QuadReal Enters UK Real Estate Debt Market Through Précis Partnership

Last week, Précis Capital Partners and QuadReal issued a joint press release stating QuadReal has acquired an interest in Précis Capital and will commit up to £1 billion to deploy into its development loans:

Précis Capital Partners (“Précis Capital”), the real estate development lending platform, and global real estate investor QuadReal Property Group (“QuadReal”) announce today that QuadReal has acquired an interest in Précis Capital and will commit up to £1 billion to deploy into its development loans. TowerBrook, Précis Capital’s founding institutional shareholder, retains a significant shareholding. Précis Capital is concurrently rebranding as Precede Capital Partners (“Precede Capital”).

Since its launch in March 2021, Precede Capital (then Précis Capital) has originated and arranged loans totalling £1.5 billion to finance the construction of residential properties in the UK. This new partnership with QuadReal will further enhance the opportunity to provide whole loan financing solutions. With the new investment, Precede Capital expects to arrange an additional £3 billion+ of loans through capital structuring via syndication and leverage.

QuadReal Property Group is a global real estate investment, operating and development company headquartered in Vancouver, British Columbia. Its assets under management total CAN$67.1 billion, of which CAN$10 billion are real estate debt assets. The team seeks to deliver strong investment returns while creating sustainable environments that bring value to the people and communities it serves, closely aligning with Precede Capital and TowerBrook’s focus on responsible investment and their respective ESG strategies. QuadReal’s discerning approach to funding structures and development risk and its experience – including the management and development of over 60,000 residential suites globally – complement Precede Capital’s growth ambitions.

Randeesh Sandhu, CEO and co-founder of Precede Capital, said: “We are delighted to partner with QuadReal as we enter the next stage of our evolution as a reliable financing partner to high-calibre borrowers. Our specialist team has built a reputation for successfully structuring large and complex financial solutions, and this partnership with a leading global institution is a strong endorsement of our track record. We look forward to working closely with QuadReal as we continue to back sponsors and developers delivering best-in-class living assets.”

Jay Kwan, Managing Director, Head of Europe for QuadReal, said: “The living sector is one of the key pillars within our global areas of conviction. Partnering with the deep bench of seasoned professionals at Precede Capital in this area, at this time, is a natural extension of both investment priorities and advancing our real estate credit business to the UK from within North America. Working closely with the TowerBrook team and its best-in-class fiduciaries only enhances what this group of professionals can offer and achieve.”

Joseph Knoll, Managing Director at TowerBrook, said: “Since its launch, Precede Capital has established itself as a significant provider of development lending in the UK. The new partnership with QuadReal and its extensive experience as a real estate manager and credit provider will accelerate that journey. We are excited about partnering with QuadReal and the new growth opportunities it will open for the Precede platform.”

Precede Capital was advised on the transaction by Greenburg Traurig and JLL Corporate Finance. QuadReal was advised by K&E, Deloitte and Mourant Ozannes. TowerBrook was advised by Goodwin Proctor and PwC.

About Precede Capital Partners

Precede Capital Partners (formerly Précis Capital Partners) is a UK-based lending platform that partners with best-in-class developers, real estate sponsors, banks and institutional investors to provide bespoke debt financing solutions for large-scale real estate projects. Established in 2021, Precede Capital is backed by TowerBrook Capital Partners, and QuadReal Property Group. Precede Capital provides finance for large-scale real estate projects across the UK. Funding a range of living assets, from residential for sale or rent, to student accommodation and later living. Precede Capital provide whole loans and whole Green Loans competitively priced, with flexible structuring and leverage.

About QuadReal Property Group

QuadReal is a global real estate investment, operating and development company headquartered in Vancouver, British Columbia. Its assets under management total CAN$67.1 billion. From its foundation in Canada as a full-service real estate operating company, QuadReal has expanded its capabilities to invest in equity and debt in both the public and private markets. QuadReal invests directly, via programmatic partnerships and through operating companies in which it holds an ownership interest.

QuadReal seeks to deliver strong investment returns while creating sustainable environments that bring value to the people and communities it serves. Now and for generations to come.

