OTPP Taps Pierre Cherki to Head Real Estate

Ontario Teachers’ Pension Plan has hired Pierre Cherki to a new executive role leading the real estate investing team that is moving over from subsidiary Cadillac Fairview Corp. in January.

Earlier this year, Ontario Teachers’ announced a restructuring that will create an in-house investing team for real estate. In January, a 37-person team will move over from Cadillac Fairview, which will continue to own, operate and develop real estate.

Mr. Cherki will lead the new, in-house team as executive managing director, real estate, Teachers’ announced on Tuesday. He has served on Cadillac Fairview’s board since 2022, and spent most of his career at German alternative investment manager DWS Group.

At DWS, Mr. Cherki was global head of real estate, then led the alternatives division, and was a member of the company’s executive board.

Real estate makes up about 12 per cent of the Teachers’ investment portfolio, with assets valued at $29.3-billion as of the end of June, including Cadillac Fairview’s properties. When Teachers’ announced the change in structure in June, it said that bringing real estate investing in-house – consistent with the way it manages its investments in other asset classes such as private equity and infrastructure – should allow for more information sharing and make it easier to co-source deals.

“Under Pierre’s leadership we plan to explore ways of effectively diversifying our portfolio by sector and stage internationally,” said Teachers’ chief executive officer Jo Taylor, in a statement on Tuesday.

Teachers’ manages $250-billion of assets for more than 336,000 working and retired teachers in Ontario, with investments in public markets through stocks and bonds, as well as privately-owned assets.

Mr. Cherki will remain on Cadillac Fairview’s board and work closely with Sal Iacono, who took over as Cadillac Fairview’s CEO in November, succeeding the long-time head of the real estate company, John Sullivan.

Private Capital Journal also reports Ontario Teachers' names Pierre Cherki as Executive Managing Director, Real Estate:

Ontario Teachers’ Pension Plan has announced the appointment of Pierre Cherki as Executive Managing Director, Real Estate, effective January 22.

This is a new investment leadership position at Ontario Teachers’, which will oversee its in-house real estate asset group to be established as of January 1, 2024. Cherki will be based in Toronto. Cherki will report to Ziad Hindo, Chief Investment Officer, and will join Ontario Teachers’ Investment Executive Team.

In June 2023, Ontario Teachers announced “Evolution to Real Estate Operating Model to Drive Growth” re-defining the functions of Ontario Teachers and Cadillac Fairview (CF).

Effective January 1, 2024, Ontario Techers’ will be establishing an in-house real estate asset class group to oversee real estate investment activities. “This aligns its real estate investment approach to that of other asset groups within Ontario Teachers’, where investment capabilities are embedded to enable information sharing, co-sourcing, and best practices across its global platform.”

Cadillac Fairview’s international team of 37 real estate investment professionals will join Ontario Teachers.

Ontario Teachers’ will focus on global real estate investing and portfolio management, while CF will focus on growth, diversification, and densification of its unmatched real estate portfolio in Canada, building on its strong reputation and history as a leader in this space. CF will also continue to provide excellence in a variety of real estate services to Ontario Teachers’ global real estate platform.

Cherki will oversee Ontario Teachers’ global real estate investing and portfolio management activities and a team of almost 40 investment professionals located in Toronto, London, Singapore, Dallas, and São Paulo.

Ontario Teachers’ real estate portfolio, inclusive of assets under Cadillac Fairview, is valued at $29.3 billion as at June 30, 2023

Cherki brings more than 25 years of real estate experience to his new role, having spent most of his career at DWS Group, one of the world’s largest managers of alternative investments with a sizable global real estate portfolio. He was a member of the DWS Executive Board and served in numerous senior management positions including Global Head of Alternatives, Global Head of Real Estate, and Head of Real Estate, Europe and Asia Pacific.

Since 2022, Cherki has been a member of the Cadillac Fairview board of directors, giving him deep knowledge of the organization and international portfolio.

OTPP issued a press release announcing the appointment of Pierre Cherki as Executive Managing Director, Real Estate:

TORONTO, CANADA, [December 5, 2024] – Ontario Teachers' Pension Plan (Ontario Teachers') is pleased to announce the appointment of Pierre Cherki as Executive Managing Director, Real Estate, effective January 22. This is a new investment leadership position at Ontario Teachers’, which will oversee its in-house real estate asset group to be established as of January 1, 2024. Mr. Cherki will be based in Toronto.

In June 2023, Ontario Teachers’ announced an evolution to its real estate investment model that will bring Cadillac Fairview’s international investment professionals in-house, aligned with Ontario Teachers’ other investment asset groups. Cadillac Fairview will remain a core part of Ontario Teachers’ global real estate portfolio, with a focus on growth, diversification, and densification of its unmatched real estate assets in Canada, building on its strong reputation and history as a leader in this space.

As Executive Managing Director, Real Estate, Mr. Cherki will oversee Ontario Teachers’ global real estate investing and portfolio management activities and a team of almost 40 investment professionals located in Toronto, London, Singapore, Dallas, and São Paulo. Ontario Teachers’ real estate portfolio, inclusive of assets under Cadillac Fairview, is valued at $29.3B as at June 30, 2023.

“I’m pleased to welcome Pierre to Ontario Teachers’ into this role,” said Jo Taylor, President and CEO, Ontario Teachers’. “For many years real estate has been an important component of our asset mix. Under Pierre’s leadership we plan to explore ways of effectively diversifying our portfolio by sector and stage internationally.”

“I’m delighted to be joining Ontario Teachers’ and look forward to leading a strong team of global professionals in supporting further growth in the real estate portfolio,” said Mr. Cherki. “Real estate has been a central part of the portfolio mix at Ontario Teachers’ for more than two decades and I am excited to build on that strong foundation to deliver value to Plan members.”

