Stocks Looking Right Past Any Potential Bad News?

The S&P 500 and the Dow Jones Industrial Average eked out gains on Friday, wrapping up a volatile week on Wall Street. A move by China to ban cryptocurrencies weighed on the technology sector and Nike shares fell as supply chain issues stemming from the pandemic hit the sneaker giant.

The Dow Jones Industrial Average gained 33.18 points, or 0.10%, to 34,798.00. The S&P 500 edged 0.15% higher to 4,455.48 and the Nasdaq Composite shed about 0.03% to 15,047.70.

“As bad as things started off on Monday for stocks, a mid-week bounce and calm on Friday isn’t so bad,” said Ryan Detrick, chief market strategist for LPL Financial. “Still, many of the worries over Evergrande, a slowing economy, and continued supply chain issues are still out there.”

The Nasdaq trailed the other major averages on a week-to-date basis but edged up into the green for the close. The Dow finished the week 0.6% higher, while the S&P 500 ended it 0.5% higher. The Nasdaq gained 0.02% for the week.

A crackdown on bitcoin by China hurt market sentiment overnight, especially with technology shares that depend on crypto-related revenue. China’s central bank declared all cryptocurrency related activities illegal on Friday. Overseas crypto exchanges providing services in mainland China are also illegal, the PBOC said.

Bitcoin dropped 5% and ether lost about 7% in reaction. Crypto-exchange Coinbase, which derives most of its revenue from retail trading, and Robinhood, which last quarter made more than half of its transaction-related revenue from crypto, shed more than 2%.

Meanwhile Nike validated the fears of investors worried about the pandemic wreaking havoc with supply chains and raising costs for companies, especially multinationals. Nike shares fell over 6% after the sneaker giant lowered its fiscal 2022 outlook because of a prolonged production shutdown in Vietnam, labor shortages and lengthy transit times. Nike expects full-year sales to rise at a mid-single-digit pace, compared to low double-digit growth it forecast before.

The company also reported quarterly revenue that missed analysts’ expectations due to softening demand in North America as the delta variant flared up. Other apparel makers and retailers fell. PVH Corp fell 1%.Within the S&P, Nike’s decline was offset by gains in reopening stocks. Carnival Corp led the index with a 3% increase after reporting quarterly earnings, while other cruise lines and air carriers rose about 2%. Energy and industrial stocks were also leaders.

It’s been a topsy-turvy week for markets. Stocks staged a two-day relief rally beginning on Wednesday after the Federal Reserve signaled no imminent removal of its ultra-easy monetary policy. Investors also bet that the debt crisis of China’s real estate giant Evergrande wouldn’t trigger a ripple effect across global markets.

Investors were still waiting to see if Evergrande, the failing developer at the center of the property crisis in the country, will pay $83 million in interest on a U.S. dollar-denominated bond that was due Thursday. The company so far is staying silent and has 30 days before it technically defaults.Concerns about Evergrande hit global markets to start the week with the Dow shedding more than 600 points on Monday.

“If Evergrande fails, the exposure outside of China appears limited, and since the government will do whatever it takes to contain it,” said Edward Moya, senior market analyst at Oanda. “If China is successful, global risk appetite may not be dealt that much of a blow.”Chinese stocks including Pinduoduo, JD.com and Baidu were among the Nasdaq’s biggest decliners Friday.

The dominant theme for the rest of the year will be falling Covid cases globally and economic acceleration, said Bill Callahan, an investment strategist at Schroders.

“Cyclical stocks in the energy, financial, industrial and travel sectors will reassert themselves as market leaders into year end,” he said, while “longer maturity global bond yields will push much higher, steepening global yield curves as investors embrace growth assets.”

Alright, it was another volatile week in markets so let me get to it.

First, since it's Friday, some good news.

Ralph Ellis of WebMD reports that a Moderna executive says the pandemic could end in a year:

The COVID-19 pandemic could effectively be over in a year because enough vaccine will be manufactured and distributed by that time, Moderna Chief Executive Stéphane Bancel said in an interview with a Swiss newspaper.

"If you look at the industry-wide expansion of production capacities over the past six months, enough doses should be available by the middle of next year so that everyone on this earth can be vaccinated,” Bancel told Neue Zurcher Zeitung, according to Reuters. “Boosters should also be possible to the extent required."

Asked if that meant a return to normal in the second half of next year, he said: "As of today, in a year, I assume."

Bancel said people who don’t get vaccinated could develop natural immunity to COVID-19.

"Those who do not get vaccinated will immunize themselves naturally, because the Delta variant is so contagious. In this way we will end up in a situation similar to that of the flu. You can either get vaccinated and have a good winter. Or you don't do it and risk getting sick and possibly even ending up in hospital,” he said.

Booster shots might contain less vaccine than the first shots, he said, because "with half the dose, we would have 3 billion doses available worldwide for the coming year instead of just 2 billion."

Bancel said Moderna is developing “Delta-optimized variants” in clinical trials that will likely be used for boosters in 2022.

