OTPP Joins CDPQ by Acquiring Big Stake in Australia's Greenstone

Ontario Teachers’ Pension Plan Board (Ontario Teachers’) announced today it has reached an agreement to acquire a 33.4% interest in Greenstone, one of Australia and New Zealand’s leading insurance distributors.

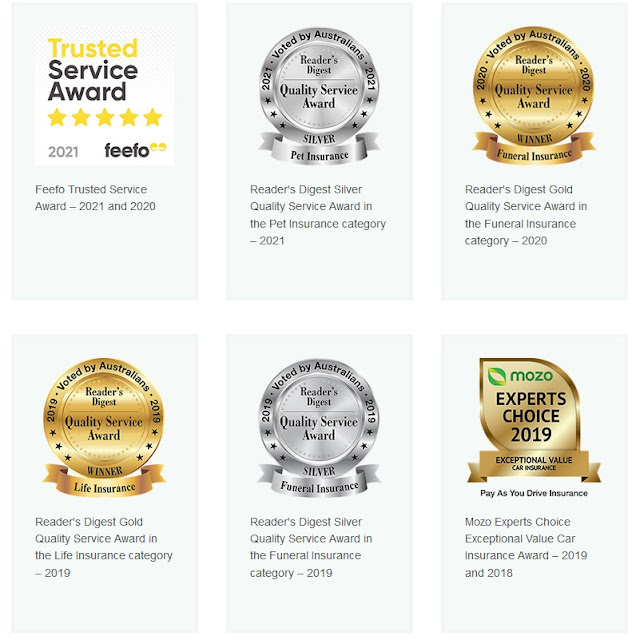

Headquartered in Sydney, and established in 2007, Greenstone has focused on developing simple and affordable life and general insurance products for Australians and New Zealanders. This positioning has enabled Greenstone to quickly become a leader in the direct distribution of insurance products with over 650,000 in force policies. Its unique customer-focused and technology-driven approach has earned the Company extensive industry awards and recognition.

Ontario Teachers’ investment represents a full exit by co-founder Gavin Donnelly, while the other two major shareholders, HIBV, and CDPQ, a global investment group, will sell-down pro-rata and collectively own the remaining interest. Ontario Teachers’ looks forward to working collaboratively with HIBV and CDPQ to reinforce Greenstone’s mission to bring innovative insurance products to Australian and New Zealand consumers.

“We are excited to add another long-term investor in Ontario Teachers’ to our register. We believe they are an ideal sponsor given their deep expertise investing in leading financial services businesses and value-added partnership model. This significant commitment from Ontario Teachers’ further validates the quality of our proposition and our commitment to the long-term growth of the business”, said Brenard Grobler, Greenstone CEO.

“The investment in Greenstone is consistent with our strategy of investing in industry-leading financial services businesses with high-quality management teams and innovative technology. We look forward to working closely with management and our partners and contributing to the company’s continued success”, said Ben Chan, Senior Managing Director, Asia-Pacific at Ontario Teachers’.

“We are delighted to have Ontario Teachers’ joining us as a new investor in Greenstone. We have a close working relationship, having together successfully invested in companies and demonstrated our commitment to ESG initiatives over the years”, said Martin Laguerre, Executive Vice-President and Head of Private Equity and Capital Solutions at CDPQ. “Greenstone is an industry leader in the insurance sector, a key focus for CDPQ, that we are pleased to support since 2016. We look forward to cooperating with Ontario Teachers’ and the management team as the business progresses into its next stage of growth”.

Both Ontario Teachers’ and CDPQ are significant investors in Australia and New Zealand. With a diverse portfolio in private equity, infrastructure and natural resources, Ontario Teachers’ has recently invested in Abano Healthcare Group and Asia Pacific Healthcare Group. For its part, CDPQ has been active in infrastructure, logistics real estate and private equity. Recent investments include Healthscope, a private hospital operator, and Sydney Metro.

The Transaction is subject to Australia’s Foreign Investment Review Board approval and other closing conditions.

