Hawkish Fed Makes For a Wild Week on Wall Street

U.S. stocks rallied into the close Friday to wrap up a roller-coaster week, buoyed by rebounding technology stocks.

The Dow Jones Industrial Average rose 564.69 points, or 1.7%, to 34,725.47. The blue-chip average posted its best day since Dec. 6 after being down more than 350 points at its lows. The S&P 500 added 2.4% to close at 4,431.85 — its best session since June 2020. The Nasdaq Composite rallied 3.1% to 13,770.57.

Shares of Apple jumped nearly 7% after a stellar quarterly results, boosting the stock averages. The company reported its largest single quarter in terms of revenue ever even amid supply challenges and the lingering effects of the pandemic.

Big Tech names Microsoft, Amazon, Facebook-parent Meta and Google-parent Alphabet all closed Friday higher after being beaten up earlier in the week, providing support to the indexes.

On the downside, Chevron shares fell around 3% after missing Wall Street earnings expectations. Dow component Caterpillar dipped about 5% even after it topped profit estimates.

The major indexes experienced outsized swings each day this week — including the Dow making up a more than 1,000-point intraday deficit for the first time ever to close higher on Monday. The S&P 500 posted an intraday range of at least 2.25% every day this week, according to Bespoke Investment Group.

“The huge intraday movements are indicative of the challenge that the market now faces, which is that financial conditions are going to be tightening,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “As new information comes in, as markets overreact in one direction or another, this type of volatility and some of these swings are probably going to be with us for some time, given the nature of what the market’s trying to price in.

The Dow finished the week 1.3% higher and the S&P 500 added 0.8% on the week, breaking a three-week losing streak. The Nasdaq Composite finished little changed week to date.

“It has been a frustrating week for investors. It’s kind of this push-pull or tug-of-war between bulls and bears,” Darrell Cronk, chief investment officer for wealth and investment management at Wells Fargo, told CNBC’s “Squawk on the Street.” “The lows may not be in yet on this kind of correction.”

The Nasdaq sits about 15% from its high. The Russell 2000, the small-cap benchmark, is in a bear market, down 19.9% from its intraday record.

With January ending Monday, the S&P 500 is on pace for its weakest month since March 2020, down 7%. The Dow could see its worst month since October 2020.The market’s fear gauge, the Cboe Volatility Index, shot up to its highest level since October 2020 and traded above 30 earlier this week.

Investors on Friday continued to digest the Federal Reserve’s pivot to tighter policy.

The Federal Open Market Committee indicated Wednesday that it likely soon raise interest rates for the first time in more than three years as part of a broader tightening of historically easy monetary policy. Markets are now pricing in five quarter-percentage-point interest rate hikes in 2022, though the long-range expectation for rates is little changed.

“As advertised, this week was dominated by the Fed meeting and parsing its Wednesday statement and comments from Fed Chair Powell,” Chris Hussey, a managing director at Goldman Sachs, said in a note. “And on Friday, the Fed’s hawkish tilt received as-expected support from another high inflation print.”

December’s core personal consumption expenditures price index, the Fed’s preferred inflation gauge, jumped 4.9% from the year prior, the Commerce Department reported Friday. The PCE jump is higher than economists expected and the hottest reading since September 1983. Along with the inflation numbers, personal income rose 0.3% for the month, a touch lower than the 0.4% estimate.

It was an insanely volatile week and there's a lot to cover.

First, the January FOMC statement was clear, the Fed is preparing to raise rates at its next meeting and it's scaling back its asset purchases, bringing them to an end in March:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

This was all expected but hawkish comments from Federal Reserve Chair Jerome Powell at the press conference on Wednesday led short-term interest rate traders to begin pricing for the possibility that the US central bank could raise rates more than four times this year:

“I do not think Fed Chair Powell could have been more hawkish during his press conference than if he raised rates today,” said Tom di Galoma, managing director at Seaport Global Holdings in New York.

Fed funds futures traders are now pricing for 4.4 hikes by December, after previously fully pricing for 4 increases.

Powell "underscored that this period is nothing like the end of the last expansion as inflation is much higher. He is implying that they will need to move faster than back then,” analysts at Bank of America said on Wednesday in a report. “Bottom line, the risks are skewed to more than 4 hikes this year.”

