.8% underperformance to their benchmark:

Again, real estate and infrastructure returned negative 5.9% and negative 2.8%, well off of the benchmarks of 2% and 7.6%, respectively. These two assets comprise 12% and 16% of the portfolio.

Jo Taylor responded:

Let me just touch briefly on real estate. We still have a high exposure to retail and office. Our Cadillac Fairview portfolio in Canada is performing operationally well, some good occupancy levels, thoughtful of new capital deployed which is densification of new sites or completing ones we already have in progress. And I would say the area we've been more focused on is international real estate. We are bringing people in-house and we want to make sure that gives us a better balance in our real estate portfolio by sector and geography. We are also moving away from things that are in development to assets that are operational.

Not an easy market, we brought in Pierre Cherki who was one of the board members at CF to run our (new in-house) real estate team, he's a good guy, he's getting his feet under the desk essentially to give us a better idea of where he wants to go with real estate and we will figure out together what level of capital should get allocated.

I then noted that 35% of the assets are in Canada and asked him if most of those Canadian assets -- like 90% -- are in fixed income and real estate:

Jo was quick to correct me, stating it's "more broadly based than that," adding:

Between those two products, we probably have $50 billion of the $100 billion invested in Canada. The rest in private equity, we also have a decent amount in infrastructure, commodities and some other activities.

It's pretty well spread across the whole of our portfolio. As I continuously say, not only do we have a decent amount of exposure to Canada as it exists today but also when we talk to our investment team, they anticipate a high level of investment into Canada over the next two or three years. If you look at our private equity and real estate portfolios, that's probably going to be $15 billion going into Canada.

I said that's very interesting because former CEOs of OTPP joined other former CEOs of Maple Eight pensions to write an op-ed in the Globe and Mail warning governments not to meddle with Canada's pension-plan model (more on that later this week).

I told Jo there's been a lot of criticism against the Maple Eight that they're not investing enough in Canada but he's telling me that Canada will remain an important geography even if OTPP is keeping the international focus.

Jo replied:

The really simple scenario is we have 35% of our portfolio in Canada, the same in the US and the other 30% spread around Europe (17%), Asia Pacific (7%) and Latin America (6%).

That to me represents a good balance in the portfolio in terms of what Canada comprises for a large, mature pension plan investing internationally. Should it be a lot more than 35%? I don't know but I think we have a good allocation there.

Why wouldn't I invest in Canada, to be honest Leo? I don't take foreign exchange risks, I make good rates of return, so when we find good projects here, we are generally enthusiastic to collaborate with government entities on infrastructure or look at projects that are available in some of our other asset classes.

For me, we are just carrying on, the debate can rage but for us we have plenty of good data to say we are pretty active investors and we created lots of wealth and jobs in our own country.

Jo then moved on to discuss the issues in infrastructure:

If you go back to 2022, our infrastructure team did really well delivering about a 20% return. To some extent, we looked at those assumptions on valuations, whether our discount rate assumptions based on the rise in interest rates and we thought we had to make an adjustment there. We are about 60 basis points off our discount rate assumptions. We are pretty much the only organization that I know of that has done that and typical of Teachers', we try to be prudent and that took a bite out of the valuations and performance for the infrastructure team.

The other thing we had were a couple of issues where they're either an ongoing issue with Covid implications or faced regulatory changes on a utility we didn't anticipate and had to make an adjustment to the specific valuation of that asset. So you add all that up together and I think we got a bit of an artificial hit that year on our run rate for our infrastructure portfolio. But what I will say to you is we like the portfolio we have, it's made great returns over many years, we still see it as an important product for us, we've got a great team looking to pick up the right opportunities. The sector has garnered a lot of attention and when that happens, pricing gets tighter so we have to be a bit more thoughtful about what we do.

I completely agree and mentioned to Jo there's increased regulatory scrutiny in Australia, the US and even discussions at the Canadian government on how private markets are being valued at pensions so it's nice to see Teachers' being very conservative in how it values these assets.

Jo responded:

A couple of things. If you go back to 2022, we took cap rates in real estate up by 100 basis points before anyone else did, and we added another 25 basis points in 2023. We are normally early and progressive about adjusting values where we think that ought to happen.

The other thing is our discount rate for the plan overall at 2.55%, it's still relatively low by international pension plan assumptions, and with that we are still well funded at 107% and gives us confidence we are at a good place in terms of the base to move forward with.