ABOUT GREENSTONE

Greenstone specialises in harnessing technology and data analytics in order to design, market, distribute and administer personal insurance products. Greenstone offers products in the life, funeral, income protection, pet and general insurance markets. These insurance products are distributed through Greenstone's proprietary brands (Real Insurance, Australian Seniors, New Zealand Seniors, OneChoice, Guardian Insurance and Prime Pet Insurance) and affinity brands (Medibank, ahm, Woolworths, Guide Dogs Pet Insurance and RSPCA Pet Insurance). In addition, Greenstone also distributes its proprietary, affinity and third party insurance products, through its online comparison website, Choosi.ABOUT ONTARIO TEACHERS’ PENSION PLAN

Ontario Teachers’ Pension Plan Board (Ontario Teachers') is the administrator of Canada’s largest single-profession pension plan, with CAD 227.7 billion in net assets as at 30 June 2021 (all figures at June 30, 2021 unless noted). It holds a diverse global portfolio of assets, approximately 80% of which is managed in-house, and has earned an annual total-fund net return of 9.6% since the plan's founding in 1990. The defined-benefit plan, which is fully funded as at January 1, 2021, invests and administers the pensions of the province of Ontario's 331,000 active and retired teachers. For more information, visit otpp.com and follow us on Twitter @OtppInfo.ABOUT CDPQ

At Caisse de dépôt et placement du Québec (CDPQ), we invest constructively to generate sustainable returns over the long term. As a global investment group managing funds for public retirement and insurance plans, we work alongside our partners to build enterprises that drive performance and progress. We are active in the major financial markets, private equity, infrastructure, real estate and private debt. As at June 30, 2021 CDPQ’s net assets total CAD 390 billion. For more information, visit cdpq.com, follow us on Twitter or consult our Facebook or LinkedIn pages.

CDPQ put out the same press release which you can read here.

The first thing I did after reading about this deal is go straight to Greenstone's website to read more about the company:

Our Organisation

We pride ourselves on being an innovative company that makes smart financial solutions simple and accessible. These quality solutions help people protect the things most important to them, and are offered through our diverse portfolio of brands and partners.

We are passionate about distributing insurance through our Australian-based call centre, and we care about making a positive impact on our community. These insurance products are distributed through Greenstone's proprietary brands (Real Insurance, Australian Seniors, New Zealand Seniors, OneChoice, Guardian Insurance and Prime Pet Insurance) and affinity brands (Medibank, ahm, Woolworths, Guide Dogs Pet Insurance and RSPCA Pet Insurance).

In addition, Greenstone also distributes its proprietary, affinity and third-party insurance products through its online comparison website, Choosi.

In October 2018, Greenstone opened the doors to the first Australian Seniors retail store, providing a personal touch in the provision of innovative, quality and affordable insurances for Australian seniors.

In April 2020, Australian Seniors launched DARE magazine — a bi-monthly publication aimed at the over 50s market, full of exciting, on-trend and relevant articles about relationships, travel, health and pastimes. This magazine is free for existing eligible Australian Seniors customers, and can also be purchased as a subscription or in our retail stores.

In May 2021, Greenstone was granted certification as a Great Place to Work® recognising us as a truly inclusive and safe workplace. We believe a culture of inclusiveness is one of the most important aspects an employer can strive for and we are so proud of this recognition.

How We Started

Our PurposePutting quality financial protection within everyone’s reach.

Our Brands & Partners

Working closely with our partners, we provide an end-to-end insurance distribution solution supporting their individual brand needs and achieving their corporate objectives. Our distribution model allows us to develop and successfully maintain a number of partnerships concurrently, with integrity, and without conflict of interest.

Our Commitment

Greenstone is committed to improving its systems and procedures to avoid human rights violations within our own operations and supply chain. Read Greenstone’s complete Modern Slavery Statement.

Accolades/Awards

As you can read above, Greenstone takes its commitment and responsibilities very seriously and that's why it has received several awards and accolades.

Importantly, Greenstone isn't just another insurance company, it's an insurance company focusing on innovation and clearly states it cares about making a positive impact on its community.

Moreover, it targets Australia's seniors, providing them with a personal touch in the provision of innovative, quality and affordable insurance.

It also launched DARE magazine — a bi-monthly publication aimed at the over 50s market, full of exciting, on-trend and relevant articles about relationships, travel, health and pastimes. This magazine is free for existing eligible Australian Seniors customers, and can also be purchased as a subscription or in its retail stores.

This is a huge market.

In fact, a recent report predicts smaller population growth and rapidly ageing citizens in Australia:

A look 40 years into Australia's future shows that thanks in part to the pandemic the population is not going to grow as quickly as previously thought, meaning a smaller economy will be tasked with managing the burden of a rapidly ageing population.

The latest Intergenerational Report (IGR) gives a glimpse into how Treasury thinks the country and the economy will look in four decades' time, and how particular policies will shape or change the outlook.

The IGR is handed down every five years, but had been delayed this time around because of the pandemic.

Treasurer Josh Frydenberg delivered it this morning, describing it as showing "early warning signs" for the government and the country about what was to come.

The report paints a picture of a country dealing with smaller-than-expected population growth, but still a large and ageing population that will continue to put greater stress on welfare and health services.

Adding to the complexity, Australians are expected to live longer.