QuadReal: Excellence lives here.

About TowerBrook Capital Partners

TowerBrook is a purpose-driven, transatlantic investment firm that works to grow and improve large and middle-market businesses by partnering with management teams and employees to build excellent companies that make a positive impact on society. Since inception in 2001, TowerBrook has raised a total of $21.1 billion and invested in 90 companies on both sides of the Atlantic. TowerBrook operates as a single, unified team of experienced investment professionals focused on unlocking value in complex situations. The firm’s highly synergistic family of funds make control and non-control investments across the capital structure, providing capital and resources to transform the capabilities and prospects of its portfolio companies.

As a disciplined investor with a commitment to fundamental value, TowerBrook seeks to deliver superior, risk-adjusted returns to investors on a consistent and responsible basis. TowerBrook is the first mainstream private equity firm to be certified as a B Corporation. B Corporation certification is administered by the non-profit B Lab organisation and is awarded to companies that demonstrate leadership in their commitment to environmental, social and governance (ESG) standards and responsible business practices.

For more information, please visit www.towerbrook.com

Even though we don't know QuadReal's exact interest in Preceded Capital (formerly Précis Capital) following this latest announcement, Dido Laurimore, a QuadReal spokeswoman told Pension & Investments in an email that the firm's stake is "a material enough investment to create alignment amongst all shareholders."

I suspect it's 49% but this is a total guess on my part.

The critical point is with this partnership, QuadReal is getting into the UK real estate commercial loan market to finance the development of new residential properties.

As the press release states, QuadReal's assets under management total CAN$67.1 billion, of which CAN$10 billion are real estate debt assets.

Almost all that real estate debt is in Canada and the United States.

QuadReal's strategic approach to real estate debt is outlined on its website:

QuadReal actively manages and services BCI’s real estate debt program.* As a significant lender to the commercial real estate industry, QuadReal focuses on direct real estate debt investments. The program, with $6.7 billion in direct real estate mortgage investing, includes strategic investments with best-in-class real estate owners, developers and partners. Investments are diversified by loan size, region and property type with a focus on industrial, office, multi-family residential and retail asset classes. Lending relationships in the future will remain diversified and focused on target markets in Canada and the U.S.

QuadReal’s prudent management of the program includes detailed underwriting, credit and financial analysis of all major tenants, guarantors and borrowers. Our in-house servicing team oversees all payments, discharges, cash flows, insurance expiries and borrower property tax payments.

*QuadReal Property Group Limited Partnership manages BCI’s real estate program. QuadReal Finance LP manages BCI’s mortgage program. QuadReal Property Group Limited Partnership and QuadReal Finance LP are affiliated entities.

Financing Commercial Real Estate in Canada and the U.S.

Paramount to the program is our commitment to work alongside those we finance to help them achieve their goals. We offer a range of mortgage products and loan amounts, and provide prompt execution and industry-leading service, which distinguishes our ability to initiate new business relationships. We are responsive and seek to expand our relationships over multiple years and transactions.

The current portfolio and potential lending opportunities focus on four areas:

Fixed term Mortgage Fund

QuadReal finances Canadian income-producing commercial and multi-family residential properties through our Fixed Term Mortgage Fund. The risk factors that are used to evaluate mortgage investments include: location; improvement(s) quality; tenant financial strength; green building features; borrower and covenantor’s financial strength; loan-to-value level; debt servicing ability; and borrower experience. Mortgage agreements may include additional security provisions such as personal guarantees, corporate guarantees, letters of credit, and the pledging of additional collateral.

Construction Mortgage Fund

QuadReal finances construction mortgages on Canadian commercial and multi-family residential properties through our Construction Mortgage Fund. The risk factors that are evaluated include: location; structure quality; pre-leasing/pre-sales; green building features; borrower and covenantor’s financial strength; loan-to-value level; debt servicing ability; and borrower’s experience. Mortgage security may also include additional provisions such as personal guarantees, corporate guarantees, letters of credit, and the pledging of additional collateral.