Powell’s hawkish bent also sent yields on short-and intermediate-dated Treasuries to two-year highs. Two-year yields rose to 1.16% while five-year yields increased to 1.70%.

Some Fed watchers are claiming the market is pricing in more rate hikes going into 2023, but others are warning raising rates while reducing the balance sheet could be a policy mistake:

5 hikes this year (from 3 right before the Fed yesterday) and 7 rate hikes now priced through mid-2023.

— Jim Bianco biancoresearch.eth (@biancoresearch) January 27, 2022

Remember, like 2 weeks ago, when we all though Jamie Dimon's "6 or 7 rate hikes" was him just saying stuff for shock value?

I think it was ... and now the market is there! pic.twitter.com/Iv30Hf7sIt

Raising rates while reducing its balance sheet could be a policy mistake for the #Fed. @BloombergTV https://t.co/7b8Qu2JX8y pic.twitter.com/wEiUhyv4Rz

— Scott Minerd (@ScottMinerd) January 27, 2022

Bond investors are worried that the Fed's not going to be able to orchestrate a soft landing, as evidenced by the steadily flattening yield curve. https://t.co/6D3IRjNwH9 pic.twitter.com/MgT27Hc92s

— Lisa Abramowicz (@lisaabramowicz1) January 28, 2022

It's worth noting, however, that leading indicators are already turning south in the US and the global economy is already slowing down considerably:

Baltic Dry Index continues to collapse and, with a 77% drawdown, is now below its pre-pandemic level pic.twitter.com/vGTk1WDcFh

— Liz Ann Sonders (@LizAnnSonders) January 28, 2022

Also, the Fed will have plenty of economic data to digest before the next meeting in March and while I don't expect it not to raise rates at that time, the path of future rate hikes can easily be altered during this period.

Interestingly, in his latest comment, Heightened Conflict Of Interest (rates): When GDP’s Almost All Inventory, Jeffrey Snider of Alhambra Investments notes:

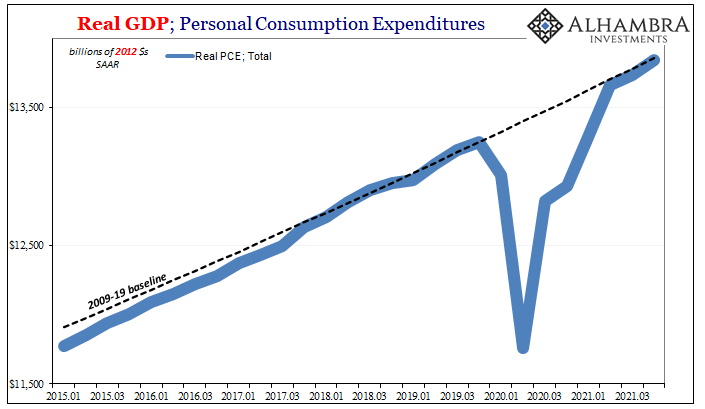

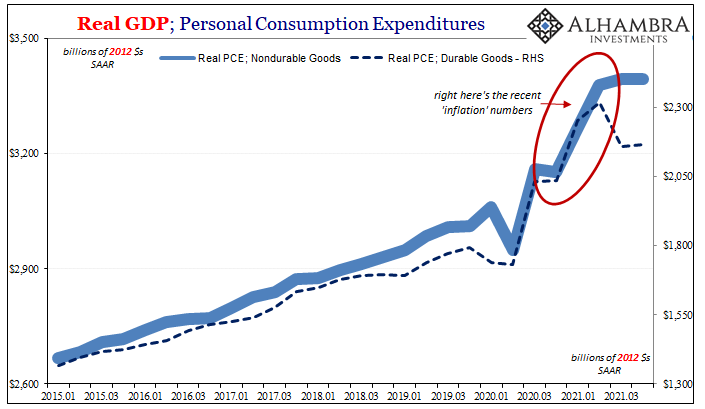

[...] while consumer spending has been unusually high on goods, it hasn’t accelerated at all since around June or July (recurring global theme). If anything, the rate of goods spending has outright declined even if from a historic high – just as all those goods ordered when supply and shipping issues had been at the worst finally begin to come tumbling out of the logistical mess.

It can’t be delta or any variant of corona since the lack of spending, despite all that government cash previously, continued all the way across Q4, too.

