On IMCO's World View and Addressing Inequality

The world is entering an unpredictable period defined by increasing fiscal policy use, decreasing global trade and higher inflation and interest rates, according to a new research paper by the Investment Management Corp. of Ontario.

“At IMCO, we believe that these global trends are leading us towards a new era of investing, one where it becomes increasingly difficult to rely on the past as a predictor of the future,” noted the paper.

According to the investment organization, the neoliberal economic policies pursued by most Western governments between 1980 and 2020 are waning as a result of a confluence of factors, including an increased use of fiscal policy by governments and de-globalization. This shift will make it less reliable for investors to draw on lessons from the past four decades in future decisions. “This multi-decade policy rate tailwind could be in jeopardy as central banks wrestle with burgeoning inflationary forces.”

According to the paper, governments’ confidence in their ability to intervene in the economy was strengthened during the coronavirus pandemic. “This experience provided a stark reminder of the power of fiscal [policy] and could set the stage for greater use of this policy lever.”

The IMCO also pointed to a slowdown in international trade, which has been in decline since 2008, as a sign that the world is entering a new economic era. Since 2020, global trade declined at a faster rate than in the previous decade. This was, in part, a response to the pandemic, Russia’s invasion of Ukraine and increased tensions between China and the U.S.

In the past two years, governments and corporations have sought to rebuild supply lines away from adversarial nations. “De-globalization will likely play a role in driving inflation as re-shoring shifts production to higher-costing regions, potentially increasing consumer prices.”

The IMCO also found efforts to decarbonize economies are pushing governments to become more involved in markets, which could lead to rising costs. “Government interventions, such as carbon pricing and other policy measures, are also likely to drive up energy prices, adding further tailwinds to the global inflationary trend.”

If direct intervention in the economy through fiscal policy does increase, it could lead central banks to adopt much higher interest rate levels than have been seen in recent decades, noted the paper. “Central banks. . . could become less willing to provide support to markets in times of slowing growth and heightened market volatility, focusing instead on taming burgeoning inflationary forces with restrictive monetary policy.”

Earlier this week, IMCO released its World View:

TORONTO (January 16, 2023) – The Investment Management Corporation of Ontario ("IMCO") today released its World View, a comprehensive research paper that defines the global trends that will most impact clients' assets and the accompanying implications for investors.

After decades of relative global stability and "predictable" economic policy, the world appears to be shifting towards a more volatile regime, with sources of economic and geopolitical disruption surfacing everywhere. Macroeconomic policy is also undergoing a profound revolution as frameworks that were once viewed as unflappable are starting to come under growing scrutiny.

This upheaval is making it increasingly difficult to rely on the past as a predictor of the future. In recognition of these changes, IMCO developed its World View as a foundational piece of research that will inform asset mix and investment decisions.

Authored by IMCO's research team following months of analysis and discussions with investment teams, senior management, and external research partners, the World View identifies six global themes expected to play a significant role in driving returns over the coming decade. Many of these represent an "inflection point" or reversal of previously entrenched trends.

The World View also examines the economic and market implications of these themes, that institutional investors such as IMCO might consider doing in response to these macroeconomic outcomes.

Read IMCO's World View here.

ABOUT IMCO

The Investment Management Corporation of Ontario (IMCO) manages $79 billion of assets on behalf of our clients. Designed exclusively to drive better investment outcomes for Ontario's broader public sector, IMCO operates under an independent, not-for-profit, cost recovery structure. We provide leading investment management services, including portfolio construction advice, better access to a diverse range of asset classes and sophisticated risk management capabilities. As one of Canada's largest institutional investors, we invest around the world and execute large transactions efficiently. Our scale gives clients access to a well-diversified global portfolio, including sought-after private and alternative asset classes. Follow us on LinkedIn and Twitter @imcoinvest.

I recommend you take the time to carefully read IMCO's World View here.