Mezzanine Mortgage Fund

QuadReal finances higher risk fixed-term and/or construction mortgages on Canadian commercial and multi-family residential properties through our Mezzanine Fund. The risk factors that are evaluated include those listed for the Fixed-Term and Construction Funds.

Mezzanine mortgages may provide a high loan-to-value or specialized sources of financing. In exchange for the higher levels of risk associated with mortgages of this nature, the Mezzanine Fund requires additional compensation and/or additional security provisions. As such, mortgage terms and security may vary based on the unique circumstances of the investment.

U.S. Mortgage Opportunity Fund

QuadReal provides U.S. income-producing, bridge, and construction financing on commercial and multi-family residential properties. Risk factors used to evaluate mortgage investments include: location; quality of improvement(s); tenant financial strength; borrower and covenantor’s financial strength; loan-to-value / loan-to-cost level; debt service level; borrower’s experience; and budget reviews. Mortgage agreements may include additional security provisions such as personal guarantees, corporate guarantees, letters of credit, interest reserves, and the pledging of additional collateral.

The U.S. Mortgage Opportunity Fund is an actively managed fund that invests directly in mortgages with terms to maturity of up to 10 years. The fund deploys capital in the U.S. through a variety of investment platforms and offers fixed term, construction, and mezzanine financing.

QuadReal is currently pursuing direct mortgages.

You can learn more about each approach to real estate debt here.

Again, the critical part is that with this partnership with Precede Capital Partners (formerly Précis Capital Partners), QuadReal is entering the UK real estate debt market.

QuadReal has acquired an

interest in Précis Capital and will commit up to £1 billion to deploy

into its development loans. TowerBrook, Précis Capital’s founding

institutional shareholder, retains a significant shareholding of Précis

Capital is concurrently being rebranded as Precede Capital Partners (“Precede

Capital”):

Since its launch in March 2021, Precede Capital (then Précis Capital) has originated and arranged loans totalling £1.5 billion to finance the construction of residential properties in the UK. This new partnership with QuadReal will further enhance the opportunity to provide whole loan financing solutions. With the new investment, Precede Capital expects to arrange an additional £3 billion+ of loans through capital structuring via syndication and leverage.

I would encourage you to read more about Precede Capital:

Starting from experience

Established in 2021 with the backing of TowerBrook Capital Partners L.P. and experienced management, we have established a core team from private equity, banking, non-bank lending and fund management backgrounds. This combination equips us to handle the technical complexity of construction finance.

We aim to build long term relationships, funding our clients from one ambitious project to their next.

Precede Capital Partners has a purpose-led culture, with strong values, investment in our people and responsible policies and practices. We’re proud to have developed a virtuous circle for real estate construction finance, helping to build much-needed housing, aiding the transition to sustainable building practises, and proactively measuring the Social Value created through the projects we finance. We believe this reduces our exposure to reputational, financial, regulatory and corporate event risk, whilst enhancing credit quality and mitigating credit risk. Our approach delivers sustainable risk-adjusted returns to purposeful counterparties.

B-Corp backedTowerBrook Capital Partners is a purpose-driven investment management firm headquartered in London and New York. The firm has raised in excess of $17.4 billion to date and invests in private equity and structured opportunities through its family of funds. As a disciplined investor with a commitment to fundamental value, the firm seeks to deliver superior, risk-adjusted returns to investors on a consistent and responsible basis. TowerBrook’s value creation strategy aims to transform the capabilities and prospects of the businesses in which it invests.TowerBrook is the first mainstream private equity firm to be certified as a B Corporation. B Corporation certification is administered by the non-profit B Lab organisation and is awarded to companies that demonstrate leadership in their commitment to environmental, social and governance (ESG) standards and responsible business practices.

Read more about TowerBrook here.

Clarity from complexity

Our management team has an extensive track record in structuring real estate finance transactions. We offer the speed and flexibility that only comes with deep sectoral experience, underwriting big ticket loans, without cumbersome bank processes.

Adaptable Realists

Our technical expertise means we give our clients hands-on support throughout each project. We take a collaborative approach to lending, building long-term relationships with our borrowers based on trust, transparency and deliverability.