Men born in 2060-61 are expected to live to 86.8 years old on average, compared to 81.4 years for people born in 2020-21.

Whereas women born in 2060-61 are expected to live to 89.3 years, compared to 85.4 for those born in 2020-21.

"IGRs always deliver sobering news. This IGR is no exception," Mr Frydenberg said.

Mr Frydenberg made clear there was no doubt the course this IGR charted had been profoundly impacted by the pandemic, particularly in population estimates.

The 2015 report projected Australia's population would hit 40 million by 2054-55. Today's report predicts it will reach 38.8 million by 2060-61 instead.

"This is the first time there has been a downward revision of the population forecast in an IGR," Mr Frydenberg said.

The same thing is going on elsewhere.

There's an old saying, "demography is destiny" and those who pay attention will be ahead of the curve whereas those who don't pay attention will be left behind.

The same goes with diversity & inclusion. Companies that are leading the charge here will be richly rewarded over the long run and those that don't will become a memory of a memory.

Luckily, Greenstone is leading the charge there too:

In May 2021, Greenstone was granted certification as a Great Place to Work® recognising us as a truly inclusive and safe workplace. We believe a culture of inclusiveness is one of the most important aspects an employer can strive for and we are so proud of this recognition.

What else? The company even has a culture section on its website where they list their values and discuss diversity and benefits:

Values

We are passionate about our core values, which contribute towards the positive culture that supports our employees, our customers and our community.

Diversity

We strongly support diversity and equality across all aspects of life. We value our employees’ unique experiences, perspectives, and viewpoints – which are critical to creating innovative products that serve our customers and communities.

Recently we were certified as a Great Place to Work® recognising Greenstone as a truly inclusive and safe workplace. We are so proud of this achievement and will continue to be passionate about creating an inclusive workplace that promotes and values diversity.

Our diversity and inclusion goals focus on:

- Creating a work environment that is inclusive and fosters growth

- Leading and managing inclusively – embracing different cultures, ethnicities, physical and mental abilities, genders and sexual orientations

- Engaging with our customers in an authentic way that reflects and respects their unique perspectives and experiences

To receive certification Greenstone employees were independently surveyed and we are proud that the following results were some of the strongest achieved.

- 99% - Agree Greenstone is a physically safe place to work

- 97% - Agree people at Greenstone are treated fairly regardless of their sexual orientation

- 97% - Agree Greenstone’s facilities contribute to a good working environment

- 96% - Agree people at Greenstone are treated fairly regardless of their race

- 96% - Agree people at Greenstone are treated fairly regardless of their gender

Benefits

At Greenstone we value our employees and believe working together across functions will lead us to achieve our goals. With an engaging and inclusive culture that sets us apart from others, we strive to be an employer of choice and reward our team with a range of benefits and incentives.

Our People

Anyway, as you can read, Greenstone doesn't just talk the talk on diversity & inclusion, it actively looks to bolster it throughout its organizations and engages with its employees (although it needs more women on its senior management team).

Financial details on this deal are not available but CDPQ acquired a 44% interest in Greenstone back in June 2016 (see press release here).

Since then, the company has grown nicely and with OTPP now acquiring a 33.4% interest in Greenstone, it will grow even more because OTPP has a specialized financial services platform and will work alongside CDPQ and HIBV to help the company grow its operations.

By the way, you'll recall in October 2019, OTPP and CDPQ partnered up with industry veteran Anurag Chandra to launch a new insurance platform, Constellation Insurance Holdings.

In March of this year, CDPQ and OTPP put out a press release stating Constellation Insurance Holdings announces it has entered into an agreement to acquire Ohio National. I wrote about it here.

Obviously, CDPQ and OTPP are very comfortable working closely together on insurance deals all over the world.

I also want to applaud Martin Laguerre, Executive Vice-President and Head of Private Equity and Capital Solutions at CDPQ for making this very public post on Linkedin:

When you're a leader, you don't just bask in the glory, you share it with everyone who worked hard to make the deal happen. Well done.

What else? I also want to publicly commend Julie Côté, Senior Director, Improvement and Financial Governance for being recognized by the Association of Quebec Women in Finance last week as a star member:

Well done and well deserved!

Lastly, on October 4th, CDPQ's CEO, Charles Emond, will be joined by Desjardins Group's CEO, Guy Cormier and Nili Gilbert of the David Rockefeller Fund in a regional roundtable discussion on shaping a low-carbon future in North America:

You can register for this event here.

Below, Greenstone specializes in the design, marketing, distribution and administration of personal insurance products. Also, with Australian Seniors, life's booming! Watch and lean why.

Comments

Post a Comment