Below, I embedded the World View at a glance themes and implications:

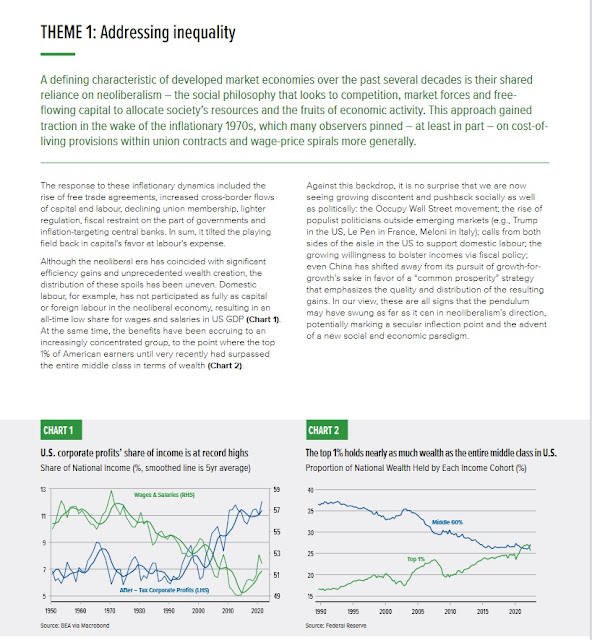

One of the key themes the report highlights is their first one on addressing inequality:

For me, this is a key theme which needs to be understood by every institutional investor.

For example, I recently posted Michael A. Arouet's tweet below on LinkedIn where he states: "How did CEOs make ends meet in the 60‘s and 70‘s when they were making just 20 times more than the average worker? (Morgan Stanley)"

How did CEOs make ends meet in the 60‘s and 70‘s when they were making just 20 times more than the average worker? (Morgan Stanley) pic.twitter.com/mxqWw0HFf4

— Michael A. Arouet (@MichaelAArouet) January 16, 2023

I shared this on LinkedIn:

Is executive compensation at Corportate America way out of hand? Well, consider Michael A. Arouet’s tweet below and consider that (I heard) 2/3 of all the S&P 500 gains since the GFC have come from buybacks where companies issue debt when yields are low to buy back their shares, artificially inflating earnings per share and executive compensation. As George Carlin notes in his famous American Dream skit: “It’s a Big Club, you and I aren’t part of the Big Club.”😁

Perhaps companies should be forced to report CEO total compensation relative to that of the average worker at their company.

It also irritates me when billionaires who should know better dismiss rising inequality as a major problem:

Stop complaining, says billionaire investor Charlie Munger: "Everybody's five times better off than they used to be." (via @CNBCMakeIt) https://t.co/IFvMDLNfmm

— CNBC (@CNBC) January 16, 2023

I wrote this on LinkedIn:

I agree with Munger that people should stop complaining and envy is a waste of emotion, but his dismissal of rising inequality is self-serving, tone deaf and shallow. The reality is today’s ultra-wealthy have benefited the most from ultra easy monetary and fiscal policies over the last four decades so to say they deserve all their billions is distorting the truth. Not saying higher taxes on billionaires is the solution but get real Charlie, a minority in society disproportionately benefit more from the capitalist system than others.

Rising inequality is already a huge problem and it threatens the fabric of social democracies.

Over the holidays, I purchased some of these books (others I already owned) because addressing inequality is an important issue I want to fully understand properly:

- The Deficit Myth

- Engine of Inequality: The Fed and the Future of Wealth in America

- The Lords of Easy Money: How the Federal Reserve Broke the American Economy

- Global Inequality: A New Approach for the Age of Globalization

- Inequality: What Everyone Needs to Know

- Radical Uncertainty: Decision-Making Beyond the Numbers

That last one isn't about inequality but it's about decision-making in a very uncertain world and Mervyn King and John Kay wrote a brilliant book that everyone should read.

All these books are worth reading, especially Karen Petrou's book on how the Fed exacerbated inequality and Stephanie Kelton's book on the deficit myth, but they all leave me incomplete.

On the one hand, being an economist by training, I know true economic growth only comes from productivity growth and that means investing in equipment and machinery as well as human capital.

But it also means getting fiscal and monetary policies right, striking the right balance between being too interventionist versus being too non-interventionist.

It all comes down to the debate between Keynesians and Friedmanites or neo-Keynesians and neo-Friedmanites, but nowadays we have new schools on modern monetary theory (my former colleague at BCA Reserarch and then CDPQ, Brian Romanchuk of the Bond Economics blog, is an expert on this topic and it irritates him when he sees shallow criticism of MMT).