The Washington Post and other media outlets said Bancel’s prediction will not come true unless more vaccine is extended to poor nations. About 80% of the population in the world’s wealthy nations have received at least one dose of vaccine, compared to 20% of people in low-income nations, The Post said.

United Nations Secretary General António Guterres this week criticized rich countries for hoarding and sometimes wasting vaccines instead of sharing more readily with poor countries, The Post said.

I agree with Bancel, one way or another, most of the world's population will be immunized from Covid by this time next year because the delta variant is so contagious.

If that happens, then cyclical stocks leveraged to the economy will rally before, anticipating growth.

But it's not a done deal, if this pandemic taught us anything it's that variants occur in people who refuse to get vaccinated or can't get vaccinated, and if another more deadly variant develops with the same transmissible properties of the delta variant, then we're in deep trouble (I doubt it but can't discount it completely).

There are other issues impacting stocks and risk assets in general.

Last week, I discussed why inflation uncertainty is weighing down markets, explaining that while there are signs of inflation stickiness in the US, if a crisis develops in China (from Evergrande or something else), then that will bring about a deflationary contagion.

This week, some big US multinationals are warning there's more inflation set to hit consumers as holidays approach:

Costco, Nike and FedEx are warning there's more inflation set to hit consumers as holidays approach https://t.co/UrS0Gx1eW8

— Leo Kolivakis (@PensionPulse) September 24, 2021

Still, it's difficult to determine just how sticky inflation is and most smart analysts are warning that the bond market is not pricing in runaway inflation, and for good reason.

Earlier this week, my former colleague from BCA Research and then years later at CDPQ, Brian Romanchuk, posted a great comment on the transitory-ness in the TIPS market:

With all the debate about the persistence of inflation, one natural thing to ask is: what is the market pricing? Unfortunately for those who are selling a “return to the 1970s” narrative, “Mr. Market” is firmly in the camp of “Team Transitory.” Of course, one imagines that the immediate response is that the “markets are wrong.” Since many of the people in the “inflation is coming!” crowd are also in the “markets are always right” camp, there is a good chance they might modify the argument to “markets are wrong according to some affine term structure model.”

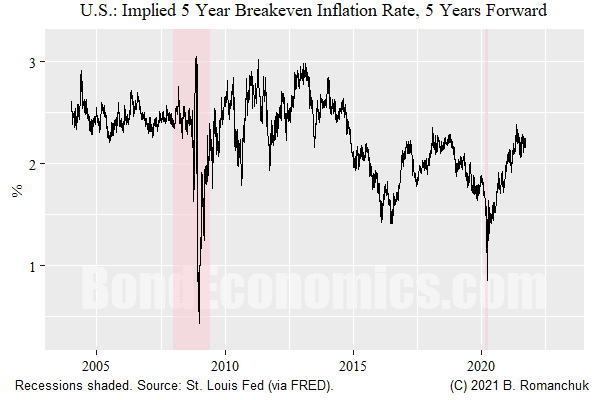

The baseline for our discussion is the most straightforward measure of “forward inflation expectations” is the figure above: the 5-year TIPS inflation breakeven rate, starting 5 years forward. I took the series directly as calculated by the St. Louis Federal Reserve as based on the Fed H.15 fitted Treasury rates, but they used the exact same approximation I would use in this circumstance.

To give a quick primer for those new to the topic, the “breakeven inflation rate” on an inflation-indexed bond (in this case, U.S. TIPS) is that future rate of inflation that gives the same total return as nominal government bonds (conventional Treasuries). That is, it is literally the rate of inflation where the two types of government bonds have the same return (break even). From the perspective of mathematical finance — as used in option pricing — this is where the expected inflation rate is, using the mathematical definition of expectation. One should keep this notion of “expectation” distinct from the notion of “forecast,” as I discuss below.

I showed the forward rate instead of the spot rate (a breakeven over the time period starting now) so that we can see what is priced in after current disturbances have subsided. (I did not even bother looking at spot breakeven inflation rates.)

As the chart above shows, the forward breakeven has recovered from the usual collapse we see in financial panics during the lockdown period, but are still well below where it was last cycle. (Which was too high in retrospect.).

(My book Breakeven Inflation Analysis offers more information on this topic.)

I would argue that the only sensible takeaway from that figure is that inflation market participants are not deeply concerned about a secular rise in inflation. Beyond that, I do not have enough information to be more specific. My immediate concern is that the above time series is an approximation, and we really would need to dig in the details of bond-specific pricing to have more confidence in the exact level of forwards.

The reality is that TIPS market is not incredibly liquid, and there are fewer issues to work with. Meanwhile, an individual issue can have pricing quirks like seasonal effects based on its coupon dates. The figure above certainly gives the correct big picture, but one should not view the specific levels as being definitive at any point in time. Even without access to the instrument-specific data, I believe that it is fair to assume that error bars are currently larger than usual.

(The inflation swap market can give a cleaner read on forwards, but I am out of the loop with regards to the liquidity in that market currently. Inflation swaps always tend to be secondary to government bond inflation markets, since it is extremely hard to find anyone other than the central government willing to sell inflation protection in size.)

