CDPQ Acquires Rogers' Cogeco Stake for $829M

Rogers Communications announced Monday it has agreed to sell all its shares in Cogeco to the Caisse de dépôt et placement du Québec for $829 million in an effort to keep its investment-grade rating.

Simultaneously, the Caisse announced it will become an “anchor investor in Cogeco Communications” after trading in Rogers’s shares in parent company Cogeco Inc.

Under the agreement with the Caisse, Cogeco Inc. will buy back 5,969,360 subordinate voting shares of subsidiary Cogeco Communications from the Caisse, while Cogeco Communications will buy back 2,266,537 of its subordinate voting shares held by its parent company. The transaction sets the price of Cogeco shares at $46.91 and Cogeco Communications at $51.40, a 10 per cent discount on Monday’s closing prices.

After the transactions, the Caisse won’t hold Cogeco Inc. stock, but will have 16 per cent of subordinate voting shares of subsidiary Cogeco Communications. Rogers held 38 per cent of Cogeco’s equity and 24 per cent of Cogeco Communications.

The transactions don’t affect effective control over Cogeco Inc., whose founding Audet family and its company Gestion Audem held 69 per cent of voting interest. Cogeco Inc. has 84 per cent of voting rights over Cogeco Communications, according to the CRTC.

Rogers held large stakes in Cogeco Inc. and operating unit Cogeco Communications Inc. for many years in the hope of acquiring it one day, but the Audet family, which controls both entities, rebuffed its overtures — including a hostile bid in 2020.

Instead, Rogers purchased Shaw Communications Inc. for about $20 billion. After that deal closed, Rogers was downgraded by S&P Global Ratings to BBB-, the lowest rung above junk. It’s similarly rated by Moody’s Investors Service, Fitch and DBRS Morningstar.

“This sale further demonstrates our commitment to strengthen our investment grade balance sheet and aggressively reduce our debt leverage ratio,” Tony Staffieri, Rogers’ chief executive, said in a statement. “We’re tracking six months ahead on our deleveraging priorities and we’re committed to reducing our debt leverage ratio even further.”

Rogers said it expects a debt leverage ratio of 4.7 by the end of the year, compared to 4.9 at the end of the third quarter.

Mathieu Dion of Bloomberg News also reports Rogers sells $829-million Cogeco stake to Caisse to pare debt:

Canadian wireless company Rogers Communications Inc. sold its stake in a rival telecommunications operator to Quebec’s largest pension manager, raising more than $829 million to repay debt in an effort to keep its investment-grade rating.

Rogers is selling its shares in the Cogeco group to Caisse de dépôt et placement du Quebec. The private deal will allow Rogers to cut its leverage ratio to 4.7 times by the end of the year, compared with 4.9 times at the end of September.

Rogers held large stakes in Cogeco Inc. and operating unit Cogeco Communications Inc. for many years in the hope of acquiring it one day, but the Audet family, which controls both entities, rebuffed its overtures — including a hostile bid in 2020.

Instead, Rogers purchased Shaw Communications Inc. for about $20 billion. After that deal closed, Rogers was downgraded by S&P Global Ratings to BBB-, the lowest rung above junk. It’s similarly rated by Moody’s Investors Service, Fitch and DBRS Morningstar.

“This sale further demonstrates our commitment to strengthen our investment grade balance sheet and aggressively reduce our debt leverage ratio,” Tony Staffieri, Rogers’ chief executive, said in a statement.

Caisse de Depot won’t hang on to all of the Cogeco shares it’s buying from Rogers. Cogeco will repurchase some and, in the end, the Quebec pension fund will wind up with a 16.1 per cent stake in Cogeco Communications, a seller of internet, cable television and wireless services within Canada.

“Given the current prices of our stocks, which we believe are undervalued, buying back shares represents an attractive use of our capital to build shareholder value,” Cogeco CEO Philippe Jette said in a statement. S&P cut its outlook on Cogeco Communications to negative.

Shares of Cogeco Inc. and Cogeco Communications have fallen by 18 per cent and 26 per cent, respectively, since the beginning of year in Toronto trading.

Yesterday, CDPQ issued a press release stating it is investing in Cogeco Communications:

CDPQ announces an investment in Cogeco Communications Inc. (TSX: CCA) following the purchase of the block of shares held by Rogers Communications Inc. (TSX: RCI.B). CDPQ will hold $350 million of the capital of this Québec leader, one of the top 10 cable companies in North America, upon the closing of this transaction, which was announced earlier today.