Mr. Cherki brings more than 25 years of real estate experience to his new role, having spent most of his career at DWS Group, one of the world's largest managers of alternative investments with a sizable global real estate portfolio. He was a member of the DWS Executive Board and served in numerous senior management positions including Global Head of Alternatives, Global Head of Real Estate, and Head of Real Estate, Europe and Asia Pacific. Since 2022, he has been a member of the Cadillac Fairview board of directors, giving him deep knowledge of the organization and international portfolio.

He holds a bachelor’s degree in Management and Economics from Tel-Aviv University and an MBA from Northwestern University.

About Ontario Teachers’

Ontario Teachers' Pension Plan (Ontario Teachers') is a global investor with net assets of $249.8 billion as at June 30, 2023. We invest in more than 50 countries in a broad array of assets including public and private equities, fixed income, credit, commodities, natural resources, infrastructure, real estate and venture growth to deliver retirement income for 336,000 working members and pensioners.

With offices in Toronto, London, Hong Kong, Singapore, Mumbai and San Francisco, our more than 400 investment professionals bring deep expertise in a broad range of sectors and industries. We are a fully funded defined benefit pension plan and have earned an annual total-fund net return of 9.4% since the plan's founding in 1990. At Ontario Teachers', we don't just invest to make a return, we invest to shape a better future for the teachers we serve, the businesses we back, and the world we live in. For more information, visit otpp.com and follow us on LinkedIn.

It's done, Teachers' has appointed a new head of Real Estate and they're set to tackle the world once the new year begins.

Pierre Cherki has tremendous experience at DWS and he's been a board member of Cadillac Fairview since 2022, giving him deep knowledge of the organization and international portfolio.

I've been saying it for a long time, OTPP has great Canadian real estate assets but it needs to diversify by sector and geography to catch up to peers like OMERS (Oxford Properties), CDPQ (Ivanhoe Cambridge), BCI (QuadReal), CPP and PSP Investments, and even HOOPP.

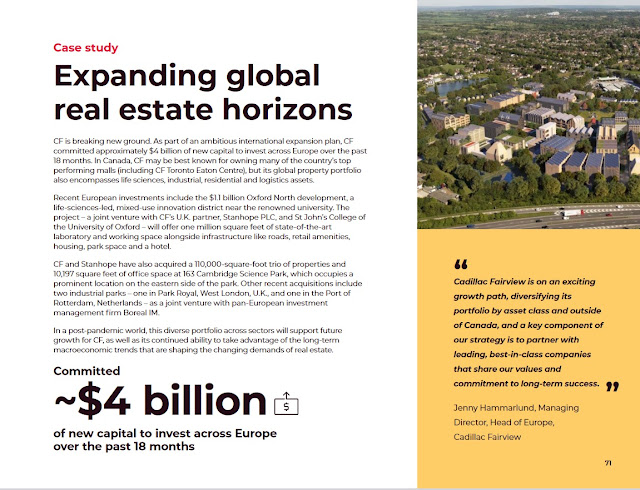

Now, it's worth noting even prior to the major reorganization announced at Cadillac Fairview back in June, the organization was moving fast to diversify its portfolio geographically and by sector.

From OTPP's 2022 Annual Report (as of end of December, 2022):

I note the following:

In line with CF’s focus on scaling and diversifying its global real estate platform, in 2022 it increased portfolio weightings in international markets to 27% from 14% in 2021, and diversified into new sectors with investments primarily in U.S. multi-family residential and life sciences, U.K. office and life sciences, and European industrial. In 2022, CF deployed $3.8 billion to international investment (with a total of $6.1 billion of remaining outstanding commitments as at December 31, 2022). CF also continued to execute on its Canadian development strategy with over 100 active projects in various stages of development. Progress continued on the development of the 160 Front Street West, Toronto, office complex with completion planned for the end of 2023, as well as various master plan developments including East Harbour,Toronto. Focus on densification plans on lands surrounding CF’s shopping centres also progressed, including the groundbreaking of its first wholly owned 288-unit residential rental project in Ottawa, which is known as the “Rideau Registry” and is expected to be ready for occupancy in 2026.

In June, the organization was bifurcated to internalize CF's international team within OTPP.

I noted the following back then:

Cadillac Fairview will continue to operate and as the statement says, it will focus on growth, diversification, and densification of its unmatched real estate portfolio in Canada, building on its strong reputation and history as a leader in this space. CF will also continue to provide excellence in a variety of real estate services to Ontario Teachers’ global real estate platform.

Remember over 65% of its assets are in Canada and most of those (43%) are in Retail with the balance (22%) in Office:

By internalizing international real estate operations, CIO Ziad Hindo and the portfolio construction team can better match assets with liabilities and take currency risk in key markets (mostly US market) where they feel they can benefit over the long run.

With Pierre Cherki set to head up Real Estate, the focus will be on ramping up international investments across many sectors but mainly multifamily, industrial, and some niche sectors like life sciences and student housing.

It will be competitive, it will be brutal, as I expect a lot of action in real estate (good and bad) over the next couple of years, leading to risks and opportunities.

Cherki and his new team will have to navigate all this and it's smart to bring them in-house to manage this asset holistically and under the Teachers' brand which s stronger than Cadillac Fairview's.

Below, Don Peebles, The Peebles Corporation CEO and chairman, joins 'Squawk Box' to discuss the commercial real estate sector, potential impact on the financial sector, and more.

And Bill Rudin, Rudin Management CEO, joins 'Squawk on the Street' to discuss whether the Federal Reserve should be worried about commercial real estate, his outlook for the real estate sector, and more.

Comments

Post a Comment