Ivanhoé Cambridge CEO on Why Adaptation is Key to Success in 2023

She is one of the most powerful people in commercial real estate in Canada, heading up a multibillion-dollar portfolio for Quebec's largest pension fund, but Nathalie Palladitcheff got her first C-suite job after deciding to take a journey nearly half a world away.

In 1997, when she was 30, Palladitcheff left her native Paris for a job with Banque Française Commerciale, based on an island in the Indian Ocean, because it offered her the opportunity to break into the upper ranks of the corporate world as chief financial officer.

"It was really far from my home, and probably because of that, I wanted to succeed," said Palladitcheff.

That decision would put Palladitcheff on the path that eventually led to her role today as president and CEO of Montreal-based Ivanhoé Cambridge, the real estate arm of pension fund manager Caisse de dépôt et placement du Québec. Ivanhoé Cambridge had 69 billion Canadian dollars, or 51.4 billion U.S. dollars, in real estate assets across the globe at the end of 2021.

Palladitcheff joined Ivanhoé Cambridge in 2015 as executive vice president and CFO, was promoted to president in 2018, and was appointed CEO in 2019.

"When I was appointed, I wanted to succeed because, again, it was away from my home, my comfort zone. I want to deserve the hospitality I have benefited from migrating to Canada."

Adopted Country

She became a Canadian citizen in February 2022, and when she got a Canadian passport for the first time, she realized what her adopted country had come to mean for her and her family.

"Failing was not an option for me," said Palladitcheff. "For me, part of the responsibility of being in the C-suite was I had to deserve this role."

Many women do well in their careers but still stall getting into the C-suite.

"I realized the chance I had, and I never left it," Palladitcheff said. For women, "sometimes you have to push a little bit harder to enter this very special club."

In 2000, Palladitcheff got her first taste of real estate and working for a public company when she joined the Société Foncière Lyonnaise, France's oldest property company, where she was a director of finance.

She got the job because of her experience in banking, she said, noting REITs in Europe at the time were looking for people with finance backgrounds.

Her own experience now includes public companies, private companies and pension funds. "For me, it's precious to have those experiences," she said, recalling her time at a public REIT and facing angry investment managers. "They are never happy with the stock price," she said with a laugh.

Palladitcheff said she feels a responsibility to help women be successful in real estate. Her advice to female colleagues is to jump on any opportunity they have to become part of the C-suite at their companies.

However, reaching the C-suite means a lot of eyes will be watching you even if you don't want to be a role model, she said.

"It's not enough to have the business card. You have to stand for something," Palladitcheff said. "You have to think of the company as one big entity. And that's what I expect of all my colleagues in the executive team. That they act as leaders of Ivanhoé Cambridge."

R É S U M É

Nathalie Palladitcheff | CEO and president of Ivanhoé Cambridge

Hometown: Paris

Current city: Montréal

Years in industry: 22

Education: Diplôme d’Études Financières et Comptables

Hobbies: Ballet

Advice to those starting out in the industry: "Do not try to plan everything. Keep your mind open."

------------

Everyone in commercial real estate had to start somewhere. CoStar's First Job column explores where careers began.

At the beginning of the year, Shantaé Campbell of the National Post also interviewed Ivanhoé Cambridge CEO Nathalie Palladitcheff who said adaptation is key to success in 2023 and that those waiting for a return to normal in commercial real estate will get left behind:

Nathalie Palladitcheff gets asked all the time when things will get “back to normal” in the commercial real estate world, but the chief executive of Ivanhoé Cambridge thinks the premise of the question is flawed.

“I would not expect that being back to normal would be really good news,” Palladitcheff said in a December interview. “I really think that we will have to adapt ourselves and adjust ourselves and find new solutions in this environment.”

The effects of the COVID-19 pandemic and the shift to hybrid work are still rippling through the real estate markets. Demand for residential and industrial space has shot up while offices and shopping centres have been slower to recover.