Indeed, the funded status remains exceptionally strong at Teachers' providing a great base:

I then moved up to private equity where I noted cost of financing is up, labor costs are up and margins are being squeezed and pretty much all big pension funds are seeing lower returns there.

I also asked him about fixed income where they noted in the annual report that volatility in yields impacted returns and I asked him specifically if they took too much duration risk and got caught after mid-year until the end-of-year rally in long bonds.

Jo responded:

Teachers' approach to fixed income is a bit different than our peers. We tend to take more of a derivative or future exposure to acquiring bond product so we don't actually own all of the fixed income product you see on the balance sheet.If you look at the fixed income return of 1.5%-2%, that's really just the interest rate spread. It's good for us in that we are more flexible in terms of moving around the duration curve. We did that ok last year and the year before, we certainly avoided making significant losses in fixed income than some of our peers. We try to do that because we are a mature plan and can't allow fixed income to take a big bite out of our performance.

To me the big challenge in fixed income is where does it sit in your portfolio as a product and how much of it do you want as exposure? We have about $85 billion in fixed income at the end of 2023. To me, that's about right and I wouldn't want increase leverage in the plan to get more of it. You will probably see fixed income tracking fairly flat going forward and that's very different from the past when we took fixed income all the way down when rates came down to zero. I think we are now in a world where we will leave it around the same size of where we have it today.

The key there is inflation expectations, I told him is see inflation stickiness persisting and asked him how their private debt portfolio is ramping up as part of the Credit portfolio.

Jo responded:

Credit did do well, made about 9% which is what we wanted it to do. As you've seen we increased it as a proportion of our portfolio. Private debt, we are building up our activity, we brought in some teams in London and Toronto to do that. Sometimes we are picking the credit slices of a transaction over the equity component. We can play in both areas which is sometimes helpful. We think the risk-adjusted returns are better on the credit piece.

The thing you always have to remember with credit is that it's a relatively cyclical product and I think we are in the middle of a cycle which will not last forever. I think at some point, credit opportunities will wane from where they've been and rates of return on credit will start to be less attractive. So it's something to have in the portfolio but not to be too dependent on it because returns will not be there on 10-year cycle.

Going forward, I noted infrastructure will produce solid returns, liquid absolute returns (hedge funds) kicked in last year (8% of the total portfolio), real estate will still suffer challenges in some sectors and private equity will do well when there are dislocations in markets and they can put money to work.

Jo responded:

When you look over the last 10 to 15 years, the asset class that has performed the best on an absolute and relative basis is private equity. We have to make sure that comes back and we drive value creation.

The structure that we now have with two CIOs, Steve McLennan who's one of them, has the job to not only look at allocation across the portfolio to make sure we have the blend right but also how we drive that value creation across the different asset groups His job is that we drive liquidity, value creation and the assumptions we are making in our long-term planning are realistic and can be driven out of the respective teams.

Instead of focusing on weaker companies and trying to manage them, it's a truism for me that you're better off looking at the strong companies and help them so they become dominant and grow more than they would do otherwise with the right support. We try to provide some operational support as well as right activity from the size of team as where they are a big asset but could become a really significant asset in our portfolio. It's easier to grow a business from a $2 billion valuation to $4 billion valuation than to try to recover value on a $200 million net in asset wher eit's going to be really hard to get back to where you started,

I then asked Jo specifically what percentage of their private equity portfolio is funds, co-investments and purely direct:

Directs has moved up a fair bit. If you look at the private equity portfolio, first bit of segmentation, we do have a funds book, but the balance about 80% is direct. We do co-investments but we do a lot more on our own to avoid the carry drag. The other thing is we made a lot of commitments recently to diversity, climate change, to the right level of social impact. You can deliver that a lot more easily when you own the asset and are a majority owner than when you're a minority partner to someone else. When we have more control, we can deliver more broadly on our commitments across the plan.

The second thing is if you look at the returns we made, our direct book has done very well relative to co-investing. If we co-invest with a partner where we are a significant minority -- say about 40% -- that's more of a controlled investment, it's more difficult when we are between 5% to 15% bracket in terms of the level of influence we have, an that's probably the area we've tuned down a little bit over the last 2-3 years.