Purpose driven pioneers

As well as providing standard Whole Loans, we are developing Green Loans for projects with sustainable construction standards using the Loan Market Association’s Green Loan Principles.

Read about our Finance Products

Socially conscientious

We know our clients make huge contributions towards society through their projects. But this is more than just a hunch. We proactively quantify this data. From Section 106 contributions towards local infrastructure, amenities and social housing, through to new job creation and more, we help our clients to see first-hand the impact of their projects. They can use these statistics in their marketing, reporting and disclosures and the industry as a whole can keep improving.

This just highlights that QuadReal chose the right partners to enter the UK real estate debt market and this platform will be critically important to the organization going forward.

Moreover, as Jay Kwan, Managing Director, Head of Europe for QuadReal, said:

“The living sector is one of the key pillars within our global areas of conviction. Partnering with the deep bench of seasoned professionals at Precede Capital in this area, at this time, is a natural extension of both investment priorities and advancing our real estate credit business to the UK from within North America. Working closely with the TowerBrook team and its best-in-class fiduciaries only enhances what this group of professionals can offer and achieve.”

Now, on the UK's real estate finance developing market, I read this from Simmons & Simmons which was published last March:

2021 was a year of cautious recovery for the UK real estate finance market, gaining momentum through the year, resulting in a very busy Q4 for most. As we enter calendar Q2 of 2022, how does the Simmons & Simmons Real Estate Finance team expect the rest of 2022 to unfold?

As we publish, Ukraine dominates thinking for understandable reasons, but we cover other topics here as well.

The COVID-19 backdrop

Much of 2022 will be shaped by the end of COVID-19 related restrictions on landlord enforcement. These were originally enacted to provide protection for tenants in relation to rental payments during the first lockdown of 2020 where business had been adversely affected by coronavirus, hindering the ability to generate revenue. The changes in law coming into force include the enactment of the Commercial Rent (Coronavirus) Bill to coincide with the end of the moratorium on landlords exercising forfeiture rights and seeking to recover commercial rent arrears. With the new legislation, commercial landlords and tenants will be able to apply to an arbitrator to resolve any business tenancy disputes regarding rents accrued during the time period that a business was mandatorily closed due to COVID-19 restrictions.

How landlords and tenants react to these measures will directly impact lenders and next steps in respect of property assets currently financed. We expect that the second half of 2022 will mark the end of any outstanding pandemic related financial covenant waivers as lenders consider their enforcement and refinancing options to coincide with the end of government support. It is likely that landlord and tenant behaviour during the height of the pandemic will be indicative of how successful any arbitration process may be.

Ukraine

The human cost of Russia's invasion of Ukraine is both horrifying and clear to see. It may take more time to understand the true implications for the worldwide property market.

The sanctions imposed are having immediate implications for banks and borrowers with ties to Russia as they now face restrictions which will instantly impact refinancing and drawdowns on existing loans. Furthermore, companies with cash stuck in the Russian system will now require more cashflow to service their debt and run their businesses and many are having to write off their Russian investments. Lenders will have to think carefully about how or whether loans can be restructured going forward in order to ensure compliance with sanctions measures.

The longer the war continues, the more we will see disruption to production in Ukraine including the impact on global commodities, in particular ore and steel. This may well exacerbate the supply chain issues we cover in 'The Development Cycle' below.

These factors will play a part in further inflation and interest rate increases which will impact borrowers and lenders alike in the real estate market and beyond.

The longer-term impact of the war in Ukraine is harder to predict, although a flight of capital and real estate requirements west, away from Russia and neighbouring states is likely. The changing political landscape (and government spending) will also have an impact, driven by defence and infrastructure needs that will flow.

Stricter ESG measures

As predicted in our 2021 outlook, the ESG agenda is gaining further momentum in 2022. Many lenders operating in the UK will be required to comply with the UK Government's Sustainable Finance Roadmap with certain rules already set out in detail and others to follow in the latter half of 2022.