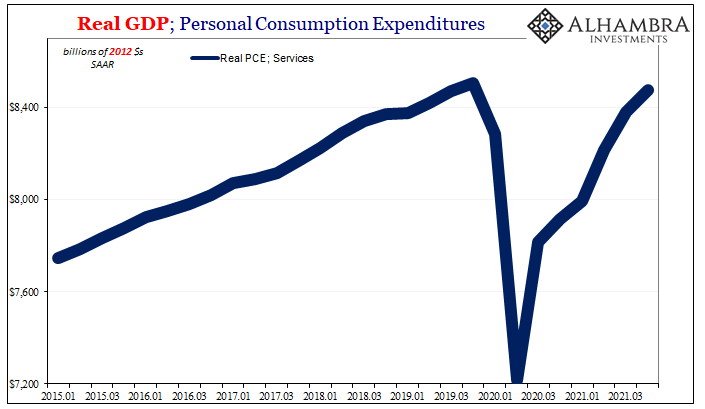

Overall, spending on services is still behind the prior 2020 peak, meaning there seems to be a limit to how much consumers will fork over even now favoring goods rather than services; though all mainstream attention has been laser-focused on only the one end of it. The goods economy was hyped up artificially and even then it still couldn’t propel total consumer activity beyond its prior baseline.

That’s already a red flag with now two weak quarters in a row.

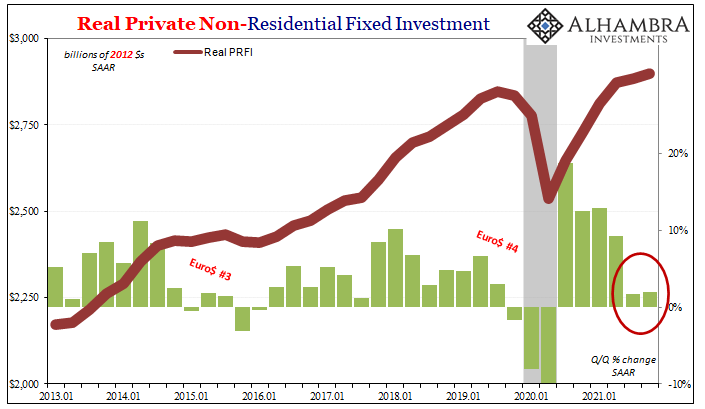

And those same two weak quarters have extended, importantly, to business investment, as well. Real Private Non-residential Fixed Investment increased only 2.0% Q3 to Q4 (SAAR) after gaining but 1.7% Q2 to Q3. Like the above rates for final sales and those for consumer spending, these are down noticeably from the two quarters to start last year, those specifically filled with federal government stipends.

Without the government at its peak influence, the economy looks quite different.

Outside of inventory, most of which was actually imported, too, the US economy in the second half of the year performed exactly in the way the bond market had been inclined. Growth and inflation expectations in longer-term yields have been waning even as CPI rates accelerated leading to the Fed’s pressure of upcoming rate hikes distorting the short end.

This gives you much needed perspective when it comes to understanding the real strength in the US economy and inflation dynamics.

This is #deflationary pic.twitter.com/myAHI87WCI

— Lance Roberts (@LanceRoberts) January 27, 2022

Still, the Fed's favorite inflation indicator is rising to levels we haven't seen in decades and for now, the hawkish tilt remains:

Key Fed inflation gauge rises 4.9% from a year ago, fastest gain since 1983 https://t.co/frImsg7j9L

— Leo Kolivakis (@PensionPulse) January 28, 2022

What does all this mean for markets?

It means more volatility and even though historically, stocks tend to rise during some periods of rate hikes, it's important to temper your enthusiasm, especially if inflation persists and also note stocks got slammed in 2001- 2004 and 2007-2008 :

As it turns out, during so-called rate-hike periods, which we seem set to enter into as early as March, the market tends to perform strongly, not poorly.

In fact, during a Fed rate-hike period the average return for the Dow Jones Industrial Average is nearly 55%, that of the S&P 500 is a gain of 62.9% and the Nasdaq Composite has averaged a positive return of 102.7%, according to Dow Jones, using data going back to 1989 (see attached table). Fed interest-rate cuts, perhaps unsurprisingly, also yield strong gains, with the Dow up 23%, the S&P 500 gaining 21% and the Nasdaq rising 32%, on average during a period of Fed rate cuts.