[Note: I still am not quite sure what percentage of their PE portfolio is purely directs meaning they originated deal and have full control relative to co-investments where they are significant minority owners relative to syndication where they are insignificant minority owners, but the key here is broadly, 80% of the portfolio is direct meaning they pay no fees and that's what drives returns.]

Jo Taylor was also clear that the focus on ESG has not hampered their performance:

A couple of things. We invest to provide a fully funded plan for our members but our members also have opinions. One of their opinions, they want us to do the right thing around climate and how those businesses are constituted and run. And we set up to make all of our businesses better over the longer term because we think if you are generally a well run business with diverse employees and diversity of thought, you will make better returns over the long run. Our evidence is what we are doing in that area s helping our businesses to perform better. If it wasn't the case, I'd go back to my other fiduciary duties and make sure we are making the best returns for our members and if that isn't working we should go back to reflect on it.

I think all the things we've been doing in that area. A good one is climate, some people ask is it a profitable area to invest. It has been for us. We've made good returns in infrastructure and early stage investing around climate. The data is convincing enough to say we can invest in those projects carefully and selectively and make good returns because over time, other investors want to own those assets and the growth they are able to get is significantly better than some other industries.

Teachers' has been a leader in climate investing and investing in the transition economy. Jo told me they really like electricity transmission and have done there in various countries but he also noted there remains uncertainty in alternative fuels and it's till early days for transition investing.

Lastly, I noted it was a really off year as they underperformed their benchmark by 680 basis points given what happened in real estate and infrastructure (see discussion above) but what are the risks he sees going forward given unprecedented herding in mega cap tech stocks in the stock market?

Jo responded:

A couple of points. We started 2023 with a very cautious and bearish outlook on the world. We thought listed equities were fully valued, there's lots of political risk out there, war going on, plenty of potential shocks to the system which led us to a conservatively composed portfolio with only 10% allocated to listed equities. I guess that played out in 2023 where we were more cautious than others were or maybe we needed to be against our benchmark. It's tough to beat an S&P 24% growth benchmark but our view was there was more downside risk which didn't turn out to be the case.

So if you look at 2024 with assets that went up in 2023, what do you do? We are more likely to stay the course and say we see plenty of risks out there, you want to keep a conservatively composed portfolio. We are a mature plan, we can't sustain large losses.

But what we will do is take a little bit more risk than a purely defensively composed portfolio, something more in mid-range, where would you allocate that risk going forward. And that is something we are looking at, where would that be best allocated an not necessarily in listed equities but there may be a component of that, but also taking a slightly different risk allocation in some other areas which should blend the rates of return up a little bit as to what we produced in 2023.

He added:

If the benchmark continues to move like it did in 2023, we are probably going to be forced to blend up the risk.

We ended up talking about Asia where they paused on China and where Bruce Crane has made some nice investments. He did admit however there are fewer larger transactions in Asia than other regions and that is why scaling activities there isn't as straightforward as you would think.

Alright, it's exactly 9 p.m., I've been working on this comment all day and want to once again thank Jo Taylor for another very insightful discussion.

Please take the time to carefully read OTPP's 2023 annual report here, it's very detailed and covers a lot more material.

I will end with some compensation tables. First, the remuneration for the board of directors:

Next the compensation for the executive team:

Note Jo Taylor's compensation did go down as short-term targets were not met but over the long run, the plan is performing very well and remains fully funded.

Also, former CIO Ziad Hindo's compensation was not disclosed but I am sure he did very well last year as he has done over the last ten years.

That is all from me, it's been a long day and I am still recuperating and my back is aching.

Remember, you simply will not find this level of detail and sophistication anywhere else, so please support this blog financially via PayPal options at the top left-hand side and help me continue the important work I do covering Canada's large pension plans and funds.

Below, CNBC anchor Sara Eisen joins Citadel founder and CEO Ken Griffin in a fireside chat, as he shares his views on the latest market trends and the key forces that will drive the industry in 2024, at the International Futures Industry conference in Boca Raton, Florida. Source: FIA (Futures Industry Association).

This is a must watch interview, Ken Griffin at his best, touting the virtues of capitalism and a system which rewards innovation and he doesn't hold back on his disdain for useless regulations, climate policies and more.

Citadel is one of the many hedge funds OTPP, CDPQ and other large Canadian pension funds invest in so take the time to listen to his views, he understands economics and the financial risks ahead.

Comments

Post a Comment