The reason why academics or central bankers will say the above reading is incorrect is because they have models that allege that the risk premia have been zooming around, and so the “real expectations” are way higher than observed breakevens. That is, the breakeven might be the mathematical expectation, but forecasts (“expectations” in common English) are higher.

One of the interesting things about fixed income is that outsiders insist that bond market participants routinely misprice bonds while within the bond market there are entire teams whose entire day job is to price bonds correctly. (I used to lead one of such teams.) Whatever.

The problem with the “risk premia zooming around” story is that it is unclear that any of the models offer useful information. They are internally consistent, yes. But do they offer useful information — where we measure “usefulness” by generating profitable trade analysis? In general, they do not pass that test. For example, it is entirely typical for the models to suggest that term premia in a certain part of the curve was heavily negative — and then the realised excess returns were quite positive, as any ignorant shnook fixed income quant could have told the academics.

In this case, I have some sympathies for a demand for inflation protection forcing breakevens lower. But there is no way to get from there to a “1970s is coming!” narrative. At best, we are “really” just back where expectations were last cycle.

Brian is a fixed income specialist, he knows exactly what he's talking about and I think too many people are getting too caught up in the inflation du jour headlines without taking a step back to see what the market is pricing in.

And the market is not pricing in secular inflation.

Still, some strategist remain firmly entrenched in the inflation camp.

In his latest weekly market wrap-up, The Bond Market Reset, Martin Roberge of Canaccord Genuity writes:

This week’s Fed comments were more hawkish than expected, with Fed Chair Powell signaling that the projected balance sheet tapering could be done by mid-2022. This would imply ~$15B in monthly reductions of bond purchases starting in November or December. Moreover, FOMC members have pulled forward the median dot into 2022, in line with the market view. While bonds reacted in a delayed fashion after the Fed comments, the increase over the past two days has brought yields to 3-month highs, up ~25bps since August lows. This week, we want to remind investors how explosive monetary conditions will likely remain when the Fed taper is through by next summer. Indeed, our Chart of the Week shows that when accounting for bond purchases, the Fed funds “shadow rate” is at -2%, nearing 2014 lows. But when we account for inflation, which is much higher this time around, the real shadow rate has fallen to all-time lows of ~-7%. To put things into perspective, when QE3 ended in 2014, real GDP growth oscillated ~2.5%. Today, the Fed projections are calling for mid-point GDP growth of ~4% in 2022, and we are told that this growth will not be inflationary despite record-low real policy rates. We expect the Fed may have to deal with the mother of all soft-landing challenges in 2022.

I suspect Martin is still long commodities given his views and if that's the case, he's probably recommending clients buy the recent dip in metal & mining stocks (XME) as they got hit hard this week and remain long energy stocks which did well this week

As far as the post-Fed meeting backup in bond yields, it's still too early to conclude a selloff is just getting underway.

When I look at long bond prices (TLT), they remain at important support levels and this could be a brief respite before they head back up (and yields head lower):

That all depends on US and global growth prospects going forward.

And while everyone is concerned about Fed tapering, I'm more concerned about another debt ceiling showdown in Washington:

The debt ceiling fight is a 'most dangerous game': Morning Brief https://t.co/4z6Hl2uzoY

— Leo Kolivakis (@PensionPulse) September 24, 2021

In my opinion, if there's even a hint of fiscal retrenchment, bond yields are headed back to record low levels.

Anyway, let me wrap it up with some stock market information:

As shown below, cyclical sectors (Energy, Financials, Industrials) leveraged to the economy performed well this week and Tech also delivered a decent performance:

But what really caught my attention again this week was the craziness that is still going on with some meme stocks which big hedge funds (not retail) are pumping and dumping indiscriminately on a rolling basis (whenever they feel like it):

Jim Keohane is right, we are in the mania phase of the market and it won't end well, especially for the most speculative segments of the market.

Anyway, those are my market thoughts this wild and volatile week

Wishing you all a great weekend!

Below, CNBC's Mike Santoli and Shannon Saccocia, Boston Private Wealth chief investment officer, break down the week's markets and where they expect them to go from here.

And Nouriel Roubini, CEO at Roubini Macroassociates, discussed the impact of

global fiscal and central bank policy on inflation, economic growth,

and inequality. He spoke on "Bloomberg Surveillance" earlier this week.

Lastly, earlier this week, Ray Dalio, founder and co-chief investment officer at Bridgewater Associates, talked about the China Evergrande Group’s debt crisis, doing business in China, the value of Bitcoin and when the Federal Reserve might start to taper its monthly bond purchases. He spoke to Tom Keene on "Bloomberg Surveillance" from the Greenwich Economic Forum in Connecticut.

Ray has always warned about regulatory risk in cryptocurrencies and he was spot on about this as China just sent shockwaves through crypto markets.

This is another great interview, take the time to listen to his market thoughts.

Comments

Post a Comment