Interest-rate cuts tend to occur during periods when the economy is weak and rate hikes when the economy is viewed as too-hot by some measure, which may account for the disparity in stock-market performance during periods when interest-rate reductions occur.To be sure, it is harder to see the market producing outperformance during a period in which the economy experiences 1970s-style inflation. Right now, it feels unlikely that bullish investors will get a whiff of double-digit returns based on the way stocks are shaping up so far in 2022. The Dow is down 4.9%, the S&P 500 is off 7.4%, while the Nasdaq Composite is down a whopping 11.9% thus far in January, at last check Wednesday.

Another factor to consider is the drawdowns that the market has experienced, leading up to the FOMC policy update, which have helped push the Nasdaq Composite into correction and had put the S&P 500 on the brink of closing there.

The folks at Bespoke Investment Group say, taking a shorter-run look at performance, that based on the past 13 times the S&P 500 has fallen at least 5% between meetings, “the average change in the following period between meetings was a gain of 1.38% while the median is nearly double that at 2.68%.”

The share of times the market gains during those periods, however, is lower, only 59%, compared against 66.22% for all meetings.

What about the so-called "Fed put"? Earlier this week, Greg Jensen, co-CIO at Bridgewater, said stocks could fall by as much as 20% more before the Fed blinks:

“Some decline in asset prices is not a bad thing from the Fed’s perspective, so they’re going to let it happen,” Jensen, 47, said in an interview over Zoom. “At these levels, it would take a much bigger move to get the ‘Fed put’ into the money. They’re a long way from that.”

He figures it’d take a drop of 15% to 20% to alarm the central bank, and even that would depend on how fast the bottom falls out from under the market. So far, Jensen said, the decline over the past few weeks has been “mostly healthy” because it has “deflated some of the bubbles,” such as cryptocurrencies.

Interestingly, Jensen had this to say about the Fed ending its asset purchases in March:

I'm not so sure the 10-year yield has to reach 3.5% or higher before public and private pensions snap them up and besides, China is still buying a ton of Treasuries and will continue to do so.One question Jensen raised is who’ll buy all the bonds that the Fed has been soaking up with quantitative easing. In addition to raising rates in March, policy makers are set to end the asset-purchase program that has inflated the central bank balance sheet by trillions of dollars.

Jensen said he figures the 10-year Treasury yield has to reach 3.5% or even 4% -- up from less than 1.9% today -- before private investors are ready to absorb all the government debt that the Fed has been monetizing.

In that scenario, with Treasury prices set to decline further, bonds fail as a hedge against stocks and the traditional 60/40 balanced portfolio is useless as a diversification tool. Jensen said a 1970s-style “stagflation” playbook is more appropriate, and investors need to increase their commodity holdings, trade out of U.S. stocks in favor of international equities and use breakevens to combat inflation.

“Expecting the environment to feel like it did over the past couple of decades is a big mistake,” he said.

As far as stagflation, it certainly feels like we're on that path but it's premature to claim a 1970s-style “stagflation” playbook is more appropriate.

I remain convinced the Fed will not make a policy blunder but the reality is inflation is a lagging indicator and inflation pressures will persist, at least for the first half of the year.

The real problem for the Fed remains the housing market and how it will extricate itself from it without causing a recession:

Housing Is the Fed’s Frankenstein, and It Won’t Be Easily Tamed https://t.co/2TbFyiGm5H via @BarronsOnline

— Leo Kolivakis (@PensionPulse) January 29, 2022

As far as whether we are just entering the nastiest bear market ever, as I stated last week, it's possible but stocks never go up and down in a straight line.