Palladitcheff, who was recently appointed as chair of the Real Property Association of Canada (REALPAC), the main industry group representing the country’s commercial real estate giants, said she tells her team that waiting for that recovery is not an option.

“We have to innovate and we’re going to have to … just be a little bit smarter than we used to be,” she said.

The good news for Canadian landlords is that office real estate markets here have weathered the storm better than some. Canada still boasts three of the five lowest office vacancy rates in North America and a stable national retail vacancy rate of 8.5 per cent, according to Colliers International.

A Commercial Real Estate Services (CBRE) report that examined the Canadian office market in the third quarter of this year put Vancouver’s vacancy rate at 7.1 per cent, Ottawa’s at 11.5 per cent and Toronto’s at 11.8 per cent. Those figures compare favourably to major U.S. centres such as Dallas at 32.2 per cent, San Francisco at 24.2 per cent and Manhattan at 15.2 per cent.

Palladitcheff acknowledges, however, that a recession could still “change the game dramatically.”

She predicts those holding office space will face competing demands that make the outcome from a downturn hard to predict. On the one hand, a recession would lead to a rush to cut costs, including rent. On the other, companies are struggling for talent, and there is a sense that a physical office is still an important tool for establishing “the right culture.”

She said that the landlords who are able to hang on in 2023 are going to be the owners of sustainable A-class commercial spaces.

Montreal-based Ivanhoé Cambridge is the real estate arm of the deep-pocketed Caisse de dépôt et placement du Québec, which manages that province’s major public pension plans.

With strategic partners and major real estate funds, Ivanhoé Cambridge holds interests in more than 1,200 high-quality buildings, primarily in the industrial and logistics, office, residential and retail sectors and had $69 billion in real estate assets as of Dec. 31, 2021.

Palladitcheff got the top job there, becoming the company’s first female chief executive, in 2019 after 20 plus years in international commercial real estate.

Her focus has been on innovation and diversification and she counts the development of a corporate social responsibility strategy that ensures the international portfolio reaches carbon neutrality by 2040 among her key accomplishments.

“My job is really to be prepared for the worst scenario and to be ready for whatever happens, Palladitcheff said.

The French-born executive kicks off her two-year term as chair of REALPAC in January, after being named to the position in November. She had previously served as vice chair.

Palladitcheff said encouraging her team to be smarter means looking at real estate as a solution rather than a problem.

She said her experience in European commercial real estate — she worked at a company there 15 years ago that already had a head of environmental, social and governance (ESG), a post that is only now becoming common in Canada — has given her an advantage when it comes to addressing sustainability.

“Real estate professionals who are going to provide the world with solutions … not more problems are going to win this race,” she said.

These are excellent interviews with Nathalie Palladitcheff (looks like they’re grooming her for the top job at CDPQ).

Recall, in late December, I also caught up with Nathalie Palladitcheff, CEO of Ivanhoé Cambridge, sending her a set of questions which she agreed to answer. You can read that post here.

Now, I'm not going to lie to you, real estate makes me very nervous in the short run and long run.

In the short run, a major global recession is headed our way.

I've written about the big risks I see here, here, here and here.

Let there be no doubt whatsoever, a major recession is already starting in the US and in a few months this will be clear and spread throughout the world:

December marked 10 consecutive m/m declines for LEI from @Conferenceboard … going back to 1960, we've never seen that stretch without economy already being in recession pic.twitter.com/7ZbHPx2pmI

— Liz Ann Sonders (@LizAnnSonders) January 24, 2023

In fact, at this point I find any talk of a soft landing downright silly and laughable:

But they told me it's going to be a soft landing!😂😂 pic.twitter.com/MXacOSWRjJ

— Leo Kolivakis (@PensionPulse) January 24, 2023

You know the old saying, "prepare for the worst and hope for the best"?