All I know is that the world is changing, whether irrevocably remains to be seen, but we have major issues like climate change and rising inequality to address and global pensions and other institutional investors need to be part of the solution.

Now, Jonathan Nitzan, another former colleague of mine at BCA Research who is now professor of political economy at York, keeps reminding me that capitalism is all about power and "differential profits".

He has told me: "Pensions are part of the problem, they invest in the global stock markets and are actively looking for strategic sabotage so they can fund their pensions."

Interestingly, I always thought that large pensions can reduce inequality, especially if we provide everyone in our society access to a well-governed defined-benefit pension plan, but he made me think about how pensions are also contributing to rising inequality.

Another way is that global pensions invest hundreds of billions, if not trillions, into private equity and hedge funds charging huge fees.

These private equity and hedge fund titans, along with Big Tech moguls, have made billions in wealth during an era of QE and ultra-low rates.

That has come to an abrupt end as inflation spiked to a 40-year high last year forcing central banks to abandon QE and low rates and replace them by QT and much higher rates.

Like IMCO, I believe higher for longer is here to stay, for now, but my ultimate end risk remains debt deflation.

To avoid that scenario, we need more interventionism from central banks and governments.

The problem? The global debt time bomb will preclude government intervention:

Martin Wolf: We must tackle the looming global debt crisis before it’s too late https://t.co/SLMMIXCwyN

— Martin Wolf (@martinwolf_) January 17, 2023

Instead, I see huge potential for global pensions to step in and play an active role in reshaping our world for the better, in the form of public-private partnerships.

But this will require political will to create winning conditions and a united front among the world's global sovereign wealth and pension funds to do the right thing and be the engines of growth -- a more inclusive, clean and sustainable growth.

Anyway, I can literally go on and on but would love to be part of panel discussion on this topic.

I commend IMCO for openly discussing these important themes and sharing their World View.

As I have stated many times on my blog, the most influential courses I took at McGill weren't in economics and mathematics -- my major and minor before I went on to do an MA in Economics -- but in political theory with Charles Taylor, the most important thinker in Canada and perhaps the world (although Tom Naylor, Robin Rowley and Alan Fenichel provided some great food for counter though in their economics courses which I thoroughly enjoyed).

We need more critical thinking in finance, more diverse views, not just more diversity per se (although we need that to get more diverse views).

This is why I'm a stickler for diversity in all its forms.

I tell pension leaders I meet and talk to and write about this publicly, stop window-dressing and implement real diversity at your funds or you'll underperform over the long run.

I mean this, you need to bomb your HR hiring practices and start anew!! (the current cookie cutter check some boxes approach is a recipe for disaster).

Alright, let me end it there but before I forget, please take the time to read Barbara Shecter's interview with IMCO CEO Bert Clark on why calling the markets in 2023 is a mug's game:

The Investment Management Corp. of Ontario was created a little more than five years ago to pool funds and entice public-sector pension plans in Canada’s largest province with lower costs and economies of scale. Bert Clark, chief executive of the now $70-billion fund, says his investment philosophy can be summed up as follows: Run your investment portfolio like it is a business as opposed to a gambling book. The Financial Post’s Barbara Shecter spoke to Clark about the fund’s approach to ESG, investing in China and why calling the markets in 2023 is a mug’s game. The following interview has been condensed for space and clarity.

Financial Post: Managing environmental, social and governance (ESG) risks has been a key concern among large businesses and institutional investors, but it seems some are now pushing back against that. As we start a new year, where does IMCO stand on ESG?

Bert Clark: Those three letters capture so many things. And so I think that’s part of the risk of that that acronym: Do we all agree on what we’re talking about when we use that term? Probably not.

For us, there are two places we’re focused in the universe of things that are described as ESG. The first is decarbonization. So we believe that that’s a long-term powerful investment trend. It’s going to create a big mess and big opportunities for investors. It’s not a trend that’s going to move in a straight line.