In his latest weekly market wrap-up, No Bear Market Signal...Yet, Martin Roberge of Canaccord Genuity notes:

Despite today’s rebound, broad equity markets are on their way to finish the week lower for a fourth week in a row. There has been no place to hide this week, with both growth and value areas succumbing to selling pressure. At Thursday’s close, the S&P 500, NASDAQ, Russell 2000 were down, respectively, 9.8%, 16.8% and 21% from their peaks. The S&P/TSX has fared better, with a 5.6% decline. In our view, market volatility this week has been driven by concerns that the Federal Reserve is now more focussed on bringing down actual inflation rather than finding comfort on inflation expectations, which remain well anchored. This subtle shift in view from Jay Powell at this week’s FOMC meeting may be raising odds of monetary overkill down the road, and this at a time when the breadth of earnings revisions keeps sinking owing to companies’ more prudent guidance. At the end of the day though, this typical tug-of-war between rates and earnings around mid-cycle is nothing new for investors. One advantage of dealing with rate shocks rather than growth shocks is that recession risks, hence bear markets, remain lower probabilities. This is what we discuss next with an update of our BMTI.

Our focus this week is on equity markets, more specifically, odds that the current correction morphs into a bear market. As a reminder, we first published our Bear Market Timing Indicator (BMTI) in March 2018. The BMTI is a diffusion index of 16 indicators helping to spot >20% S&P 500 declines. When enough indicators (i.e., 75% and over) are flashing red, our BMTI triggers a sell signal which remains valid for a full year. So far, the BMTI remains below the 75% threshold (see our Chart of the Week), meaning investors should consider the January pullback as a non-recession correction. Interestingly, the current episode looks similar to that in Fall 2018 when our BMTI remained below 75%, hence recommending a buy-on-dips strategy even as the S&P 500 correction extended beyond the 10% mark. Looking ahead, we find that even accounting for a Fed rate hike in March, a flattening of the US T-bond yield curve below 50bps and persistent market volatility, the BMTI should remain below 75% over the next month or two because several economic indicators should come out of their bearish signal. In general, it is the positive reading of the model’s economic variables that is preventing the BMTI from issuing a sell signal. Of course this could change through the year but until then, investors should resist the temptation to sell into a market already in correction territory and very oversold.

So buy the dips? Maybe but I caution my readers, even though shares of Apple, Microsoft and Visa popped this week after they announced decent earnings, the trend is still down and these pops look like nothing more than short covering to me:

Remember, even in a bear market, you have strong rallies but you know you're in a bear market because they fizzle quickly and shares hit new lows.

I'm not saying we are in a bear market but the way a lot of stocks are trading, it sure feels that way.

Year-to-date, Energy stocks are once again leading the way, outperforming every other sector which is in the red:

Now more than ever, professional money management is imperative, these aren't markets for novices speculating on crap.

In the span of four weeks, six negative daily Dow reversals of 1%+. This happened 99% of the time in the past in 1987 (crash); 1990 (recession), 1997-98 (Asian crisis); 2000-03 (tech wreck/recession), 2008-09 (GFC), 2018 (Powell!). All either ~20% corrections or 30%+ bear markets

— David Rosenberg (@EconguyRosie) January 28, 2022

Bulls, this is my gift to you for the weekend.

— Mac10 (@SuburbanDrone) January 28, 2022

You have two days to figure out the pattern. pic.twitter.com/UtluRqkw1C

There's your week bulls, the second largest 200 DMA % crossover in two decades.

— Mac10 (@SuburbanDrone) January 28, 2022

Twenty-one percent back and forth in one week. Only one percent less than Mar 2020.

Sold to you. pic.twitter.com/x2KlsnwiiG

Below, watch Jerome Powell's press conference from a couple of days ago.

Second, earlier this week, Eric Johnston, head of equity derivatives and cross asset at Cantor Fitzgerald, and Phil Camporeale, portfolio manager at JPMorgan Asset Management, joined 'Closing Bell' in a bull vs. bear debate.

Third, Schroders North America's Ron Insana and Hightower Advisors' Michael Farr join 'Power Lunch' to discuss the markets and what Fed tightening this year could mean.

Fourth, Josh Brown, Ritholtz Wealth Management CEO, joins the 'Halftime Report' to discuss the state of the markets and where he sees opportunity.

Fifth, for almost a half-century, value-investing icon Jeremy Grantham has been calling market bubbles. Now, he says US stocks are in a “super bubble,” only the fourth in history, and poised to collapse. In this interview, Grantham, co-founder of Boston’s GMO, goes further, explaining his bubble analysis and discussing what he sees as multiple threats to the economy and the planet, including persistent inflation and climate change. He spoke exclusively with Erik Schatzker on Bloomberg’s “Front Row.”

Last but not least,

Comments

Post a Comment