Well, this time I can unequivocally tell you to prepare for the worst and pray it doesn't get worse:

Jeremy Grantham Warns of a 17% Plunge in the S&P 500 This Year https://t.co/Z9tTK7NMl7 via @YahooFinance

— Leo Kolivakis (@PensionPulse) January 24, 2023

'The Fed-fueled fantasy bubble has popped.' Stock investors are detached from reality -- but they're about to get a big dose. https://t.co/29U0YDR3cZ

— Leo Kolivakis (@PensionPulse) January 24, 2023

"Ah yes, Leo, but who cares about the stock market that is deflating fast? Real estate, infrastructure are tangible assets you can see and touch and they're perfect for large pension funds looking to hedge against inflation and that want to match their long dated liabilities with long duration assets."

Be very careful here, I wasn't born yesterday and know quite a bit about real estate and infrastructure.

Yes, they hedge against inflation and are long duration assets but they too benefited during the long era of ultra-low interest rates which fueled the bubble in everything!

So I expect them to get hit very hard over the next two years as this global recession unfolds.

There is no way -- ZERO -- that any senior executive working at Canada's large pension funds can think otherwise and if they do, they have a very nasty surprise in store for them.

When it comes to private markets, in this environment asset selection, diversification and valuations matter a lot.

If you're going to buy, make sure you're buying quality assets across sectors and geographies and make sure you're not paying up huge for these assets because it will come back to haunt you.

Even in real estate? Especially in real estate!

Today, the Montreal Gazette published an article from Frédéric Tomesco stating Montreal office vacancies hit all-time high as 2022 ended:

Office vacancies in metropolitan Montreal reached an all-time high in the fourth quarter as companies continued to cut back on workspaces to account for hybrid work arrangements.

Greater Montreal’s overall office market ended the year with a vacancy rate of 17 per cent, U.S.-based real estate services firm CBRE Ltd. said in its most recent quarterly report. In the third quarter, the rate was 16.5 per cent.

Demand for real estate in business hubs such as Montreal has ebbed since March 2020 as employers initially kept most staffers home before adopting flexible return-to-work policies that require office presence only a few days a month. More than 367,000 people worked downtown before the start of the pandemic, according to a recent report from the Chamber of Commerce of Metropolitan Montreal.

“We’re definitely seeing occupiers adopting space consolidation strategies and moving into smaller spaces,” Ruth Fischer, managing director of CBRE’s Quebec operations, said in an interview. “Oftentimes they are spending the same amount of money because they are trading lower-quality, bigger spaces for more expensive, higher-quality spaces that are going to facilitate the collaboration that has to happen in offices now.”

Downtown Montreal’s vacancy rate improved slightly to 16 per cent in the fourth quarter from 16.1 per cent three months earlier, CBRE also said. Employers in the central business district vacated close to 1.1 million square feet of office space over the course of 2022, the data show.

Average vacancy rates for Class A buildings, the most prestigious type of office space, improved to 13 per cent in the fourth quarter from 13.3 per cent. Class A vacancies remain more limited compared with less expensive properties because downtown employers place more emphasis on “quality, amenity-rich” spaces with features such as gyms or bike storage facilities, CBRE says.

“Yes, the overall vacancy rate is high, but good quality space does not have a high vacancy rate,” Fischer said. “Our brokers tell us that if you have a space on the market that is turnkey and is good quality, it will go.”

Vacancy rates in suburban Montreal averaged 18.3 per cent.

Two buildings — including Laval’s Espace Montmorency — opened their doors in the metropolitan area this past quarter, covering a combined 407,000 square feet.

Greater Montreal’s office-building “pipeline” has shrunk to its lowest level since 2017, CBRE said. No new projects started construction over the last three quarters.

Across Canada, the office vacancy rate hit an all-time high of 17.1 per cent in the fourth quarter, CBRE data show.

It’s a far different story in industrial real estate, where market conditions remain tight amid strong demand for e-commerce shipments. Some 1.6 per cent of warehouses and other industrial properties across Canada sat empty in the fourth quarter, compared with just under six per cent at the start of 2013.