Witness what is happening in Europe right now where they’re starting to go back to coal, because they have to. But I think over the longer term what will happen in Europe is that the tension with Russia around sources of natural gas is actually just going to accelerate the movement towards decarbonization. And so that for us is a big part of how we think about ESG, the move to decarbonization and things we’re doing to make sure that we’re on the right side of that trend.

FP: What’s the second thing?

BC: The other for us is the risk of owning things that aren’t consistent with our ESG beliefs because of our passive exposures. Often you find organizations surprised that they own things that wouldn’t accord with their investment beliefs because they’re in the index. And that’s a complicated thing to navigate because most organizations will require some amount of passive liquid broad market exposure to rebalance the portfolio or to get access to broad asset classes before they’re willing to actively invest in those market segments. And so that’s an area where you don’t have a solution yet, but we are spending a lot of time thinking about how can we make sure that we don’t own things that aren’t consistent with our ESG investment beliefs.

I think the events of the Russian war on Ukraine was a real turning point on that. We had very small exposure through this sort of broad market index exposure and that caused us to say, ‘Wow, we would never intend to invest in Russia, that was not part of our investment strategy.’ How do we avoid ever having that happen again, where we find ourselves holding something that we don’t want to own? So, as I said, we don’t have the solution yet, but it is something we’re spending a lot of time thinking about.

FP: What’s your strategy on divestment when it comes to the energy sector — oil and gas? How does it fit with what you said about wanting to be on the right side of the decarbonization trend?

BC: We don’t have a divestment strategy. I think that fossil fuels will be around for the coming decades. They can’t be eliminated from our economy and societies quickly. And we believe that one of the opportunities and one of the roles we can play is to help decarbonize and that means working with and investing with fossil fuel companies.

There are things that we likely wouldn’t invest in, certainly on a standalone basis, like coal mining or coal-fired power generation, but that doesn’t mean when we buy a company or utility that has some of that in their portfolio that we will not invest in them. So it’s pretty targeted exclusion. But we’re not divesting at this point.

FP: The response by businesses and investors to Russia’s invasion of Ukraine has led to talk about how to manage China’s escalating tensions with Taiwan. Do you have a view on that?

BC: The war by Russia on the Ukraine was a real wake-up call for investors. For many years, investors were able to ignore geopolitics and continue to invest and leave the politics to government.

We do believe that for geopolitical reasons, there is more risk around China today than there was a year ago. And so we take a cautious approach. It means that we don’t invest in private, illiquid assets in China. That’s not part of our strategy. We invest in public assets only, which would allow us to alter our exposure more quickly.

We don’t overweight China — we essentially have it at market weight within our public equities. So we’re not taking an active view that they’re going to outperform. We think they’re too big and too important a potential market segment to not have, but we keep them at market weight.

FP: Are you planning any change in strategy when it comes to China?

BC: We’re … trying to invest there actively, meaning not buying broad market indexes. That’s our goal. It’s something we haven’t yet achieved but it’s something we’re targeting doing, because we don’t want to end up owning things in China that don’t accord with our ESG investment beliefs. It’s a nut we haven’t cracked, but it’s a high priority for us. At the total portfolio level, we have a very small allocation to China.

FP: You do make investments in private assets outside China. What’s the strategy there?

BC: We do believe that private asset investments can represent secure, long-term investment opportunities. There are things that are possible in terms of value enhancement when in a private market context. You don’t need to be focused on short-term earnings or short-term distributions. You can focus on long-term value creation. There’s more flexibility in terms of the capital structure (and) in terms of the strategy.

And so over the long-term, we continue to believe that private markets are an area that can outperform. That doesn’t mean that you’re automatically going to have to earn more on every private investment than you would on public markets, but there is that possibility.

FP: Do you tend to invest alone in private markets or with partners?

BC: It’s really important that you do them (efficiently to) get your costs down. If you access private markets through external funding programs, you will be paying extremely high fees that potentially absorb all the benefit of that asset class. So the keys to success for us there are identifying the best partners who have origination capabilities and value-add capabilities that we couldn’t replicate on our own and then investing as much as we can alongside them on a no fee basis.

It’s our goal to have about 50 per cent of our assets invested in private assets — half in funds, half direct (investments). That would be a significant growth over what we had when we launched five years ago where we were more in the range of a quarter to a third of the portfolio.