“Already active with Cogeco Communications through past acquisitions, CDPQ is supporting the growth projects of this leading telecommunications company as connectivity needs continue to grow. This major share purchase, orchestrated by CDPQ, is key for the company and its plan to develop the North American market,” said Kim Thomassin, Executive Vice-President and Head of Québec at CDPQ.

“We're delighted by an even stronger engagement by the CDPQ,” said Philippe Jetté, President and Chief Executive Officer of Cogeco Inc. and Cogeco Communications Inc. “This transaction is a unique opportunity for us to build shareholder value while pursuing the delivery of our strategic plan,” added Mr. Jetté.

Cogeco is a growing competitive force in today’s telecommunications sector. Through its business units, Cogeco Connexion in Canada and Breezeline in the U.S., it provides Internet, video and telephone services in Québec, Ontario and 13 U.S. states.

CDPQ first invested in Cogeco Communications in 2013 by providing a CAD 50 million loan. In 2017, CDPQ also contributed USD 315 million toward the transaction to acquire MetroCast cable systems in the United States. At USD 1.4 billion, this transaction is Cogeco Communications’ largest acquisition to date.

ABOUT CDPQ

At CDPQ, we invest constructively to generate sustainable returns over the long term. As a global investment group managing funds for public pension and insurance plans, we work alongside our partners to build enterprises that drive performance and progress. We are active in the major financial markets, private equity, infrastructure, real estate and private debt. As at June 30, 2023, CDPQ’s net assets totalled CAD 424 billion. For more information, visit cdpq.com, consult our LinkedIn or Instagram pages, or follow us on X.

CDPQ is a registered trademark owned by Caisse de dépôt et placement du Québec and licensed for use by its subsidiaries.

À PROPOS DE COGECO COMMUNICATIONS INC.

Rooted in the communities it serves, Cogeco Communications Inc. is a growing competitive force in the North American telecommunications sector, serving 1.6 million residential and business customers. Through its business units Cogeco Connexion and Breezeline, Cogeco Communications provides Internet, video and phone services in Canada as well as in thirteen states in the United States. Cogeco Communications Inc.’s subordinate voting shares are listed on the Toronto Stock Exchange (TSX: CCA).

So why is CDPQ investing in Cogeco Communications, acquiring Rogers' stake?

I think this part was telling:

“Given the current prices of our stocks, which we believe are undervalued, buying back shares represents an attractive use of our capital to build shareholder value,” Cogeco CEO Philippe Jette said in a statement. S&P cut its outlook on Cogeco Communications to negative.

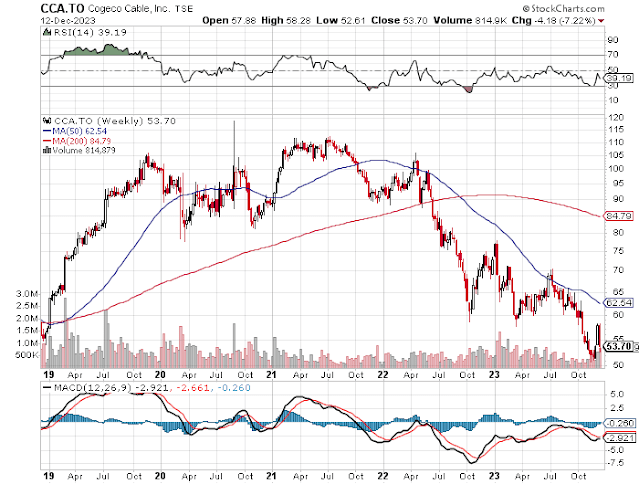

I looked at shares of Cogeco and they've been on a downtrend over the last couple of years:

So CDPQ is acquiring them at a reasonable price and Rogers is unloading them to pay down debt it incurred from the Shaw Communications acquisition (it way overpaid for Shaw).

I also didn't know much about Quebec's Audet family but learned this about Louis Audet:

Impressively, Mr. Audet joined Cogeco in 1981 and held the position of President and Chief Executive Officer of Cogeco Inc. and Cogeco Communications Inc. starting in 1993. Under his leadership, Cogeco became a leading Canadian communications company, operating internationally and generating revenues of over $2.3 billion annually.Given the Caisse's dual mandate, it makes sense to own this company here in Quebec and help nurture its growth.

The fit with Rogers was all wrong, both culturally and in terms of where Cogeco was heading.

I cannot add much more than this because to be honest, I just don't know enough about Cogeco except it's growing nicely and with CDPQ as an anchor investor, it can now focus exclusively on its growth and become an even larger communications company.

Below, Brian Madden, CIO of First Avenue Investment Counsel, discusses the deal on BNN Bloomberg and why it makes sense for all parties involved.

Comments

Post a Comment