In Montreal, the industrial vacancy rate held steady at 1.2 per cent. Industrial rents in greater Montreal soared more than 50 per cent in 2022, the most among major Canadian markets. Montreal-area rents finished the year at $15.39 per square foot — the first time that they topped $15.

“A year ago, we were having conversations about whether or not rents would cross the $10 mark,” Fischer said. “Obviously we’re never returning to the $5 per square foot rents that we saw pre-2017, but the rate of growth is slowing.”

Rising industrial rents “reflect the change in the way people consume. We expect large volumes of products very quickly,” she said.

Through 2022, the availability of industrial space in Montreal has declined for 15 consecutive quarters. Net absorption in the latest period hit 758,000 square feet, boosting the full-year total to about 1.7 million square feet, according to CBRE data.

Faced with this red-hot demand, development activity continues apace. Another 3.8 million square feet of industrial space are under construction in Montreal and due for delivery in 2023.

Interestingly, yesterday right before I finished my comment on when McKinsey comes to Canada's Crown corporations, I drove downtown to go to Place Ville Marie to return a gift at the FedEx store.

It was just after 5 p.m. and I was struck by two things, most offices are ghost towns and second, Ivanhoé Cambridge and its partners did a great job revamping Place Ville Marie.

It doesn't get a perfect score because there are still accessibility issues for people with disabilities, but it's just beautiful and boy did it ever need a revamp!!

PVM is the crown jewel of Montreal office buildings but even it felt a lot less busy than when I was working there at BDC between 2008-2010.

All this to say, hybrid work is here to stay. Maybe the CDPQ Infra's REM will entice more people to come work downtown once it officially begins this spring but all that remains to be seen.

The future of offices remains very murky but Class A buildings that score highly on sustainability and offer a lot of amenities (great food court, gym, spas, children daycare, etc.) will be in high demand.

What if CDPQ gets stuck with all these office buildings and vacancy rates stay elevated?

No problem, they can look into revamping them into mixed use commercial real estate where you have apartments or condos and offices (once you own the land, there are many possibilities).

As for industrial real estate -- aka logistics properties -- they remain red hot but a severe recession will definitely hit their valuations hard.

Yes, I'd rather hold multifamily and industrial real estate all over the world, but make no mistake a severe global downturn is headed our way and it will impact all asset classes hard, including real estate.

That brings me back to Ivanhoé Cambridge President and CEO Nathalie Palladitcheff.

Most real estate leaders aren't visionaries.

I saw this with Neil Cunningham, PSP's former CEO.

He did a great job running PSP's real estate department and a solid job as CEO (basically kept things smooth) but he lacked vision and it ended up costing him his job as CEO.

[Note: No matter how badly they screw up, CEOs at Canada's large pension funds are never fired or let go, they are asked to (more like forced to) resign by their Board. It happened to Neil and to Gordon Fyfe who had disagreements PSP's Board at the time on compensation. André Bourbonnais left on his own to join Mark Wiseman at BlackRock because he felt the axe was coming.]

Where am I going with this?

Oh yeah, real estate people lacking vision.

Before Neil Cunningham ran Real Estate at PSP, it was André Collin who left PSP to join Grayken's Lone Star Funds where he still works.

Like Neil, André is an accountant by training (McGill grad) and that profession doesn't exactly breed visionaries.

Who cares? Collin ended up joining John Grayken's Lone Star and by my estimation his net worth must now exceed a quarter of a billion dollars, so who cares if he lacks vision?

I didn't say he's not smart but he's a shark who bought himself the best gig at Lone Star and he'll make another killing buying distressed properties for pennies on the dollar when the next global downturn strikes before he rides off into the sunset. But trust me, he lacks vision!!

Nathalie Palladitcheff on the other hand, she might be an accountant by training and worked as a CFO, but she doesn't lack vision (her upbringing and experience and interest in arts may explain this).