FP: I want to turn to the economics and the impact of factors like inflation and interest rates. Where do you see those trends going and how do you see that playing out in 2023?

BC: I don’t believe in trying to predict near term future economic or market events. It’s in some sense standard practice in the asset management industry, but it might be almost impossible to do.

If you think back to this time in 2019, three years ago, we hadn’t heard of COVID. Six months later, the markets dropped so much that central banks were buying credit, and people were contemplating calamity. Three months after that, the markets had bounced back so much that people were launching SPACs, companies that had no defined business. Fast forward a year from there, and you have a war in Europe, and people are talking about stagflation.

I find it sort of humorous that notwithstanding what we just had in the last three years, someone says: ‘I’m going to call next year.’ Wow. All I hope is that it’s nowhere near as exciting or interesting as the last three years. I also think the very long term is equally unrealistic.

FP: So what framework do you use to make investments?

BC: You have to take some point of view. I actually think, oftentimes, let’s call it the medium term, the next five or 10 years, there are trends that are very powerful and unlikely to disappear in that period of time. And then there’s hard work to adapt your portfolio to navigate those trends. The 40-year period of declining interest rates and inflation, I think, is coming to an end. It’s been a golden era for all investors because when the risk-free rate is coming down, the value all things is going up. It’s going to be, in our view, at least the likelihood of higher interest rates and inflation going forward.

We do believe that economies will decarbonize. We don’t pretend to know how fast that will happen, what technologies may emerge along the way, what regulations may emerge along the way, but we think the big long-term trend towards decarbonization is real. We think that represents a real risk for investors that you could end up owning assets that generate low returns, much lower returns than you had hoped for depending on the way regulations evolve. But we think there’s also tremendous opportunity that’s going to exist.

So an example of what that looks like is an investment we’ve made in the U.K. in a wholly owned company called Pulse, where we’re installing utility-scale batteries in the U.K. energy or the electricity transmission grid. We think that’s an example of the kind of thing we want to do more of where it involves real work, real expertise, real knowledge of the markets and the path in a market to decarbonization, and we’re looking at investment in more things like that. So that’s energy transition, and we’re looking to deploy about $5 billion over the next five years in investments like that.

This is brand new for us. To the extent that we’ve been making energy transition investments, it hasn’t been deliberate up to this point. It hasn’t been a strategy. We don’t have a baseline because it’s something we’re just starting to do as of January, where we’ll launch this new strategy to deploy $5 billion over the next five years in energy transition investing.

This is truly a great interview, in line with IMCO's World View.

The only thing I disagree with Bert on is that calling the markets in 2023 is a mug's game.

I'm pounding the table hard, telling everyone we are headed for a nasty and prolonged earnings and economic recession and you need to be prepared.

So please read my Outlook 2023 as well as my more recent comment on why private debt might be the next subprime crisis.

"But Leo, didn't Ray Dalio once ask you 'what's your track record?'"

Yes, he did, and I wrote about it here today in a LinkedIn post as well as why I am still LONG the USD and would use the latest selloff to add to my position, ignoring Ray's nonsense on how a dollar-denominated global order is 'fading away':

OH PLEASE! 🙄 Dollar-dominated global order is 'fading away': Ray Dalio https://t.co/7QkEHFq9L7

— Leo Kolivakis (@PensionPulse) January 18, 2023

Alright, let's end it there, more to come Friday when I cover markets.

Below, in her landmark book, financial services doyenne Karen Petrou explains how, despite better intentions, Federal Reserve policies have been major drivers of economic inequality in America. Beginning with 2010 policies that widened the wealth gap, the Fed more than doubled down on its errors in 2020.Watch some interviews with her.

Also, what does "economic inequality" mean? How is it measured? Why should we care? Why did inequality rise in the United States? Is rising inequality an inevitable feature of capitalism? What should we do about it? Professor Galbraith takes up these questions in his latest book, "Inequality: What Everyone Needs to Know," bringing to life one of the great economic and political debates of our age, particularly important in this critical presidential election year. In his talk Professor Galbraith will share his latest economic research on inequality and explain his findings in a way that everyone can understand.

Comments

Post a Comment