One of the impacts of the new regulations will see the FCA clamping down on greenwashing by requiring lenders to report on the framework of the Task Force on Climate Related Financial Disclosures in respect of their financial products. Failure to do so may result in fines for those lenders. Careful thought will be needed before lending on property to ensure it meets the standards set by the FCA, all the while keeping their reporting functions flexible to meet the ever-evolving ESG regulations.

Looking beyond 2022, one of the factors property investors will consider when sourcing debt will be to identify those lenders who are meeting ESG data collection and other reporting requirements in the most functional and practical way possible for all parties.

The office

2021 was an uncertain year for the return to the office. The on-off nature of pandemic related restrictions meant a return to the office was not fully visible and, whilst most companies were unwilling to forgo their real estate, new COVID-19 variants meant workers were not able to move back to the office.

2022 sees a more optimistic outlook with offices seeing more footfall. This year, the choice to reconfigure existing office space or to downsize (in the longer term) will be one that tenants will make. If the decision is made to reconfigure, employers will need to put plans in action to create a better office experience for their employees by developing hybrid working facilities and embracing technology. Previous office data and trends will become redundant in the new normal and employers will have to respond to employees' needs in real time to optimise their real estate.

As a result of the growing ESG agenda, we expect the fight to invest in the greenest office space will see further disparity in performance between prime office assets and those that do not meet ESG standards. This will be further exacerbated by lenders' growing ESG targets and the firming up of green legislation in relation to lending.

With some city dwellers eschewing urban life in favour of country living, we also expect investment in regional offices to continue to grow.

The development cycle

The appetite for development remains high in 2022, but not without its challenges.

COVID-19, Brexit and now Ukraine have created labour shortages and supply chain issues. As a result, we expect lenders will continue to have to amend existing facility agreements to reflect delayed practical completion dates.

Furthermore, rising construction costs because of supply chain issues and the increase in interest rates mean that developers no longer have the pricing certainty they once could rely on when assessing new development projects. In turn, developers will see their profit margins squeezed as the gross development value of assets struggles to keep up with the rising cost of development, making some projects economically unfeasible. As development projects become more expensive and higher risk, the pool of lenders willing to lend against such projects may get smaller.

There will also be the theme of 2021 seen in 2022 with the continuing hardening of the construction insurance market, not helped by the war in Ukraine. This will be seen on several fronts, from the professional indemnity insurance market struggling to provide insurance on an "each and every" claim basis, to the increasing difficulty of how to adequately insure against damage to an existing building whilst works are being carried out.

Despite the obstacles, financial institutions will continue to compete to finance the best (and greenest) development opportunities.

Hotels and leisure - the bounce-back?

For hotels and restaurants that managed to demonstrate their resilience throughout the pandemic without being forced into closure, we predict that the remainder of 2022 will see those assets continuing to recover at pace. In turn, lenders will be able to resume debt service waterfalls and financial covenant monitoring that was previously halted because of the pandemic.

With travel for business and leisure picking up, we expect investors will be on the hunt for hotels in prime locations in the capital and other major cities and for lenders to fund those acquisitions. However, with the slowing down of domestic tourism as consumers return to holidaying abroad, hotels and restaurants in more rural areas may not see the continued interest they experienced in 2020 and 2021.

Tax issues

Following substantial changes to UK real estate taxation in the last few years the tax landscape continues to evolve in 2022.

Residential Property Developer Tax comes into effect from 1 April 2022 and will apply to companies carrying out a wide range of activities (including marketing and management) connected with the development of residential property in the UK. It applies where the company (or a group member or a JV vehicle with which it has a sufficient connection) has a relevant interest in land held as trading stock. The tax is specifically intended to fund cladding remediation costs and is (at least in theory) intended to be temporary, for a period of around 10 years. The scope of the new tax is deliberately wide, and although the tax rate is low at 4%, this is calculated on a broader tax base than corporation tax: in particular, deductions for financing costs are not taken into account. The definition of residential property for these purposes includes land for which planning permission is sought or granted, not only land where actual development has commenced. Taxpayers should already be looking at the potential application of RPDT to existing structures, and when setting up new structures should look at whether there is scope to mitigate or at least simplify application of the tax. In some cases, the group allowance of £25m per accounting period may fully alleviate the potential tax charge, but particular care is required in relation to joint venture structures, where the RPDT rules are particularly complex.