She has a vision for her organization, her team, for the the REALPAC team she will now lead.

You need vision to be a solid leader, especially when the going gets tough.

[Note: The only minor fault I'd give Nathalie is she has way too many meetings and needs to be a little more hands off as a leader and trust her instinct more.]

The next recession, you will see who are the great leaders versus who are the not so great leaders.

There's a reason why Jean-Guy Desjardins is coming back to head up Fiera Capital, the asset management firm he founded. He knows what lies ahead and it's going to be tough, very tough!

He'll survive but he needs to stop hanging around yes men and women and hire more people like me, fearless people who have the balls and brains to tell it to him like it is no matter how much it bruises his (inflated) ego.

[Note: I'm not looking for a job at Fiera but he needs to clean house there and I'll meet him for lunch one day to give him my brutally honest thoughts. I also always wanted to meet Gordon Fyfe's mentor, heard TONS of stories about him (all good) when Gordon gave me lifts back home.]

Alright, let me wrap it up there but the key message I want you to retain in this post is hard times are coming to all asset classes, including real estate, infrastructure, private equity and private debt.

Nathalie is right, those waiting for a return to normal in commercial real estate will get left behind.

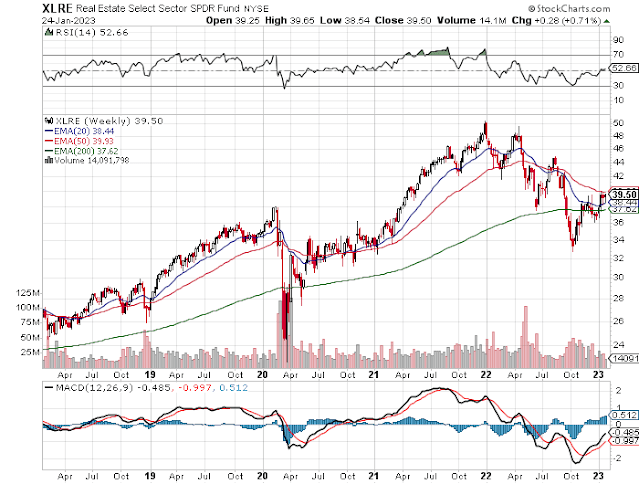

How do I know? Just look at the lousy performance of REITS and we haven't seen the worst of it:

I'll tell you something else, publicly listed real estate will get hit hard before private real estate and come out of the recession first, which is why it outperforms when the recession ends.

I would highly recommend that all real estate (public and private) is managed by one department at Canada's large pension funds. That includes mortgages and commercial lending.

Alright, let me wrap it up.

Below, Starwood Capital CEO Barry Sternlicht has made no secret of his displeasure with Fed moves this year, taking aim at rising rates as a threat to capitalism itself. But he’s also hinted there are opportunities to be had for savvy investors who know where to look. Sternlicht was recently interviewed by Sara Eisen, CNBC “Closing Bell” anchor.

Let me give Sternlicht and all investors some friendly advice: keep your eyes peeled on wage inflation in the US and all over the developed world this year:

Walmart increases average hourly wage to more than $17.50 https://t.co/6QHUeebLyW via @YahooFinance

— Leo Kolivakis (@PensionPulse) January 24, 2023

Ten years ago Abe would have celebrated a headline like this. It feels different when it is happening despite your efforts, however. It's a big red flag in my opinion as it reveals that Japan no longer control their financial system the way they used to.https://t.co/Xpyqw1L16o

— Francois Trahan (@FrancoisTrahan) January 22, 2023

Also, don't be surprised if the Fed increases by 50, not 25 bps, at its next meeting:

Come on Fed, dare you to go 50 bps again!😁

— Leo Kolivakis (@PensionPulse) January 24, 2023

So get used to higher for longer until the next crisis hits and deflation swamps us!

Alright, let me end it there. I definitely don't get paid enough to offer all of you this great advice!!

Comments

Post a Comment