On the tax compliance and administration front, a point for real estate finance lenders and borrowers to keep an eye on is that the time it takes to obtain treaty clearances in respect of UK interest withholding continues to extend, now running at around 4-5 months in many cases (irrespective of whether the lender has a UK treaty passport). In the context of quarterly interest payment dates this means that it will be important to consider whether a long first interest period or mechanism for accrual of interest pending clearance should be included in the finance documents. For the same reasons, borrowers facing a passported lender may also find that they are more often asked to rely on "provisional" treaty clearance to make a gross interest payment on time.

I look forward to seeing what this year's outlook for the UK real estate financing market has in store.

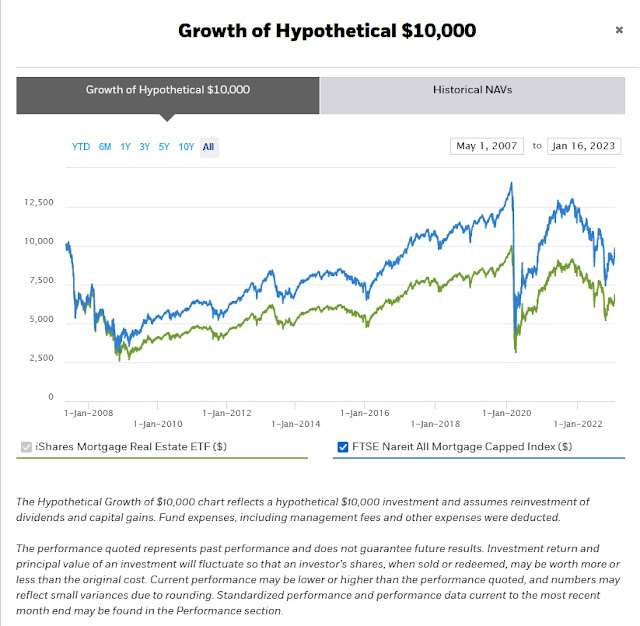

One final note, I was looking at the long-term performance of the iShares Mortgage Real Estate ETF (REM) which seeks to track the investment results of an index composed of U.S. REITs that hold U.S. residential and commercial mortgages.

Now, this is a US ETF with a nice yield (11%) but it shows you that tough times have arrived for US REITs that hold US residential and commercial mortgages.

And they will get tougher. I expect a deep and prolonged global recession which will begin in the US and then spread throughout the developed world.

But don't confuse real estate debt with the potential crisis I see in private debt, it's not the same thing as there are strong secular headwinds supporting real estate debt in Canada, the US and the UK.

People need places to live. Canada, the US and the UK need immigration and these people need to live somewhere. You need to build new multifamily properties for them and make them ESG compliant.

Still, as you will learn below, the commercial real estate debt market is fraught with risks and opportunities ahead as rates have soared and a looming recession lies ahead.

In particular, floating-rate loans which have become popular during the low-interest-rate era are being reset at higher rates so when defaults jump, vulture funds like Lone Star will swoop in to buy those loans at pennies on the dollar. Global pensions that manage their liquidity risk properly will also seize opportunities when defaults spike.

Below, the biggest opportunity in Commercial Real Estate in 2023.

Floating rate rate loans became increasingly popular over the last few years, as interest rates dropped to record-low levels and many investors believed that rates would stay low (indefinitely).

But fast forward to today, and properties encumbered with floating rate debt have become some of the most at-risk deals in the entire commercial real estate market, with the 30-day average SOFR (or the interest rate index used to benchmark many floating-rate CRE loans) jumping from less than 10 basis points back in March to over 300 basis points less than nine months later.

So to break down how this is impacting the CRE market today (and the opportunities that might arise as a result), in this video, they walk through how floating rate loans are affecting deals right now, what might happen if rates continue to rise (or even stay at current levels), and how this might ultimately create a significant amount of buying opportunities for commercial real estate investors in the next 12-18 months.

Comments

Post a Comment